Condos hit with 563% charge enhance

[ad_1]

DAYTONA BEACH SHORES, Florida – Tom Baker lives in a retirement dream constructing: A spacious three-bedroom beachside condo with unobstructed morning sunrises, waves marking the time and the tender sand of consolation.

The retired Marine and Military veteran and his spouse Joan moved right here from the Tampa Bay space. She had a Daytona Seashore timeshare they frequently visited. Ten years in the past they moved to their retirement house: a fourth-story condominium on the Atlantic Ocean.

“I completely love Daytona Seashore,” he stated. “I completely love the place I dwell, and I really like this constructing.”

So why does he appear so offended? Two phrases: Property insurance coverage.

For Baker and plenty of different Florida condominium house owners, the very idea of insurance coverage – to ease worries throughout occasions of misery – appears misplaced, particularly after the 2021 collapse of the Champlain Towers South in Surfside and the two-punch combo of the 2022 hurricane season: Ian and Nicole.

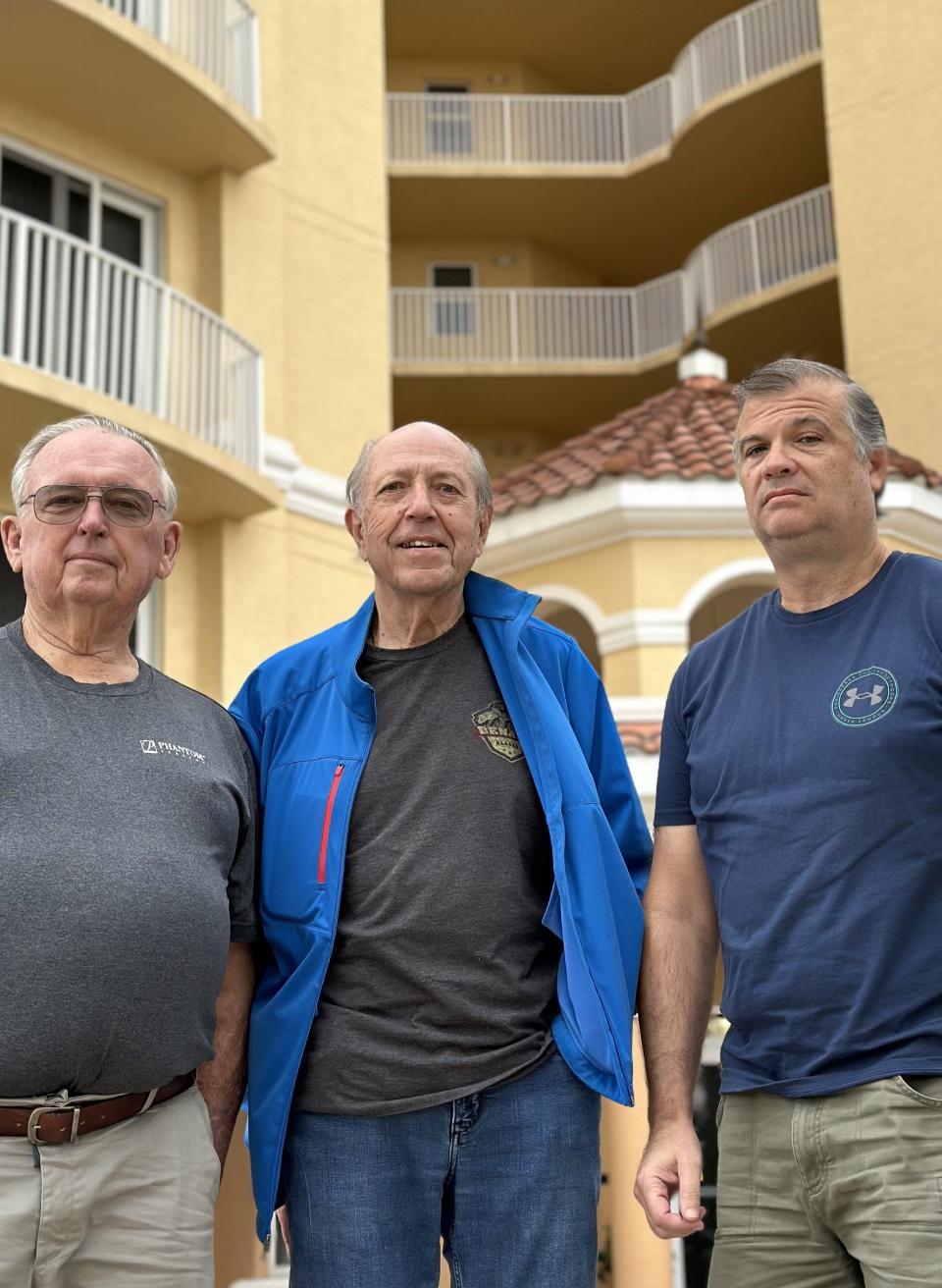

The latter storms simply over a yr in the past pounded a seawall exterior the Marbella Condominiums, then destroyed a pool and deck space. And the Surfside catastrophe, which killed 98 individuals, shined a lightweight on structural security, delayed upkeep and the necessity for the state to enact extra strict laws to forestall future collapses.

