25 School Cities That Are Good for Retirees

Though retirees are a long time from their school commencement, many are opting to stay in school cities. Based on MarketWatch, older Individuals have been flocking to varsity cities for numerous causes, together with affordability, walkability and cultural, instructional and leisure alternatives. As well as, school cities typically have various populations, and with college students and college workers transferring out and in, there are at all times new folks to satisfy. There are additionally typically a plethora of part-time job alternatives for retirees who might want some further revenue to pad their financial savings.

Florida’s Retirees Are Fleeing: Here’s Where They’re Going Instead

Be taught: The Simple, Effective Way To Fortify Your Retirement Mix

To seek out the very best school cities for retirees, GOBankingRates examined numerous elements, together with livability scores, the share of the inhabitants ages 65 and older, month-to-month dwelling prices (groceries, healthcare, utilities, transportation and different miscellaneous bills) and housing prices. Based on this analysis, these are the 25 best college towns for retirees.

1. Huntington, West Virginia

-

Livability rating: 81

-

Share of the inhabitants ages 65 and older: 17.2%

-

Month-to-month expenditure prices: $1,951

-

Common mortgage: $707

See: 5 Ways Boomers Should Prepare For Social Security Cuts

Social Safety Cuts: States That Would Be Impacted The Least

2. Lexington, Kentucky

-

Livability rating: 86

-

Share of the inhabitants ages 65 and older: 13.5%

-

Month-to-month expenditure prices: $1,775

-

Common mortgage: $1,783

Social Safety Replace: There’s a New Cut-Off for Earnings — What It Means For Your Retirement

3. Stevens Level, Wisconsin

-

Livability rating: 85

-

Share of the inhabitants ages 65 and older: 12.7%

-

Month-to-month expenditure prices: $1,691

-

Common mortgage: $1,491

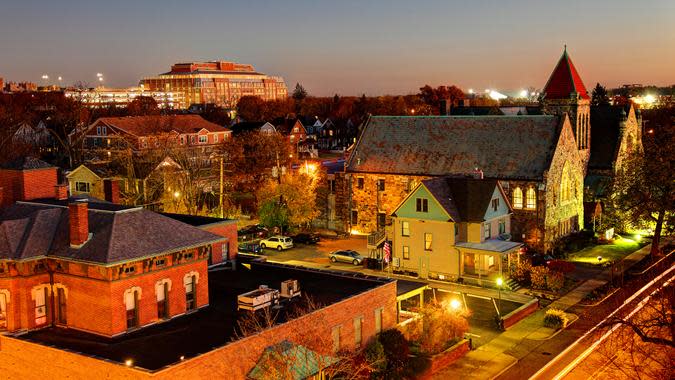

Pictured: College of Wisconsin Madison

4. Ames, Iowa

-

Livability rating: 90

-

Share of the inhabitants ages 65 and older: 10.5%

-

Month-to-month expenditure prices: $1,863

-

Common mortgage: $1,886

5. Lawrence, Kansas

-

Livability rating: 88

-

Share of the inhabitants ages 65 and older: 11.6%

-

Month-to-month expenditure prices: $1,882

-

Common mortgage: $1,829

6. Regular, Illinois

-

Livability rating: 87

-

Share of the inhabitants ages 65 and older: 11%

-

Month-to-month expenditure prices: $1,816

-

Common mortgage: $1,424

Retired however Need To Work? Try These 8 Jobs for Seniors That Require Little to No Experience

