The buckets of AI and the place Nvidia is crushing it

Now we have had a number of AI information currently – product launches from OpenAI, Google, and Microsoft. Now we’re simply ready for Apple and its upcoming WWDC convention. Simply final week, we wrote about how a lot of the business was anticipating these bulletins to showcase what AI might do.

This additionally obtained us eager about methods to border any rational dialogue of the topic of neural community based mostly machine studying, a.ok.a. AI. We now loosely see the sector creating in three classes:

- AI as a Function

- AI as a Product or Platform

- AI as Magic

By “AI as Magic,” we’re speaking about Synthetic Normal Intelligence or aware computer systems. As a lot as sure individuals assume that is imminent, we aren’t satisfied. Perhaps that is potential, however we don’t assume it’s coming anytime quickly.

Editor’s Be aware:

Visitor writer Jonathan Goldberg is the founding father of D2D Advisory, a multi-functional consulting agency. Jonathan has developed development methods and alliances for firms within the cellular, networking, gaming, and software program industries.

On the different finish of the spectrum, “AI as a Function” is what we regularly check with as “under the hood” improvements. These are a big assortment of small good points that AI gives to software program we had been already working. As an illustration, a number of SaaS firms have reported 5%-10% reductions in the price of service supply by introducing some type of AI into their programs. Fb has reported related small good points to its ad-matching algorithms. These usually are not glamorous, however in mixture, they supply great worth. If AI delivers nothing else, that is already a big increase.

That leaves the final class the place AI turns into a product in its personal proper. This might evolve additional into full platforms offering a big selection of companies and worth. That is the realm that the massive firms are all combating over, as evidenced by their demos. At this level, our sense is that they aren’t fairly there but.

Admittedly, this can be a purely subjective evaluation based mostly on watching their launch movies, with no hands-on expertise. However our metric may be very clear – what would we be keen to pay for? The reply is just not a lot. Every part launched thus far is emotionally compelling and appears unimaginable, however what utility does it ship? From what we are able to inform, all the things is both relevant to a distinct segment during which we aren’t members – higher drawing instruments, as an example – or is just not fairly dependable sufficient to be reliable, equivalent to AI brokers.

However these are simply the patron purposes. There are a lot of different firms trying to make use of AI instruments to advance their efforts. A few of these could also be very promising. We expect robotics, for one, appears poised to make main advances with the most recent crop of instruments. We aren’t speaking about C-3PO humanoids, however new ranges of movement for machines.

This sector is presently hampered by a scarcity of adequate coaching information, however there have been important advances in artificial information creation within the final 12 months. These have issues for consumer-facing purposes (i.e., fashions constructed on hallucinations), however may very well be very helpful in different fields. One other space that appears very promising is AI for drug discovery. We all know that each one the most important (and minor) biotech firms are investing closely in Nvidia gear. And there are various different examples. We expect this space goes to see a number of experimentation. That may imply many failures and useless ends, but it surely might additionally end in hanging advances.

And we expect that’s the key level in all of this. We’re nonetheless within the very early days of AI programs. There are clear advances coming at a frenetic tempo. Finally, we’re optimistic that these will ship on the promise, however it’s more likely to be a messy course of.

Nvidia has one other sturdy quarter with demand nonetheless far outstripping provide

In the meantime, the chief in AI {hardware} has reported strong earnings. It’s occurring so commonly that issues are beginning to get boring. However then, CEO Jensen Huang obtained on the decision, and the inventory went up extra on his commentary.

The numbers: the corporate reported 1Q25 income of $26 billion, up 18 p.c from the earlier quarter and an astonishing 262 p.c from the identical interval final 12 months, forward of consensus of $24.5 billion. These are massive numbers by any metric. Oh, in addition they introduced a ten for 1 inventory cut up, catnip for retail traders.

