A As soon as-in-a-Era Funding Alternative: 1 Knowledge Heart Inventory That Might Go Parabolic (Trace: not Nvidia)

[ad_1]

Synthetic intelligence (AI) is the largest tailwind within the know-how sector proper now. Generative AI has myriad purposes, and mega-cap-tech behemoths are main innovation efforts throughout the business.

One of many delicate development alternatives in AI is knowledge facilities. In reality, Statista estimates that community infrastructure, storage, and server options might be a $439 billion alternative by 2028.

Certainly, Nvidia and Superior Micro Units have to date been massive beneficiaries in knowledge center-network providers. Nevertheless, good buyers know that there are peripheral alternatives exterior of the plain winners.

One AI knowledge middle inventory that I have been monitoring is Oracle (NYSE: ORCL). Let’s break down why Oracle might be a profitable alternative for long-term buyers as the info middle increase continues to unfold.

AI knowledge facilities are on the rise, and…

Outdoors of Nvidia and AMD, a lot of different tech companies are making a splash within the knowledge middle realm.

Vertiv is a novel alternative that is been witnessing outsize development from the rising demand for data center services. Furthermore, the corporate’s shut ties to Nvidia actually do not damage.

Moreover, Amazon not too long ago introduced an $11 billion funding to construct out extra knowledge middle infrastructure. This is not fully stunning contemplating Amazon is a frontrunner amongst cloud-computing platforms, and the corporate is growing its personal semiconductor coaching and inferencing chips.

…Oracle is quietly rising as a serious drive

Again in March, Oracle introduced monetary outcomes for its third quarter of fiscal 2024 (ended Feb. 29). On the floor, the corporate’s income development of seven% yr over yr would possibly seem mundane.

Nevertheless, Oracle reported a lot of different key efficiency indicators exterior of conventional monetary statements. Maybe crucial of those metrics was remaining efficiency obligations (RPO). It is a essential working metric as a result of it measures an organization’s backlog, offering buyers with a glimpse of future development.

As of the top of Oracle’s fiscal Q3, RPO grew 29% yr over yr to $80 billion — a document for the corporate.

One of many causes for such excessive backlog? Knowledge facilities. In the course of the earnings name, Oracle’s chairman, Larry Ellison, acknowledged that the corporate “is constructing knowledge facilities at a document stage”.

He is not exaggerating. Simply this week, Bloomberg reported that considered one of Elon Musk’s start-ups, xAI, is rumored to be speaking to Oracle for a $10 billion deal to hire cloud servers.

Is Oracle inventory a purchase?

The potential deal between Oracle and xAI doesn’t make the inventory a purchase. The deal might crumble, and there’s no assure xAI will use Oracle for its cloud options.

With that stated, I am cautiously optimistic that the deal will come to fruition. Oracle already works with xAI because it pertains to different AI providers. Furthermore, Larry Ellison and Elon Musk have a well-publicized optimistic relationship — a lot in order that Ellison used to serve on Tesla‘s Board of Administrators.

The larger thought right here is that companies are counting on extra than simply the legacy hyperscalers of Alphabet, Microsoft, Amazon, and Nvidia for his or her AI cloud wants. Whether or not Oracle closes its cope with xAI, I see the negotiations as a serious supply of validation that there might be many winners exterior of huge tech within the AI knowledge middle realm.

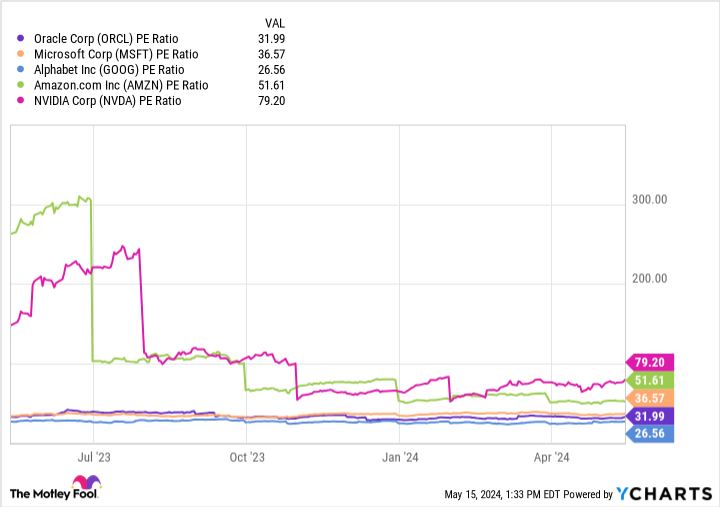

Though Oracle’s price-to-earnings (P/E) ratio of 31.9 is not precisely grime low-cost, it’s far under a lot of its friends.

I believe now could be a terrific alternative to start constructing a place in Oracle inventory. As demand for AI cloud-storage options continues to rise, Oracle ought to see an inflow of enterprise from each new and current clients.

The secular traits fueling AI signify a brand new development narrative for Oracle, and I see now as a good time to scoop up some shares. The most effective days seem like they’re forward for Oracle, and I am bullish that additional positive factors are in retailer for long-term shareholders.

Do you have to make investments $1,000 in Oracle proper now?

Before you purchase inventory in Oracle, contemplate this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they consider are the 10 best stocks for buyers to purchase now… and Oracle wasn’t considered one of them. The ten shares that made the reduce might produce monster returns within the coming years.

Contemplate when Nvidia made this checklist on April 15, 2005… when you invested $1,000 on the time of our advice, you’d have $566,624!*

Inventory Advisor offers buyers with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of Might 13, 2024

Suzanne Frey, an govt at Alphabet, is a member of The Motley Idiot’s board of administrators. John Mackey, former CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Adam Spatacco has positions in Alphabet, Amazon, Microsoft, Nvidia, and Tesla. The Motley Idiot has positions in and recommends Superior Micro Units, Alphabet, Amazon, Microsoft, Nvidia, Oracle, and Tesla. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and quick January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure policy.

A Once-in-a-Generation Investment Opportunity: 1 Data Center Stock That Could Go Parabolic (Hint: not Nvidia) was initially revealed by The Motley Idiot

[ad_2]

Source