As unhealthy as all of that was, for Baker, the true catastrophe arrived in December 2022: the property insurance coverage invoice for Marbella, the place he serves on the condominium affiliation’s board.

For the 24-unit constructing, property insurance coverage jumped from $40,534 for 2022 to almost $269,000 – a 563% enhance. And Rob Lasch, one other Marbella board member, stated he’s anticipating one other enhance when the coverage supply arrives, which might be any day now.

And the rise got here regardless of a historical past of Marbella, which was in-built 2007, by no means having filed a declare, Lasch and Baker stated. There was no declare filed for the $2 million injury on the condominium’s ocean-facing deck.

“Nothing acquired paid out for the injury exterior as a result of it was the seawall, and no person was insuring the seawalls,” Lasch stated.

So Marbella residents are getting hit laborious on either side of the hurricane. They’re having to give you the total quantity to repair the injury, whereas additionally bearing the burden of elevated charges.

Baker stated his spouse desires to maneuver, leaving him to ponder merely not shopping for property insurance coverage for the constructing – one thing his fellow board members don’t help as a result of it violates Florida legislation and would go away the board members personally uncovered to lawsuits.

“In a minute, I wouldn’t pay one other dime in property insurance coverage, as a result of it’s unlawful, it’s immoral, and it’s improper. You possibly can’t justify this cost. That is out-and-out stealing. Theft,” he stated. “And excuse me for being passionate. I’m pissed.”

Different condominium house owners additionally see exponential charge hikes

Marbella isn’t alone. Many condominium associations throughout the state have stated they, too, have confronted astronomical property insurance coverage charge hikes.

Proper subsequent door, the 109-unit Grand Coquina Condominium went from paying $207,000 for property insurance coverage in 2022 to $680,000 for 2023, a 228% enhance, stated Jeff Sussman, the affiliation’s treasurer.

That amounted to a $2,331 extra evaluation per unit this yr, whereas Sussman tasks one other evaluation of between $3,000 and $6,000 per unit can be required in 2024.

Grand Coquina filed a declare in search of reimbursement for water injury its board members contend was attributable to wind throughout the storms. The declare was denied, stated Marro Porcelli, president of the Grand Coquina Condominium Affiliation Inc.

Grand Coquina employed an legal professional and a structural engineer to problem the denial. Board members anticipate they may obtain a settlement supply.

“There’s loads of combat left in us,” Porcelli stated. “We’re not giving in to the criminals.”

Marbella is comparatively new, constructed 15 years in the past beneath strict constructing codes. Because of this, it stands on 42 pylons which might be 40 ft lengthy and attain all the way down to the laborious core beneath the sand, Smith stated.

In different phrases, residents there are assured if the constructing itself may face up to Ian and Nicole, it is unlikely to crumble anytime quickly.

And Smith stated the deductible for any catastrophe is $1 million.

That leads Baker to query what the insurance coverage is definitely masking.

‘We do not have insurance coverage. We’ve an insurance coverage invoice’

“If a twister got here throughout this constructing and ripped the roof fully off, our deductible is greater than the restore. If an atomic bomb goes off downtown, and blows this constructing down, we don’t acquire due to the battle clause,” Baker stated.

“There isn’t any means this constructing can acquire,” he stated. “It is a concrete constructing with sprinklers. You couldn’t burn the rattling factor down in the event you constructed a bonfire inside. We do not need insurance coverage. We’ve an insurance coverage invoice.”

Baker has written to all 160 state lawmakers in addition to 15 information organizations concerning the plight of condominium house owners. He went to Tallahassee throughout this yr’s session.

“I realized one thing a very long time in the past within the navy,” he stated. “For those who make a criticism, have a suggestion on how you can repair it, OK?”

He is proposed dropping the requirement that condos buy insurance coverage. And he is additionally talked about condos discovering a method to self-insure.

Largely, Baker stated his pleas have been ignored.

