Billionaire Ken Griffin Simply Made a As soon as-in-a-Technology Guess on This Inventory. Time to Purchase?

[ad_1]

When Ken Griffin, founder and chief government officer of Citadel, makes an funding choice, everybody stands up and takes discover. That is as a result of this investing large has produced show-stopping outcomes over time, with Citadel bringing in about $74 billion in returns since its 1990 launch. That makes it essentially the most profitable hedge fund ever.

So it is no shock buyers are keen to listen to about Griffin’s newest strikes. This famous person investor holds greater than 4,000 shares and funds in the Citadel portfolio, and greater than 19% of the portfolio is made up of know-how shares. Clearly, Griffin believes within the potential of a few of at this time’s greatest tech firms. And that leads me to certainly one of his newest strikes.

Griffin elevated his place in Amazon (NASDAQ: AMZN) by greater than 200% within the fourth quarter, shopping for greater than 4 million shares to carry his holding to about 6.2 million. Because of Amazon’s dominance within the two high-growth industries of e-commerce and cloud computing and the corporate’s technique to win within the synthetic intelligence (AI) market, this seems like a once-in-a-generation guess. Is it one you must comply with? Let’s discover out.

Amazon’s monitor report

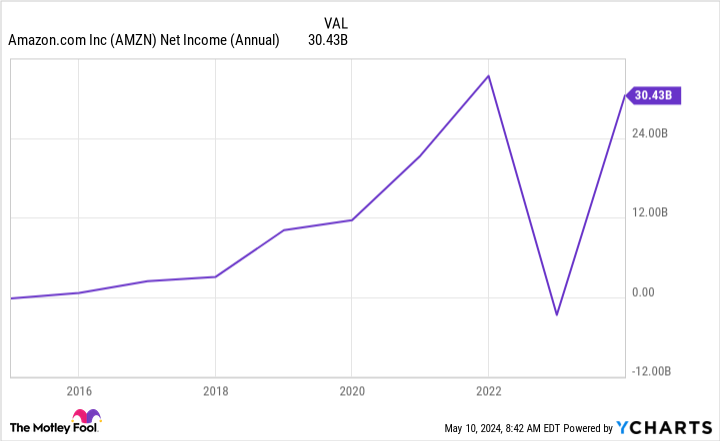

First, earlier than we even get to the much-talked-about space of AI, we’ll discuss Amazon’s monitor report. The corporate has progressively added to its e-commerce and cloud computing companies, and this has translated into billion-dollar gross sales and revenue. Amazon has even demonstrated its skill to handle a tough high-interest price surroundings. As larger charges and common financial strain weighed on demand for discretionary objects and cloud companies, the corporate revamped its price construction, centered on effectivity — and went on to shift from a uncommon annual loss to revenue final yr.

These efforts ought to assist Amazon proceed to regulate prices and enhance income. For instance, the transfer to a regional success mannequin from a nationwide one — bringing stock nearer to the shopper — has decreased Amazon’s price to serve.

Now, Amazon’s focus on AI throughout its companies could supercharge this already strong development story. Amazon represents a singular AI guess as a result of the corporate makes use of the know-how to enhance its operations, and subsequently decrease prices and higher serve clients — and thru Amazon Net Providers (AWS), it sells AI services to clients. So Amazon is benefiting from AI in two methods.

In e-commerce, for instance, Amazon makes use of AI to find out one of the best supply routes, a key step in making deliveries cheaper and quicker. This pleases Amazon and its clients. And Amazon makes use of AI in lots of different methods throughout the success course of.

From chips to Amazon Bedrock

However AWS could also be the place Amazon is ready to attain the most important AI victory. AWS delivered $25 billion in gross sales this previous quarter, for a $100 billion annualized run price, and that is due to the cloud supplier’s strengths in AI. Amazon, via AWS, gives clients AI options to satisfy all of their wants from a broad vary of chips to a completely managed service referred to as Amazon Bedrock that permits clients to customise high massive language fashions for their very own functions.

And Amazon gives a spread of AI-powered apps throughout its e-commerce and cloud companies to assist clients with every part from purchasing to coding.

One motive I consider AWS could possibly be among the many greatest gamers in AI over time is that it is the world’s main cloud supplier by far — and this implies potential clients already are proper there, prepared to show to AWS for his or her AI wants too. Since Amazon has constructed an enormous number of AI services comparable to the wants of each cost-conscious clients and people with important budgets, it is able to ship.

Must you comply with Ken Griffin’s transfer?

Contemplating the rise in Ken Griffin’s Amazon funding and his presence in AI tech shares, he clearly sees this potential. So, do you have to comply with this billionaire investor into Amazon proper now?

A take a look at Amazon’s valuation exhibits it is buying and selling for 41x ahead earnings estimates. That is decrease than ranges approaching 60 late final yr. On the identical time, gross sales are on the rise on the firm, and AWS has seen clients emerge from a interval of price chopping and begin deploying new initiatives. So a brand new wave of development could be getting began, and that makes the shares look fairly cheap at at this time’s stage.

And it is essential to recollect the overall AI development story is simply getting began too, with the market forecast to develop at a double-digit compound annual development price to achieve greater than $1 trillion by the top of the last decade.

All of this implies, proper now, Amazon seems like a once-in-a-generation funding alternative — not just for billionaire Ken Griffin however probably for you too.

Must you make investments $1,000 in Amazon proper now?

Before you purchase inventory in Amazon, think about this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they consider are the 10 best stocks for buyers to purchase now… and Amazon wasn’t certainly one of them. The ten shares that made the lower may produce monster returns within the coming years.

Take into account when Nvidia made this record on April 15, 2005… should you invested $1,000 on the time of our suggestion, you’d have $550,688!*

Inventory Advisor supplies buyers with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of Could 6, 2024

John Mackey, former CEO of Entire Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Adria Cimino has positions in Amazon. The Motley Idiot has positions in and recommends Amazon. The Motley Idiot has a disclosure policy.

Billionaire Ken Griffin Just Made a Once-in-a-Generation Bet on This Stock. Time to Buy? was initially revealed by The Motley Idiot

[ad_2]

Source