America’s richest states see their tax income plunge

[ad_1]

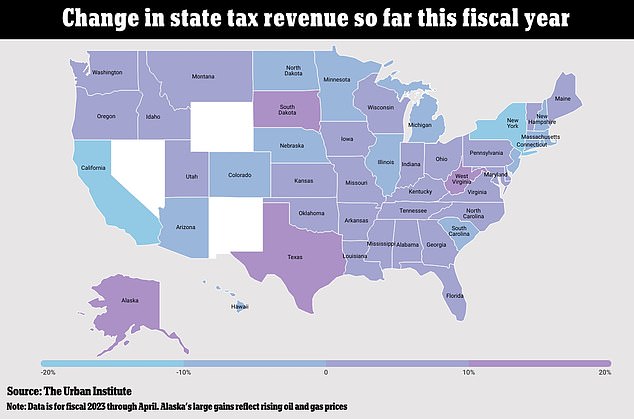

A few of the richest US states are seeing sharp declines of their tax revenues, whereas others are making positive factors, as demographic shifts and variations in tax insurance policies gasoline diverging tendencies throughout the nation.

New York and California, which each rely closely on taxing the incomes of their wealthiest residents, noticed tax receipts plunge within the 2023 fiscal 12 months by way of April, in response to Urban Institute information obtained by DailyMail.com.

In the meantime, Texas and Florida, which rely totally on gross sales taxes, noticed wholesome development in tax receipts, after each states made inhabitants positive factors and shopper spending remained sturdy.

‘You are beginning to see this divergence,’ Emily Mandel, an economist at Moody’s Analytics, instructed Bloomberg News. ‘It is positively one thing we’re seeing within the information.’

After operating a number of years of giant funds surpluses as inventory markets boomed, California has seen the sharpest drop-off in tax receipts, with a decline of 24.9 % from the identical interval final 12 months.

New York and California are seeing sharp declines of their tax revenues, whereas different states are making positive factors, as demographic shifts and variations in tax insurance policies gasoline diverging tendencies

California Governor Gavin Newsom is seen above. After operating a number of years of giant funds surpluses as inventory markets boomed, California has seen the sharpest drop-off in tax receipts

New York was shut behind, with a decline in tax income of 19.5 %, after private revenue tax receipts within the Empire State dropped by almost a 3rd.

In all, 17 states reported annual declines in complete tax income, and nationwide, complete state tax income was down 5.5 %.

The City Institute discovered that the median state noticed year-over-year private revenue tax revenues for April decline 32.4 %.

Private revenue tax revenues for the states totaled $57.8 billion in April, which was 43.5 % decrease than one 12 months in the past.

Conversely, the states which can be much less reliant on private revenue taxes noticed the most important positive factors in tax receipts for the interval, as state gross sales tax income rose 7.1 % nationwide.

Alaska, which depends virtually solely on taxing vitality firm income, was an outlier, with tax income rising 83.2 % attributable to rising oil and fuel costs.

West Virginia noticed tax receipts acquire 14.1 % — additionally due principally to rising company revenue taxes, though private revenue and gross sales tax receipts have been additionally up within the Mountain State.

New York noticed a decline in tax income of 19.5 %. New York Governor Kathy Hochul is seen above

California’s funds deficit is anticipated to achieve almost $32 billion within the coming fiscal 12 months, after the Golden State ran a funds surplus of $55 billion in 2022‑23

Texas and Florida are the 2 most populous states and not using a state private revenue tax, and each made wholesome positive factors after seeing an inflow of latest residents in recent times, driving their gross sales tax income larger.

Tax income in Texas rose 12.2 % for the interval, whereas Florida’s gained 9 %.

Among the many eight states with no private revenue tax, all these with information obtainable reported some enhance in state revenues this 12 months. (No information was obtainable for Nevada and Washington, which don’t tax private revenue.)

The diverging tendencies seem due partly to financial and tax coverage elements, in addition to important inhabitants shifts following the COVID-19 pandemic, which noticed massive migrations out of pricey coastal cities and towards Solar Belt states.

From April 2020 to July 2022, the inhabitants of Texas grew by 884,000, or 3 %, whereas the Sunshine State added 707,000 residents, representing a acquire of three.3 %, in response to Census information.

Throughout the identical interval, New York and California, that are likewise among the many largest states by inhabitants, noticed the most important web decreases in residents, every shedding greater than 500,000.

The shifts mirror an inner migration of considerable proportions, fueling booming inhabitants development within the South that would have financial and political implications for many years to return.

New York and California have every misplaced greater than half 1,000,000 folks since 2020

A map exhibits the proportion change in state populations from 2020 to 2022

Consultants cite a confluence of things, together with the rise of distant work, pandemic well being fears about dense city areas, and considerations over housing prices, excessive taxes and crime for driving a flood of inner migration towards Solar Belt states.

As properly, California particularly has been harm by its heavy reliance on taxing the capital positive factors revenue of ultra-wealthy residents, a method that results in booms and busts.

In Might, Governor Gavin Newsom revealed the state’s funds deficit is anticipated to achieve almost $32 billion within the coming fiscal 12 months, after the Golden State ran a funds surplus of $55 billion in 2022‑23.

California has a progressive tax system that depends closely on wealthy folks and taxes funding positive factors as common revenue, which means it will get about half its revenues from simply 1 % of the inhabitants.

When the financial system is sweet and the inventory market surges, the rich pay extra in taxes and revenues can soar rapidly. When the financial system is unhealthy, they pay much less and revenues can plunge simply as quick.

For many states, the 2022-23 fiscal 12 months ends on Friday, and a brand new funds cycle begins.

[ad_2]

Source