Baker met with Rep. Tom Leek, R-Ormond Seashore, who was receptive to at the very least one in every of his concepts. The workplace of Sen. Jason Pizzo, D-Sunny Isle Seashore, responded to a packet of data Baker mailed to all lawmakers. However in any other case, he is heard nothing.

Baker stated he is most dissatisfied in Sen. Tom Wright, R-New Smyrna Seashore, who represents Daytona Seashore Shores.

“For one yr, I’ve been attempting to get an appointment with Sen. Wright,” Baker stated. “I even went to his workplace. He walked proper previous me. He didn’t prolong me the courtesy of shaking my hand.”

Wright didn’t reply to a request for remark.

Leek, whose district consists of Daytona Seashore Shores, likes at the very least one in every of Baker’s concepts.

Is self-insuring a good suggestion?

“We’re actively discovering methods to assist the Florida client, and permitting condominium associations to self-insure is a good suggestion. In truth, measures that enhance competitors within the insurance coverage market and drive extra carriers into Florida will profit customers,” he wrote.

Mark Friedlander, Florida spokesman for the Insurance coverage Data Institute, stated Florida has lengthy had a sophisticated relationship with property insurance coverage, and it acquired more difficult with the Surfside collapse and the hurricanes of 2022.

Lots of the insurers that provide condominium protection began to tug again from the Florida market on account of elevated danger on the older coastal properties, Friedlander stated in an electronic mail.

“The insurers that remained enhanced their underwriting standards. This started the development of serious premium will increase for grasp affiliation protection,” he stated. “Insured losses incurred from substantial property injury generated by hurricanes Ian and Nicole final yr additional impacted the supply and value of grasp condominium insurance coverage,” Friedlander wrote.

Along with “grasp coverage prices” shared amongst all condominium unit house owners, particular person condominium house owners dwelling in high-risk properties are seeing their condominium unit coverage premiums enhance considerably – 50% to 100% on common, he added.

Over the previous two years, the Florida Legislature has handed a flurry of modifications with the objective of resolving the property insurance coverage disaster, thus far to no avail.

A few of these measures embody tweaking laws associated to Residents Property Insurance coverage Corp, the state-run insurer of final resort, authorizing actions to be taken by the Florida Workplace of Insurance coverage Regulation, and cracking down on bad-faith claims.

In an early November particular session, lawmakers allotted $181.5 million to the My Secure Florida Residence Program, which supplies owners a wind-mitigation survey and grant funds to make properties extra sturdy.

Leek stated he is assured that what lawmakers have been doing has been achieved is working.

“The Legislature’s insurance coverage reforms are taking maintain,” Leek wrote in response to questions. “New carriers are getting into the Florida insurance coverage marketplace for the primary time in years. Simply this month, a brand new service entered the Florida condominium affiliation insurance coverage market.

“It is occurring and it does take time, and we’ll proceed to work to offer a local weather of competitors and selection,” he wrote.

Friedlander additionally referenced the brand new service as a constructive signal: “Final week, Florida’s insurance coverage regulator introduced {that a} new insurer, the Condominium House owners Reciprocal Change, can be getting into the state’s market in 2024 and supply grasp condominium coverage protection to associations. We hope this can be a primary step towards stabilizing the marketplace for this protection.”

Condominium house owners socked with $64,000 in assessments

Because of either side of the property insurance coverage drawback – excessive charges and being awarded no claims for the injury, Marbella condominium house owners have every paid roughly $64,000 in HOA charges and assessments in 2023, stated board President Jim Smith.

Baker acknowledges beachside condominium house owners – notably those that have to date been in a position to take in the excessive insurance coverage payments and the assessments to pay for damages – most likely do not appeal to a lot sympathy in Florida.

“Now us wealthy son-of-a-bitches, pardon me, we are able to handle someway and get away with it,” he stated.

However different condominium house owners have had their retirement desires dashed, shifting due to the excessive prices, whereas an exodus awaits if the issue isn’t contained, affiliation board members say.

They recognize what Baker has achieved to lift consciousness of the issue.

“He is taken this on, and he is very captivated with it,” stated Jim Smith, the Marbella Condominium Affiliation Board president.

Baker stated: “Individuals who moved down right here on mounted incomes and purchased themselves their closing place now discover themselves with an inconceivable invoice.”

Solutions: What’s going on with the stalled condo high-rise on A1A in Daytona?

This text initially appeared on The Daytona Seashore Information-Journal: Daytona Beach Shores condo owners call 563% insurance increase ‘theft’

[ad_2]

Source