Report: Apple and Goldman Sachs are breaking apart over money-losing Apple Card

Apple

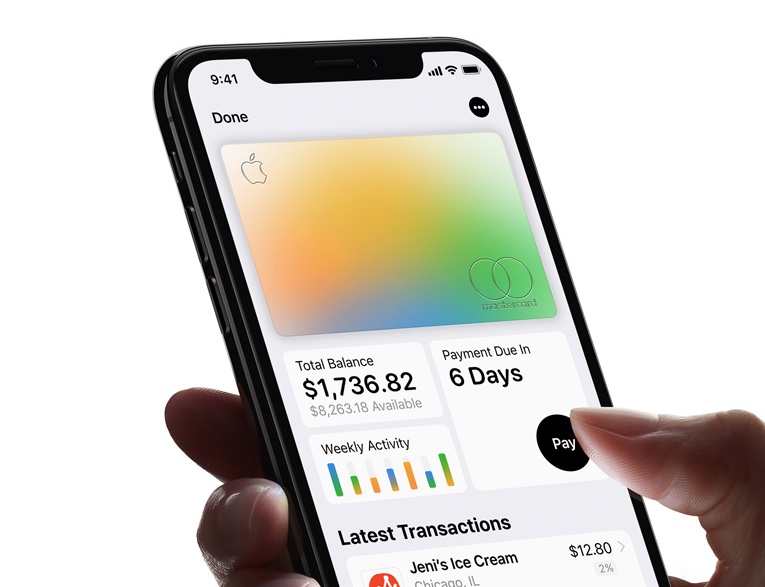

Apple has repeatedly trumpeted the success of its monetary companies, a product lineup that now encompasses the Apple Card bank card, high-interest financial savings accounts, and a buy-now-pay-later service referred to as Apple Pay Later.

However even when these merchandise have confirmed moderately common with shoppers, they haven’t been understanding for the financial institution that Apple has partnered with to produce these companies. Goldman Sachs’ shopper companies have been dropping the corporate billions of {dollars}, based on reporting from Bloomberg, CNBC, and The New York Times, amongst others. These losses have been pushed partly by a a lot higher-than-usual loss charge on its bank card loans—that means that individuals with Goldman-backed bank cards just like the Apple Card are literally making their funds much less typically than individuals with bank cards from different banks.

At this time, The Wall Avenue Journal reports that Apple has despatched Goldman Sachs a proposal that may finish their partnership inside the subsequent 12 to fifteen months, leaving Apple to discover a new backer for its monetary merchandise.

Although initiated by Apple, Goldman Sachs has allegedly been fascinated about ending its partnership with Apple for a while now. The monetary losses look like the most important level of competition between the businesses, however the WSJ additionally experiences that Apple has annoyed Goldman Sachs execs by demanding that most individuals who apply for an Apple Card get accepted, and that every one Apple Card prospects obtain their payments on the identical day (banks sometimes attempt to unfold these payments out to keep away from a deluge of customer support calls). Executives additionally partly blame Apple for regulatory points that Goldman has had with the Client Monetary Safety Bureau and the Federal Reserve.

The WSJ does not know whether or not Apple shall be partnering with one other firm to supply its monetary companies, although Synchrony Monetary is allegedly , and the WSJ reported earlier this year that American Specific may additionally take over. Citigroup decided not to back the Apple Card back in 2019 over (apparently well-founded) considerations that it would not earn the corporate any cash.

In a statement to CNBC, Apple neither confirmed nor denied that it might be parting methods with Goldman Sachs however reiterated its assist for the Apple Card and its different companies.

“Apple and Goldman Sachs are targeted on offering an unimaginable expertise for our prospects to assist them lead more healthy monetary lives,” wrote an Apple spokesperson. “The award-winning Apple Card has seen an important reception from shoppers, and we are going to proceed to innovate and ship the most effective instruments and companies for them.”

Offering companies just like the Apple Card has change into extra necessary to Apple’s backside line in recent times, as income development from the iPhone, iPad, Mac, and different {hardware} companies has slowed or flatlined. That {hardware} continues to be the place the corporate makes most of its cash, however the companies enterprise—together with its monetary companies, but additionally iCloud, Apple TV+, Apple Music, and the App Retailer—is at the moment driving the expansion that Apple’s shareholders demand.