This Extremely Low-cost Semiconductor Inventory May Develop into the Subsequent Nvidia

Nvidia (NASDAQ: NVDA) inventory has been on a tear on the inventory market over the previous yr and a half, which isn’t stunning — the corporate has been delivering phenomenal earnings and income development due to the booming demand for its synthetic intelligence (AI) chips.

Nvidia instructions a dominant place within the AI chip market with a market share of greater than 90%. It’s leagues forward of rivals comparable to Intel and AMD, that are nonetheless seeking to reduce their tooth on this market. For instance, Nvidia is anticipated to promote $87 billion price of AI chips this yr. AMD and Intel, in the meantime, predict to generate $4 billion and $500 million, respectively, from AI chip gross sales this yr.

Nvidia is clearly the go-to chipmaker for firms that need to prepare and deploy AI fashions, as its share of this market illustrates. The inventory market has rewarded the corporate’s dominance handsomely, which is clear from the 507% soar in its share worth because the starting of 2023. This beautiful rally has introduced Nvidia’s trailing earnings a number of to 74, which is kind of wealthy when you think about that the Nasdaq-100 index has an earnings a number of of 30 (utilizing the index as a proxy for tech shares).

There’s a strong likelihood that Nvidia can justify this costly a number of with tremendous growth going forward. However there may be another for buyers who’re on the lookout for an organization that might replicate Nvidia’s AI-driven success in a distinct market and is buying and selling at a lovely valuation proper now — Qualcomm (NASDAQ: QCOM).

Let us take a look at the the explanation why this chipmaker has the potential of turning into the subsequent Nvidia.

Qualcomm’s place within the smartphone market is about to unlock an enormous alternative

Qualcomm is the second-largest producer of software processors utilized in smartphones. The corporate managed 28% of this market on the finish of 2023, trailing the top-ranked producer MediaTek by 5 share factors.

One could argue that Qualcomm is not as dominant as Nvidia in its subject. Nevertheless, it would not be stunning to see Qualcomm finally seize an even bigger share of the smartphone processor market due to the proliferation of AI-enabled smartphones. On its Could earnings convention name when administration was discussing the corporate’s fiscal 2024 second-quarter outcomes (for the three months ended March 24), CEO Cristiano Amon mentioned:

In premium and high-tier smartphones, our Snapdragon cell platforms proceed to set the bar for efficiency and on-device gen AI capabilities. Just lately launched flagship Android units powered by Snapdragon 8 Gen 3 are seeing robust demand globally, particularly in China.

Extra particularly, Qualcomm’s income from chip gross sales to Chinese language smartphone clients elevated greater than 40% yr over yr within the first half of the present fiscal yr. This spectacular year-over-year enhance in Chinese language income signifies that Qualcomm is making strong headway in a rustic the place MediaTek is the main participant, and is aiming to nook 30% of the flagship smartphone market.

Qualcomm is seeking to construct upon its rising prominence within the Chinese language smartphone market by bringing on-device AI capabilities “to a broader vary of flagship and high-tier smartphones with the brand new Snapdragon 8S Gen3 and Snapdragon 7 Plus Gen 3 cell platforms, launching within the second half of 2024.”

All this explains why Qualcomm is anticipating its development to speed up from the present quarter. The corporate delivered a income enhance of simply 1% within the second quarter of fiscal 2024 to $9.4 billion. It’s forecasting $9.2 billion in income within the present quarter on the midpoint of its steering vary, which might be a 9% soar over the identical interval final yr.

The corporate is anticipating its earnings to develop at a sooner tempo of 20% yr over yr to $2.25 per share within the present quarter. Wall Road would have settled for $2.18 per share in earnings on $9.06 billion in income from Qualcomm, however the firm is about to go previous these expectations due to the rising demand for AI-powered smartphones and its enhancing affect in markets comparable to China.

That is not stunning, as the corporate’s AI-capable smartphone chips are being deployed by main smartphone OEMs (authentic gear producers). Qualcomm is seeking to push the envelope on this house by specializing in bringing AI capabilities into mid-range smartphones as properly.

In all, Qualcomm is setting itself as much as profit from the bustling marketplace for generative AI smartphones, shipments of that are anticipated to develop at an eye-popping compound annual development price of 65% between 2024 and 2027, in keeping with Counterpoint Analysis.

The inventory’s valuation makes it a no brainer purchase

The generative AI smartphone market is at present in its early phases of development. Counterpoint estimates that these units will account for 11% of the general smartphone market in 2024, after which develop to 43% of the market in 2027. Even then, there shall be quite a lot of room for development in gross sales of generative AI smartphones as extra firms carry these units to the market.

So Qualcomm is doing the suitable factor by bolstering its portfolio of AI-focused smartphone chips, and it’s making good headway on this market, with marquee clients comparable to Samsung. Because of this, there’s a good likelihood of Qualcomm turning into an even bigger participant within the smartphone chips market and replicating the success that Nvidia has seen within the AI chips market.

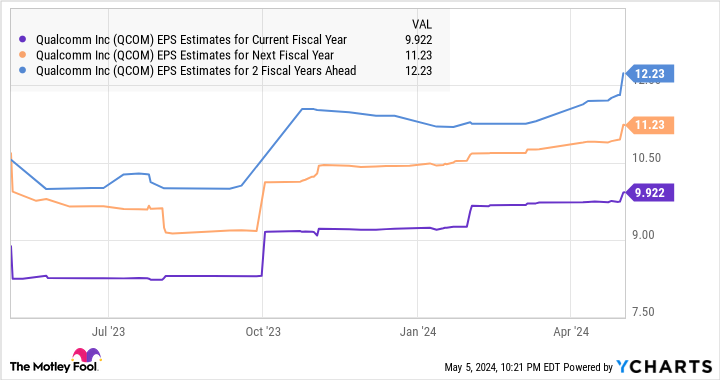

That is why buyers would do properly to purchase Qualcomm at its present valuation. The inventory sports activities a price-to-earnings ratio of 24, which is properly beneath the multiples that Nvidia and the broader Nasdaq-100 index command. The ahead earnings a number of can also be engaging at 19. Furthermore, as the next chart reveals, analysts have been elevating their earnings development expectations from Qualcomm.

All this means that Qualcomm is able to delivering stronger development within the coming years due to profitable catalysts such because the AI smartphone market, the place the corporate is a key participant. That is why buyers on the lookout for the subsequent Nvidia ought to think about shopping for Qualcomm earlier than this semiconductor inventory steps on the fuel.

Do you have to make investments $1,000 in Qualcomm proper now?

Before you purchase inventory in Qualcomm, think about this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they imagine are the 10 best stocks for buyers to purchase now… and Qualcomm wasn’t certainly one of them. The ten shares that made the reduce may produce monster returns within the coming years.

Contemplate when Nvidia made this checklist on April 15, 2005… when you invested $1,000 on the time of our advice, you’d have $554,830!*

Inventory Advisor offers buyers with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of Could 6, 2024

Harsh Chauhan has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Superior Micro Units, Nvidia, and Qualcomm. The Motley Idiot recommends Intel and recommends the next choices: lengthy January 2025 $45 calls on Intel and brief Could 2024 $47 calls on Intel. The Motley Idiot has a disclosure policy.

Prediction: This Incredibly Cheap Semiconductor Stock Could Become the Next Nvidia was initially revealed by The Motley Idiot