Put together for shares to plummet 30% and a recession to strike any day now, legendary market prophet says

-

Shares might plummet by as a lot as 30%, a legendary Wall Road forecaster has stated.

-

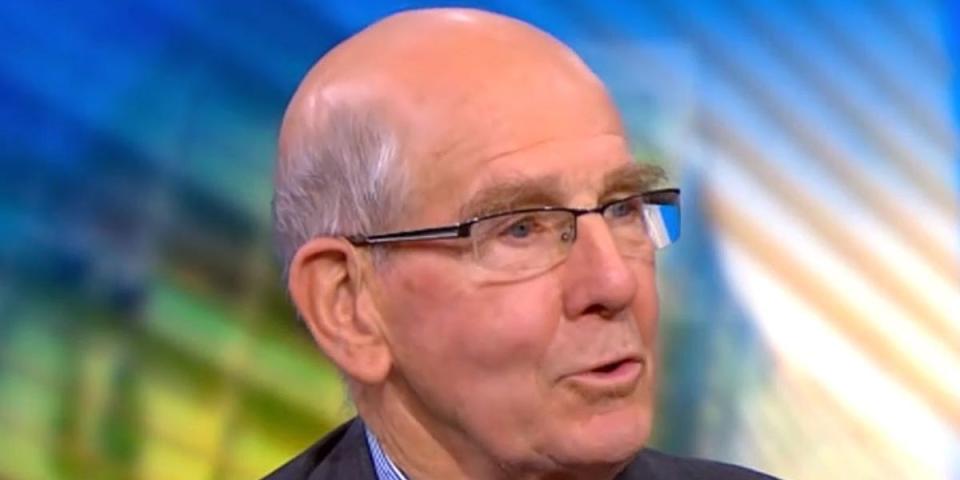

Gary Shilling stated he was anticipating a recession to hit imminently if one wasn’t underway already.

-

He stated he was betting on Treasury bonds and the US greenback and towards shares and commodities.

Put together for shares to plunge by a 3rd and a recession to strike imminently, a legendary market forecaster has stated.

“I have been of the opinion that shares — and I got here out with this forecast early final 12 months — would decline about 30% to 40% peak to trough,” Gary Shilling, the president of A. Gary Shilling & Co., advised “The Julia La Roche Present” in an interview aired this week.

“You’d have an additional decline of about 30% from right here to get that 40% general decline, peak to trough,” he stated.

Shilling’s forecast suggests the S&P 500, which hit a file excessive of practically 4,800 factors in January final 12 months, might nosedive to about 2,900 factors, its lowest degree since Could 2020. The benchmark inventory index fell by 18%, together with dividends, final 12 months however has rallied 17% this 12 months.

The veteran economist, recognized for correctly calling a number of main market traits over the previous 50 years, stated he anticipated shares to fall as a result of the US financial system was faltering.

“We most likely do have a recession coming shortly if we’re not already in it,” Shilling stated, pointing to the inverted yield curve, weak point in main financial indicators, and the Fed’s dedication to crushing inflation.

“While you have a look at that mixture of issues, it is fairly exhausting to flee a recession,” he stated.

Shilling served as Merrill Lynch’s first chief economist earlier than launching his personal economic-consulting and investment-advisory agency in 1978. He stated the general financial system tended to melt solely a bit throughout recessions, however slash company income would usually plunge by 20% to 30%, and shares would undergo an analogous drop.

He forecast decrease inflation within the years forward because the long-term development of globalization pushes down costs. He advised the Federal Reserve would lower rates of interest solely deep into subsequent 12 months, as soon as the financial system has weakened considerably and it is clear that inflation is not a menace.

The market prophet — who predicted and profited from the collapse of the mid-2000s housing increase — stated he was betting on Treasury bonds and the US greenback. Alternatively, he is positioned wagers towards shares through exchange-traded funds and towards commodities by shorting copper.

Shilling additionally disclosed the “greatest bubble” on his radar at present was commercial real estate — particularly workplace buildings, motels, and buying malls — and he stated he believed it was beginning to burst.

Learn the unique article on Business Insider