2 Shares That Might Comply with Go well with

The U.S. authorities has targeted considerably on the nation’s place within the semiconductor market, and that is not stunning — chips play a important function in a number of industries, starting from automotive to smartphones, computer systems, and synthetic intelligence (AI).

A key effort: the CHIPS and Science Act, which was enacted in 2022, has accelerated investments within the U.S. semiconductor business. As part of this program, the U.S. authorities has awarded almost $30 billion in grants and $25 billion in loans to seven corporations. Thanks to those huge investments, semiconductor manufacturing capability within the U.S. is about to triple by 2032, rising an estimated 203% in lower than a decade, in accordance with a report by the Semiconductor Business Affiliation and Boston Consulting Group.

Let’s take a more in-depth have a look at two semiconductor companies which are beneficiaries of the CHIPS Act. Each have already obtained help from the U.S. authorities, are rising at a terrific fee, and will ship big upside by 2032 that would match the bounce in U.S. semiconductor spending.

1. Micron Expertise

On April 25, Micron Expertise (NASDAQ: MU) reached preliminary phrases with the U.S. authorities for a proposed funding of $6.1 billion beneath the CHIPS Act, together with proposed loans of as much as $7.5 billion. The reminiscence specialist says that this grant will assist its capex plans value $50 billion to construct superior chips within the U.S. via 2030.

This improved manufacturing capability will give Micron’s progress an enormous increase in the long term, permitting it to win a much bigger share of the promote it operates in. Micron was the third-largest provider of dynamic random entry reminiscence chips (DRAM) final yr, with a share of 23%.

It’s value noting that Micron is witnessing strong demand for its DRAM chips because of AI. As an example, on the March earnings convention name, administration remarked that Micron has offered out its high-bandwidth reminiscence (HBM) capability for 2024. Micron additionally added that “the overwhelming majority of our 2025 provide has already been allotted.”

That is not stunning — the demand for HBM is anticipated to triple this yr due to its deployment in AI chips from the likes of Nvidia and others. HBM demand is anticipated to double as soon as once more subsequent yr and will clock annual progress of 68% via 2030. In the meantime, the general reminiscence market is anticipated to generate $338 billion in annual income in 2032, in comparison with $134 billion in 2023, in accordance with Credence Analysis.

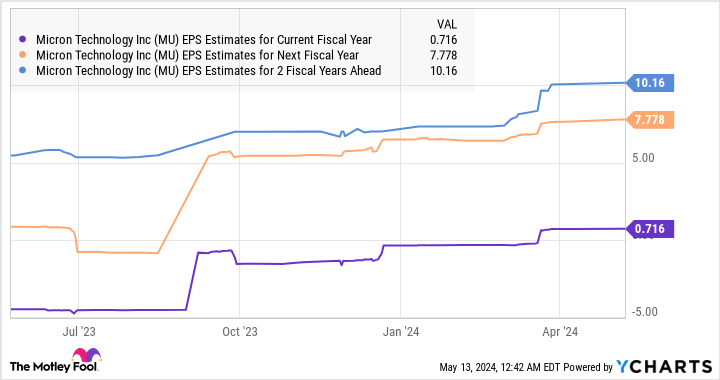

So, Micron’s larger manufacturing capability, because of the favorable circumstances within the U.S. semiconductor business, ought to pave the way in which for long-term progress. The nice half is that Micron is already rising rapidly because of outstanding end-market demand. As the next chart signifies, its earnings are anticipated to take off following a lack of $4.45 per share within the earlier fiscal yr.

Assuming Micron does hit $10.16 per share in earnings in a few fiscal years and trades at 30 occasions earnings, consistent with the Nasdaq-100‘s earnings a number of (utilizing the index as a proxy for tech shares), its share value may improve to $305 per share. That may be 2.5 occasions its present inventory value. Furthermore, the secular progress alternative within the reminiscence market and the corporate’s give attention to enhancing its capability may assist it ship extra upside sooner or later, and the inventory might even triple in the long term.

With Micron at present buying and selling at 17 occasions ahead earnings, buyers are getting deal on this semiconductor inventory proper now, and they need to contemplate making the most of its low cost valuation. It appears constructed for spectacular long-term progress.

2. Taiwan Semiconductor Manufacturing Firm

Taiwan Semiconductor Manufacturing Firm (NYSE: TSM), popularly referred to as TSMC, is one other beneficiary of the CHIPS Act. Final month, the U.S. Division of Commerce proposed $6.6 billion in direct funding and one other $5 billion in proposed loans to the foundry large to assist its enlargement within the U.S. The corporate has already accomplished its first fabrication facility within the U.S. and is at present establishing one other one. And now, TSMC will add a 3rd fabrication plant in Arizona.

This new plant will convey TSMC’s complete funding in U.S. semiconductor manufacturing in Arizona to $65 billion. TSMC says that it has determined to construct a 3rd plant to “meet sturdy buyer demand leveraging probably the most superior semiconductor course of know-how in america.” TSMC administration mentioned on the April earnings convention name that it plans to spend 70% to 80% of its $28 billion to $32 billion capital funds for 2024 on superior course of applied sciences.

These superior processes confer with chips manufactured on nodes which are 7 nanometers (nm) or smaller, and their demand has elevated considerably over the previous yr because of AI. TSMC’s clients, corresponding to Nvidia, AMD, Intel, and Apple, are utilizing course of nodes which are 5 nm or smaller of their AI chips and AI-focused merchandise corresponding to MacBooks.

Furthermore, this sturdy buyer base has made TSMC the world’s main foundry with a market share of 61%, in accordance with Counterpoint Analysis. This places the corporate means forward of Samsung, the second-largest foundry on the earth with a share of 14%. This dominant market share implies that TSMC is in a strong place to capitalize on the general progress of the semiconductor market.

Priority Analysis forecasts that the semiconductor market may very well be value an estimated $1.9 trillion in 2032, in comparison with $664 billion final yr. In easy phrases, the worldwide semiconductor market may triple in lower than a decade, and TSMC might witness strong progress in its enterprise by increasing its manufacturing capability and capturing a much bigger share of the identical.

Analysts anticipate TSMC’s earnings to extend at an annual fee of 21% for the subsequent 5 years. Assuming it may preserve even a 15% annual earnings progress for the subsequent decade, its backside line may bounce to $25 per share. TSMC has a five-year common earnings a number of of 21, and an identical a number of after a decade (hypothetically — all else equal) may ship its inventory value to $525 primarily based on the earnings projected above.

That may be greater than thrice its present inventory value, suggesting that buyers trying to benefit from the revolution within the U.S. semiconductor business would do nicely to purchase TSMC inventory for the long term.

Must you make investments $1,000 in Micron Expertise proper now?

Before you purchase inventory in Micron Expertise, contemplate this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they imagine are the 10 best stocks for buyers to purchase now… and Micron Expertise wasn’t one among them. The ten shares that made the reduce may produce monster returns within the coming years.

Contemplate when Nvidia made this checklist on April 15, 2005… for those who invested $1,000 on the time of our suggestion, you’d have $553,880!*

Inventory Advisor supplies buyers with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of Might 13, 2024

Harsh Chauhan has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Superior Micro Gadgets, Apple, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Idiot recommends Intel and recommends the next choices: lengthy January 2025 $45 calls on Intel and brief Might 2024 $47 calls on Intel. The Motley Idiot has a disclosure policy.

U.S. Chip Manufacturing Could Triple in Less Than a Decade: 2 Stocks That Could Follow Suit was initially revealed by The Motley Idiot