Florida motorists charged TWICE as a lot for automobile insurance coverage than these in Ohio

[ad_1]

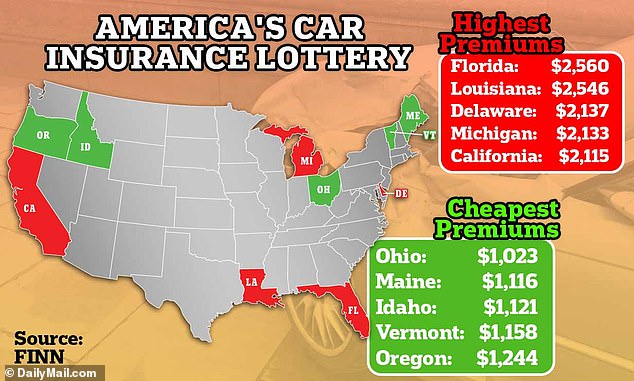

Motorists are dealing with a automobile insurance coverage lottery with premiums ranging by as a lot as $1,500 a yr, contemporary evaluation reveals.

A report by automobile subscription agency FINN discovered Florida residents confronted the steepest prices, with the typical annual premium costing $2,560 for full protection.

It was adopted by Louisiana, Delaware, Michigan and California the place premiums averaged $2,546, $2,137, $2,133 and $2,115 respectively.

By comparability, Ohio drivers pay simply $1,023 for insurance coverage – the most affordable of any state. Maine, Idaho, Vermont and Oregon additionally made the highest 5 of lowest premiums.

Throughout the board, the typical annual premium within the US is now $1,648, figures present.

It comes after it was revealed that automobile insurance coverage is currently one of the main drivers of inflation, having shot up 16.9 percent in the last year, based on the US Labor Division.

Insurers have blamed hovering premiums on increased restore prices, bigger medical payments, elevated litigation and extra accidents.

Motor accidents have soared for the reason that pandemic, with the variety of fatalities rising by 10.5 % between 2020 and 2021.

However the discrepancy between states has been attributed to the protection of roads and in addition the variety of uninsured drivers in every state.

For instance, the report notes that Florida has the best proportion of uninsured drivers. Some 20 % of motorists don’t have protection.

It means those that do take out insurance coverage face an unfair premium to account for the elevated dangers.

Automotive insurance coverage in Florida has shot up 88 % within the final ten years – the best fee of any state. Additionally it is suffering the highest rate of inflation in the U.S.

Researchers estimated that annual premiums within the Sunshine State might attain $4,13 by 2033 if the present pattern continues.

Equally, 10 % of drivers in Louisiana are additionally uninsured – pushing up the price of premiums.

The price of residing in america has risen sharply over the previous yr and automobile insurance coverage is not any totally different as some charges have risen by as a lot as 40 %

State Farm in New York has bumped its costs by 11 %

What’s extra, the Pelican State is house to a disproportionately excessive variety of vehicle-related lawsuits, the report notes.

In the meantime low-cost prices in Ohio had been attributed to protected roads and a ‘extremely aggressive insurance coverage market.’

Maine got here out second as a result of its low inhabitants density which slashes the danger of collisions.

Consultants beforehand warned U.S. insurers had been desperately attempting to recuperate their losses incurred final yr.

In response to the S&P International, automobile insurers misplaced 12 cents for every greenback paid out in a premium.

And america’ largest automobile insurance coverage firm State Farm misplaced 28 cents on each greenback written final yr which equates to a $13billion underwriting loss for its auto arm.

Addressing the unprecedented underwriting losses final yr, a spokesman for State Farm stated: ‘We proceed to regulate…to verify we’re matching worth to danger.’

Neil Alldredge, chief government of commerce affiliation Nationwide Affiliation of Mutual Insurance coverage Corporations, advised the Wall Street Journal: ‘It’s in all probability the worst interval for auto insurers it’s been in 30 years not less than.’

However shopper our bodies have criticized insurers for enhancing prices – when households are already struggling underneath the hovering price of residing.

Carmen Balber, government director of the group Shopper Watchdog, advised the Wall Avenue Journal: ‘Unrestrained fee hikes are hitting the pocketbooks of Individuals, and people least in a position to pay are seeing the worst burden.’

[ad_2]

Source