The Finest Credit score Monitoring Companies for February 2024

Credit score monitoring providers aid you preserve shut tabs in your credit score whereas serving to to guard you in opposition to fraud and knowledge breaches.

Since your credit score rating helps decide whether or not you’re authorised for a personal loan, credit card, mortgage and even renting a brand new house, it’s vital to verify the quantity is correct.

Monitoring your credit score rating can even aid you keep one step forward of fraudsters and identification thieves. The best variety of knowledge breaches recorded in a single 12 months occurred in 2023, in line with an Identity Theft Research Center report.

Based on the report, there was a 78% enhance in publicly introduced knowledge breaches from 2022 to 2023.

By conserving an in depth eye in your knowledge, you would keep away from being added to the ever-growing record of victims. Listed here are a number of the greatest free providers to make use of for each monitoring your credit score and conserving your knowledge safe.

Experian

Finest general credit score monitoring instrument

Value: $0 to $24.99 month-to-month

Experian — one in every of the three major credit bureaus — helps you to test your FICO credit score rating and your Experian credit score report without cost, everytime you’d like. Although, what places this service forward of different choices is its free entry to Experian Enhance, which components in extra monetary info to enhance your FICO rating from Experian. It additionally offers the clearest breakdown of your credit score report, with clear visuals displaying info like your credit score utilization and open credit score accounts.

You do should navigate by means of tons of product suggestions, which is a tad annoying. Of the three credit score bureaus, Experian gives the perfect person expertise.

There’s a premium membership for $24.99 month-to-month that provides advantages like a credit score rating comparability amongst all three credit score bureaus, subscription cancellation and invoice negotiation service, identification theft insurance coverage, and fraud alerts and backbone assist.

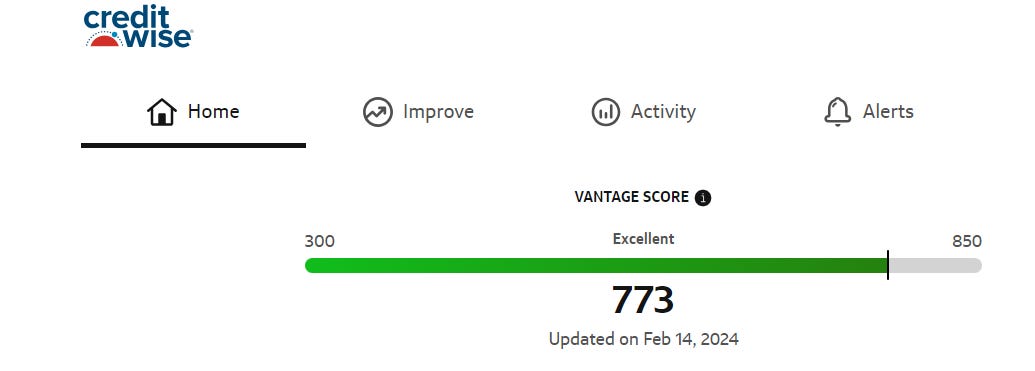

Capital One CreditWise

Runner up

Value: Free

This can be a free service that everybody can use, not solely Capital One cardholders. You’ll want to produce your Social Safety quantity, telephone quantity and deal with. When you’ve signed up, you’ll be able to test your VantageScore 3.0 credit score rating and TransUnion credit score report everytime you like.

Past that, there are a variety of helpful options. Chief amongst them could also be free darkish internet monitoring to your private info like your electronic mail and deal with. In reality, CreditWise alerted me that my private electronic mail deal with was discovered on the darkish internet and prompted me to take motion.

There are additionally instructional assets that specify vital phrases like credit score utilization and supply recommendation for lowering debt. CreditWise additionally gives a breakdown of what’s impacting your credit score rating, something that has affected it just lately (although you’ll have to have your account open for a bit to profit from this) and actionable suggestions for bettering your credit score rating.

Value: $0 to $30 month-to-month

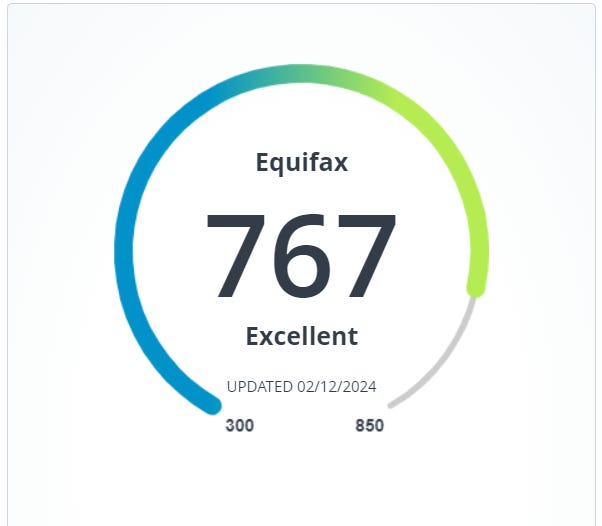

One other of the large three credit score bureaus within the US, Equifax, suffered one of many worst data breaches in 2017 affecting more than half of all Americans.

If you happen to’re feeling forgiving, Equifax’s credit score monitoring providers are on par with opponents, and its a number of pricing choices might will let you discover a plan higher suited to your wants and price range.

It’s not essentially the most modern-looking web site, nevertheless, and generally is a bit clunky, however its product gives are much less intrusive than different choices.