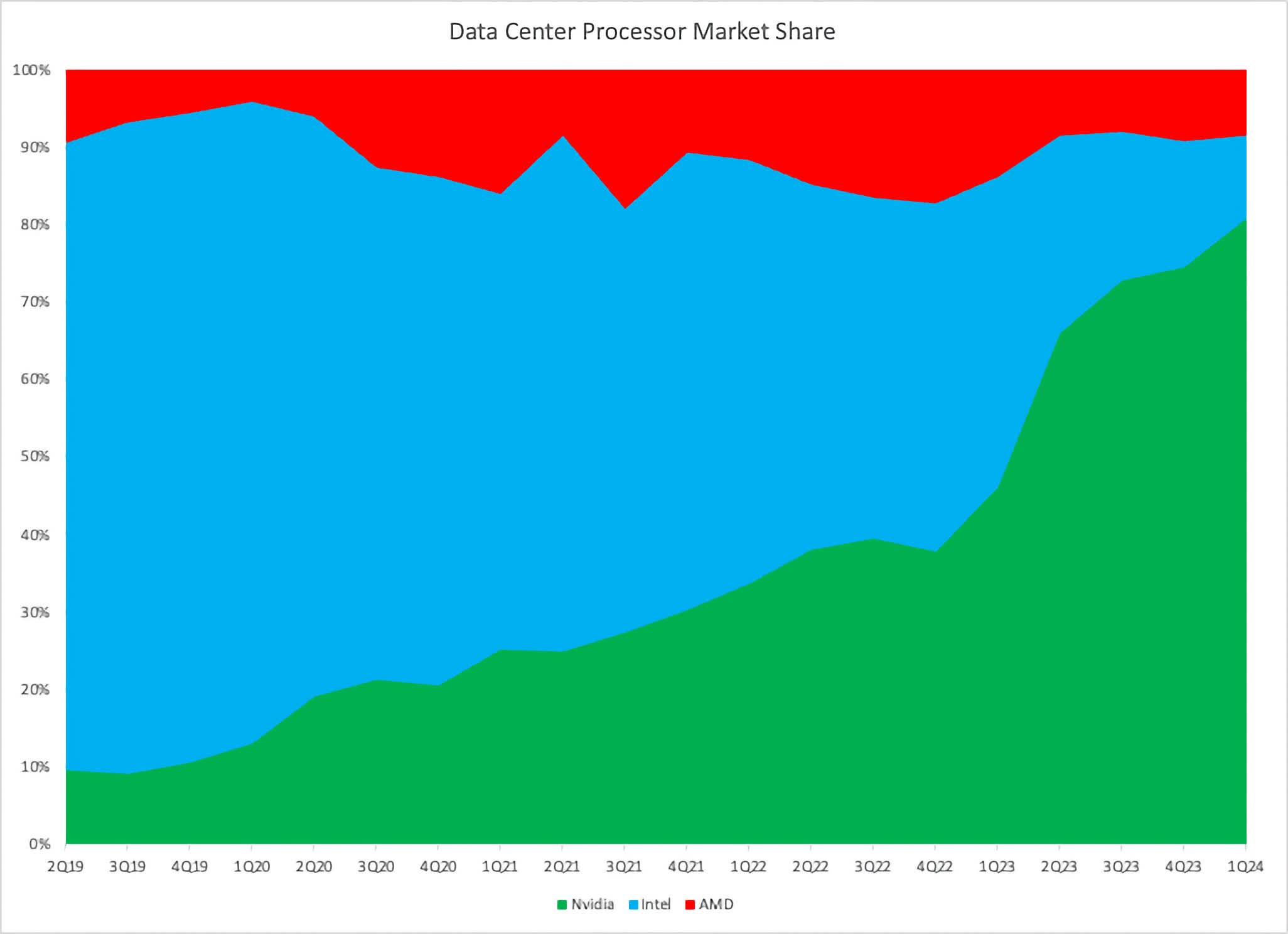

It’s exhausting to know how massive and the way shortly Nvidia has grown. Our most well-liked metric presently is Nvidia’s share of pockets for information heart processors, Nvidia, Intel and AMD’s reported information heart income. That determine reached 81% within the quarter. They took some extent of share from AMD and 5 factors from Intel.

In equity, Nvidia’s information heart income consists of networking merchandise equivalent to Infiniband. Conveniently, the corporate started breaking out its information heart networking income. In idea, we must always take away that from the calculation, as neither AMD nor Intel have comparable merchandise.

That being stated, that spend is coming from the identical set of shoppers. Even stripping it out solely takes their share to 78%. To place that in context, Arista, an organization that solely sells networking merchandise, did $5.3 billion in income for all of 2023.

A couple of different issues that stood out for us. Nvidia claims they’re now supplying 100 “AI factories,” that are information facilities operated independently of the hyperscalers. We wrote about these a couple of months again, and we stay considerably cautious in regards to the topic. There’s nothing flawed with Nvidia’s numbers, but when there are points, we are going to probably see them telegraphed from this sector.

It’s price noting that many of those AI factories flip round and re-sell capability to the hyperscalers, which is a bit round. We’re additionally uncomfortable with the truth that Nvidia appears to have an extra-heavy hand with these firms. Nvidia is their main provider, actually the premise of their enterprise mannequin in these instances of tight GPU provide. Nvidia additionally appears to promote its complete stack to them – full programs – and sure designs them as effectively. On prime of all that, Nvidia is probably going an investor in a lot of them.

The corporate additionally added some shade to its commentary about “Sovereign AI,” which they’re now defining as “a nation’s capabilities to provide AI utilizing its personal infrastructure.”

The emphasis this quarter was on AI factories constructed together with telecom networks, equivalent to Japan’s $740 million funding in a mission led by telco KDDI, Sakura Web, and Softbank to construct up that nation’s “AI Infrastructure.” That is one other space that makes us a bit uncomfortable. A market phase constructed on governments constructing AI capabilities feels a bit too imprecise. Alternatively, it’s clearly producing a number of income for the corporate.

Most likely essentially the most asked-about subject on the decision was the extent of demand. The corporate indicated they anticipate demand to outstrip provide effectively into subsequent 12 months. Going into the decision, there have been issues that the corporate’s new Blackwell line of GPUs would cannibalize gross sales of the earlier technology Hopper chips. The quick reply is that there doesn’t appear to be an issue, with the corporate turning into much more supply-constrained for sure Hopper merchandise in the course of the quarter.

When requested how prospects really feel about present purchases after they see new merchandise coming to market, Huang replied they’ll “efficiency common their method into it.” That is his method of claiming prospects will purchase no matter they will get their arms on. We really heard a greater clarification in the present day: prospects know Nvidia’s roadmap and are constructing plans round that. They’ll use B200 after they can get some and H100 after they cannot.

We must also level out that if we flip this argument round, Nvidia is creating merchandise at an enviable tempo and deserves credit score for the advances they’re driving. Of key significance right here, Nvidia has to take care of the slowdown in Moore’s Law as a lot as anybody else, however they’re nonetheless driving efficiency good points by pulling each lever they will. This consists of their complete design of information facilities and their full programs method. This might find yourself being a robust drive working within the firm’s favor over the long run, as presently nobody else (exterior the highest hyperscalers) has the flexibility to drag all these levers.

All in all, Nvidia continues to execute strongly on all cylinders. We all know the place to search for issues, however there are presently no indicators of hassle on the horizon. Demand stays very sturdy, and the corporate appears to be like set to outpace the competitors for the foreseeable future.