Tesla Q1 deliveries beat expectations as China helps enhance gross sales

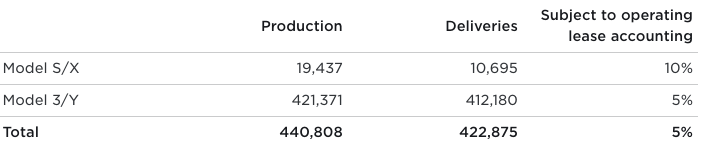

Tesla stated Sunday it delivered 422,875 electric vehicles within the first quarter of 2023, simply beating Wall Road estimates of round 420,000 models. The corporate produced 440,808 autos in the identical interval.

The supply and manufacturing numbers are report outcomes for the EV maker. Within the fourth quarter of 2022, Tesla delivered 405,278 and produced 439,701 models. These This autumn deliveries have been additionally report outcomes, however they missed Wall Road expectations.

It seems that a big share of deliveries got here from autos produced by Tesla’s Shanghai gigafactory. The automaker has been issuing value cuts in all markets, together with China, the place the latest reductions have prompted a price war amongst rivals. The end result is a rise of Tesla gross sales in China from final 12 months, which suggests the East Asian nation helps to spice up Tesla’s international supply numbers.

Tesla doesn’t break down its supply and manufacturing numbers by area, however based on knowledge from the China Passenger Automobile Affiliation (CPCA), Tesla collectively bought 140,453 China-made autos in January and February. The CPCA hasn’t but printed March’s knowledge. If Tesla’s March deliveries in China match February’s numbers, it will imply greater than 50% (or practically 215,000) of Q1 deliveries got here from Shanghai.

Tesla’s Q1 2023 supply and manufacturing numbers. Picture Credit score: Tesla, by way of screenshot

Tesla began slicing costs for its EVs in China in October. Most lately, Tesla once more lowered the costs of Mannequin 3 and Y there in January by between 6% and 13.5%, including gasoline to the fireplace of a value conflict within the nation. Rivals Xpeng and Nio, in addition to worldwide manufacturers like Volkswagen and Mercedes-Benz, additionally discounted their costs to compete with Tesla automobiles, which are actually as much as 14% cheaper than final 12 months. In some circumstances, they’re nearly 50% inexpensive than within the U.S. and Europe.

The automaker mirrored related value cuts in Europe, Mexico and the U.S. over the previous few months. This 12 months, Tesla dropped costs for Model Y and Model 3 vehicles within the U.S. by as much as 20%, and Model X and Model S autos by as much as 9%. Final week, Tesla also relaunched its European referral program to attempt to enhance gross sales earlier than the top of the quarter.

Tesla’s share value rose 6.24% Sunday (in off buying and selling hours) following the automaker’s quarterly production and supply outcomes.

Tesla wanted a robust end result after a risky previous few months in buying and selling. On the finish of 2022, Tesla’s share price plummeted amid CEO Elon Musk’s overhaul of Twitter. Traders have been additionally involved final 12 months that the numerous reductions Tesla carried out throughout markets — together with a $7,500 discount for U.S. patrons who took supply earlier than 12 months’s finish — may point out low demand from clients.

Throughout Tesla’s Q4 2022 earnings name in January, Musk tried to assuage traders by saying that demand really exceeded manufacturing. On the time, Tesla acknowledged that the worth decreases and common inflationary surroundings may have an effect on the corporate’s short-term automotive margins, however that the corporate stated it’s extra centered on its working margin.

We’ll know extra about how the worth decreases globally have affected the general enterprise when Tesla reviews first quarter earnings on Wednesday, April 19. On the finish of final 12 months, Tesla stated it expects to stay forward of the long-term 50% compound annual development price with round 1.8 million automobiles for the 12 months.