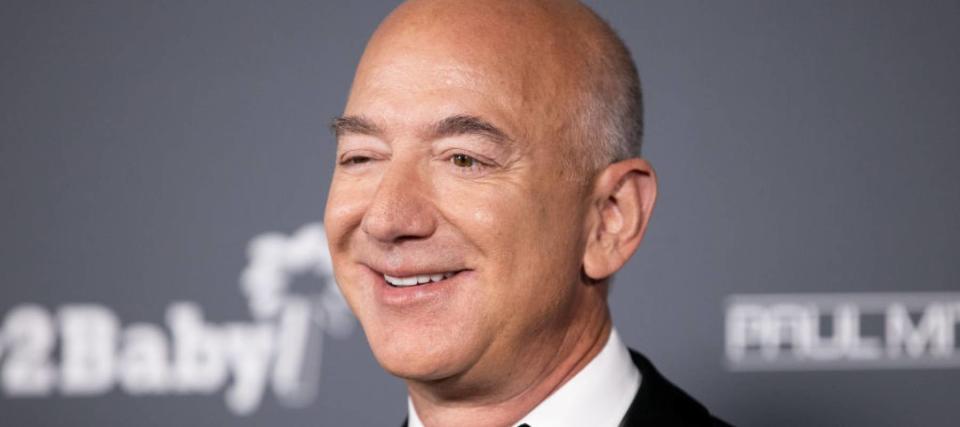

Amazon’s Jeff Bezos outfoxes Washington — the billionaire is saving almost $600 million in taxes by shifting from Seattle to Miami. Right here’s 3 methods you’ll be able to sidestep the taxman

Jeff Bezos made a masterful cash transfer when he left his long-time digs in Seattle for a pad in Miami’s so-called “Billionaire Bunker.”

The Amazon (AMZN) founder — presently the second-richest particular person on this planet — stated he moved to Florida in 2023 to be nearer to his mother and father and his rocket firm Blue Origin.

Don’t miss

Ditching the Emerald Metropolis turned out to be a really profitable resolution for the businessman. It has since been reported by CNBC that his transfer to Indian Creek will save Bezos many thousands and thousands of {dollars} in taxes.

Right here’s how Bezos is conserving his {dollars} from Uncle Sam — and 3 ways you are able to do the identical (even in the event you’re not sitting on billions like Bezos).

Promoting Amazon shares

Because the late Nineties, Bezos has offered billions of {dollars} price of Amazon shares to fund his philanthropy, different enterprise initiatives and his billionaire way of life.

However in 2022, he hit pause on his inventory gross sales when Washington state imposed a brand new 7% capital features tax on gross sales of shares or bonds of greater than $250,000.

After shifting to Florida, Bezos took his foot off the brake. He just lately offered round 12 million Amazon shares for roughly $2 billion, based on an organization submitting on Feb. 9.

As a resident of the Sunshine State — which doesn’t tax on capital features — Bezos managed to save lots of round $140 million in taxes he would have needed to pay to Washington state for a similar transaction.

He additionally introduced a pre-scheduled stock-selling plan to unload 50 million shares earlier than Jan. 31, 2025, which might be price almost $8.5 billion immediately.

With the Florida benefit, he’ll save round $593 million on capital features taxes — and that’s if Amazon shares stay flat (keep in mind that the inventory has jumped greater than 13% to date this yr).

It’s essential to notice that each states — Washington and Florida — haven’t any state earnings tax and their actual property tax charges each hover round 1%. The actual game-changer, for Bezos at the least, appears to be Washington’s relatively new capital gains tax, which might see him hand billions over to the IRS. Listed below are 3 ways it can save you a few of your hard-earned money from the tax man.

Comply with Bezos’ transfer

In case your tax invoice fills you with monetary dread yr after yr, then perhaps it is best to think about a Bezos-style transfer to a special, extra tax-friendly state. That is what financial gurus like Grant Cardone have been recommending.

They typically cite latest migration traits of their arguments. Texas and Florida skilled the best inhabitants progress in 2023, based on Census Bureau data, with features of 473,453 individuals and 365,205 individuals, respectively. Each states haven’t any private earnings tax — which might aid you save an excellent chunk of your pay from Uncle Sam every year.

If you happen to’re contemplating shifting states since you’re bored with paying excessive earnings taxes, it’s essential to do not forget that private earnings tax charges solely inform a part of the tax story.

You must think about every particular person state’s private earnings tax brackets and the accessible deductions, exemptions and credit. Additionally do not forget that property and gross sales taxes can affect a state’s affordability.

For instance, whereas Texas has no state earnings tax, it has one of many highest efficient property tax charges within the nation, at 1.68%. In the same vein, zero-individual earnings tax Tennessee has the best gross sales tax within the nation, at 9.548%.

Learn extra: Because of Jeff Bezos, now you can cash in on prime real estate — with out the headache of being a landlord. This is how

If you happen to’re contemplating making a transfer, it might be price consulting with a tax skilled to get a transparent image of your whole tax liabilities earlier than packing up your life.

There’s additionally different elements to think about. The common price of householders insurance coverage in Florida is thrice greater than the nationwide common and has elevated 102% within the final three years, per the Insurance coverage Info Institute.

Spend money on tax-advantaged accounts

If you happen to’d slightly keep put the place you reside, one of many best methods to carry some a refund from the IRS is to spend money on tax-advantaged automobiles like a 401(k) account or a person retirement account (IRA).

With a 401(ok) retirement financial savings plan, you’ll be able to steer a portion of your pay into an account — as much as $23,000 in 2024 — which you’ll be able to then invest to grow your money. You received’t pay tax on these contributions till you withdraw your funds during retirement, and by then you have to be in a decrease income-tax bracket.

If you happen to don’t have entry to a 401(ok), you would possibly think about opening a standard IRA, the place you’ll be able to contribute pretax earnings — as much as $7,000 (for these underneath age 50) and $8,000 (for these age 50 or older) in an IRA in 2024 — and develop it tax-free till you make withdrawals in retirement.

An alternative choice is a Roth IRA, the place your contributions are taxed upfront in order that your withdrawals are tax-free in retirement. This, after all, is much less useful for decreasing your upcoming tax legal responsibility — however Roth IRAs can supply some advantages and flexibility in comparison with conventional IRAs.

Decrease your taxable earnings

You’ll be able to reduce the amount of money you owe to the IRS via efficient utilization of tax credit score and tax deductions. If you do not have an accountant, tax prep softwares can search via credit and deductions for you.

Tax credit are extremely fascinating as a result of they instantly cut back your tax invoice. Some widespread examples embody: the child tax credit (CTC), the electric vehicle (EV) tax credit and the earned income tax credit (EITC).

All tax credit have completely different thresholds for eligibility and are sometimes primarily based partly in your earnings. It is very important monitor the IRS tax credit score necessities in case your earnings adjustments over time.

Tax deductions are barely completely different in that they decrease your taxable earnings. When filing your taxes, you’re given the selection to both take the usual deduction or itemize deductions.

For tax-year 2024, the standard deduction for single filers is $14,600 and $29,200 for joint filers.

Itemizing your deductions lets you declare certified deductions individually — like medical bills, donations and mortgage curiosity, and so forth. — however whereas that will prevent just a few additional bucks, it received’t take any stress out of your taxes.

What to learn subsequent

This text supplies data solely and shouldn’t be construed as recommendation. It’s supplied with out guarantee of any sort.