7. Winona, Minnesota

-

Livability rating: 77

-

Share of the inhabitants ages 65 and older: 16.9%

-

Month-to-month expenditure prices: $1,618

-

Common mortgage: $1,357

8. Lewisburg, Pennsylvania

-

Livability rating: 79

-

Share of the inhabitants ages 65 and older: 17%

-

Month-to-month expenditure prices: $1,926

-

Common mortgage: $1,796

9. Norman, Oklahoma

-

Livability rating: 84

-

Share of the inhabitants ages 65 and older: 12.7%

-

Month-to-month expenditure prices: $1,876

-

Common mortgage: $1,521

10. Greensboro, North Carolina

-

Livability rating: 82

-

Share of the inhabitants ages 65 and older: 13.3%

-

Month-to-month expenditure prices: $1,702

-

Common mortgage: $1,571

Retired However Need to Work? 5 Jobs for Retirees That Feel Like a Vacation

11. Evanston, Illinois

-

Livability rating: 83

-

Share of the inhabitants ages 65 and older: 16.4%

-

Month-to-month expenditure prices: $1,931

-

Common mortgage: $3,319

12. Richardson, Texas

-

Livability rating: 85

-

Share of the inhabitants ages 65 and older: 13.5%

-

Month-to-month expenditure prices: $1,927

-

Common mortgage: $2,767

13. Denton, Texas

-

Livability rating: 86

-

Share of the inhabitants ages 65 and older: 11.2%

-

Month-to-month expenditure prices: $1,826

-

Common mortgage: $2,210

14. Ann Arbor, Michigan

-

Livability rating: 88

-

Share of the inhabitants ages 65 and older: 12%

-

Month-to-month expenditure prices: $1,784

-

Common mortgage: $3,200

15. Greenville, South Carolina

-

Livability rating: 79

-

Share of the inhabitants ages 65 and older: 14.4%

-

Month-to-month expenditure prices: $1,740

-

Common mortgage: $1,789

Dave Ramsey: 6 Biggest Retirement Myths You Should Stop Believing

16. Champaign, Illinois

-

Livability rating: 83

-

Share of the inhabitants ages 65 and older: 10.6%

-

Month-to-month expenditure prices: $1,808

-

Common mortgage: $1,245

17. Iowa Metropolis, Iowa

-

Livability rating: 84

-

Share of the inhabitants ages 65 and older: 11%

-

Month-to-month expenditure prices: $1,758

-

Common mortgage: $1,935

18. Chattanooga, Tennessee

-

Livability rating: 75

-

Share of the inhabitants ages 65 and older: 16.8%

-

Month-to-month expenditure prices: $1,766

-

Common mortgage: $1,791

19. Syracuse, New York

-

Livability rating: 79

-

Share of the inhabitants ages 65 and older: 12.6%

-

Month-to-month expenditure prices: $1,966

-

Common mortgage: $1,069

Additionally: 5 Places to Retire That Are Just Like North Carolina but Way Cheaper

20. West Lafayette, Indiana

-

Livability rating: 90

-

Share of the inhabitants ages 65 and older: 6.7%

-

Month-to-month expenditure prices: $1,699

-

Common mortgage: $2,055

21. Newark, Delaware

-

Livability rating: 83

-

Share of the inhabitants ages 65 and older: 12.1%

-

Month-to-month expenditure prices: $2,000

-

Common mortgage: $2,071

22. Eugene, Oregon

-

Livability rating: 78

-

Share of the inhabitants ages 65 and older: 16.5%

-

Month-to-month expenditure prices: $1,755

-

Common mortgage: $2,907

23. Buffalo, New York

-

Livability rating: 78

-

Share of the inhabitants ages 65 and older: 12.9%

-

Month-to-month expenditure prices: $1,957

-

Common mortgage: $1,333

Be taught: How Big Is Bill Clinton’s Social Security Check?

24. Tallahassee, Florida

-

Livability rating: 82

-

Share of the inhabitants ages 65 and older: 10.8%

-

Month-to-month expenditure prices: $1,863

-

Common mortgage: $1,782

25. Lubbock, Texas

-

Livability rating: 78

-

Share of the inhabitants ages 65 and older: 12%

-

Month-to-month expenditure prices: $1,809

-

Common mortgage: $1,268

Methodology: To seek out school cities which can be excellent for retirees, GOBankingRates analyzed quite a few school cities in the USA sourced from ListWithClever’s Greatest School Cities. With a listing of school cities, GOBankingRates discovered the [1] complete inhabitants and [2] inhabitants ages 65 and over sourced from the U.S. Census American Shopper Survey. Utilizing these elements, the share of the inhabitants ages 65 and over was calculated. For every metropolis on the listing, the price of dwelling was calculated primarily based on [3] grocery cost-of-living index, [4] healthcare cost-of-living index, [5] utilities cost-of-living index, [6] transportation cost-of-living index and [7] miscellaneous cost-of-living index, all sourced from Sperlings BestPlaces. The fee-of-living indexes have been multiplied by the nationwide common expenditure prices for folks ages 65 and over, sourced from the Bureau of Labor Statistics Shopper Expenditure Survey, to seek out the price of dwelling throughout all of the expenditure classes for every metropolis. The livability index was sourced from AreaVibes, scored and weighted at 1.25. Utilizing the Zillow Residence Worth Index, the common house worth in August 2023 was sourced, and utilizing the Federal Reserve Financial Analysis’s nationwide common 30-year fastened fee mortgage, the common mortgage value was calculated. The common mortgage mixed with the month-to-month expenditure value offers the whole month-to-month value for every metropolis. The share of the inhabitants ages 65 and over was scored and weighted at 1.00, the whole month-to-month value was scored and weighted at 1.50, and the livablity index was scored and weighted at 1.25. All of the scores have been mixed and sorted to indicate the faculty cities which can be excellent for retirees. All knowledge is updated as of Sept. 25, 2023.

This text initially appeared on GOBankingRates.com: 25 College Towns That Are Perfect for Retirees