The service offers a replica of your Equifax credit score report and displays your credit score and Social Safety numbers by scanning web sites the place shopper info has been offered. Equifax additionally sends alerts about suspicious actions, like somebody making use of for credit score in your title on the opposite facet of the nation.

Value: $30 per 30 days

Additionally among the many high three main credit score monitoring providers is TransUnion. With TransUnion, you’ll be able to test your credit score rating report as usually as you’d wish to see in case your rating has modified.

Whereas it is going to price you round $30 to enroll in TransUnion’s credit score monitoring providers, the credit score bureau gives some free providers, corresponding to the flexibility to freeze your credit score, dispute your credit score report and enroll in fraud alerts to assist defend your credit score profile.

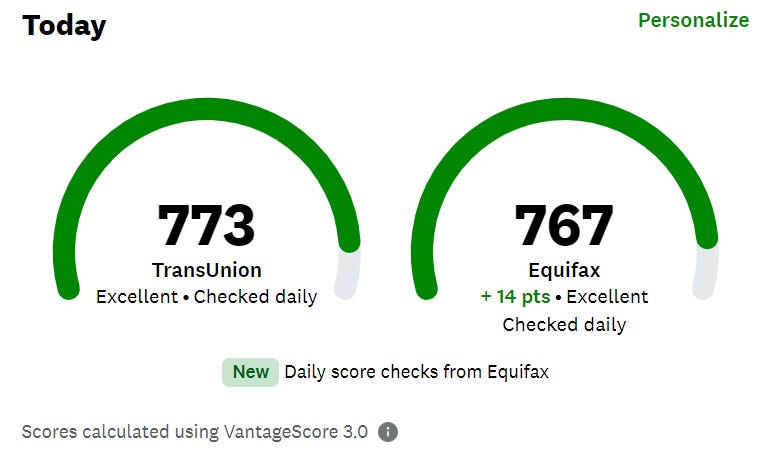

Value: Free

Credit Karma is a private finance firm that provides a service to test your Equifax and TransUnion credit score scores as usually as you’d like without cost. You too can entry your credit score reviews from each bureaus, however not from Experian.

Credit score Karma displays your credit score and sends weekly updates and can notify you if there’s any change to your credit score rating. Each your TransUnion and Equifax credit score report is displayed in a format that’s simpler to parse than on both of the credit score bureaus’ personal web sites.

The positioning additionally reveals your rating and components that have an effect on your rating, like in the event you’re utilizing an excessive amount of of your bank card restrict, in addition to derogatory marks and hard inquiries.

Credit score Karma can even warn you if any of your electronic mail or passwords have been uncovered in knowledge breaches and has quite a few instructional assets. And like the opposite websites, Credit score Karma will match you with credit score merchandise. Though, you need to take your approval odds with a grain of salt.

American Specific MyCredit Information

Value: Free

American Specific’ MyCredit Information let’s you test your Experian credit score report and FICO credit score rating freed from cost, even in the event you aren’t an American Specific cardholder.

It’s a clear interface which shows your credit score rating, the components that impression it and a graph displaying your Experian rating historical past. You too can set a goal credit score rating, entry monetary calculators and see your complete Experian credit score report.

You too can use a FICO rating simulator to see how any modifications in your funds may impression your rating forward of time. And like lots of the different providers on this record, Amex will warn you if any of your private info has been compromised.

Value: Free

FreeCreditReport.com is a pared-down service supplied by Experian to entry your credit score report and credit score rating without cost. The corporate offers you with an up to date credit score report each 30 days. You’ll have entry to your account historical past, together with mortgages and credit score traces.

FreeCreditReport.com reveals you exhausting inquiries in your account, tracks your credit score utilization and reveals any potential marks in opposition to you, like late funds.

Mixing and matching providers might assist cowl extra floor

In the case of checking your credit score, there are plenty of methods to go. You possibly can choose one service or pair free providers collectively to entry your FICO score from all three main bureaus. Nonetheless, in the event you go that route, remember the fact that you received’t have the promised credit score safety and monitoring that Experian, TransUnion and Equifax supply.

It’s additionally a good suggestion to incorporate Capital One’s CreditWise within the combine. Free darkish internet monitoring is one other layer of safety in opposition to identification theft.

FAQs

Your credit score is a three-digit quantity that’s calculated based mostly in your credit score reviews from the three main US credit score bureaus, Experian, TransUnion and Equifax. Each FICO and VantageScore — the 2 main credit score scoring fashions — vary from 300 to 850.

When making use of for credit score, lenders might test your credit score reviews and credit score rating to find out in the event you’re price lending cash to. Some components that may have an effect on your rating embrace hard inquiries that happen if you apply for credit score, derogatory marks for paying a invoice late and the way a lot of your complete credit score you’re utilizing (the much less you employ, the higher). Every credit score bureau maintains its personal reporting, so your rating might fluctuate based mostly on which credit score reviews are used within the evaluation.

Many individuals imagine checking their credit score rating will ding their credit score report, however that’s not true. Checking your personal credit score rating is taken into account a delicate inquiry and received’t have an effect on your credit score. Nonetheless, in the event you’re making use of for a mortgage or bank card, and an organization runs a credit score test on you, that’s thought of a tough inquiry, which might briefly deliver your rating down a number of factors.

The editorial content material on this web page is predicated solely on goal, unbiased assessments by our writers and isn’t influenced by promoting or partnerships. It has not been supplied or commissioned by any third celebration. Nonetheless, we might obtain compensation if you click on on hyperlinks to services or products provided by our companions.