3 Synthetic Intelligence (AI) Shares Set to Profit

[ad_1]

For the primary time in an extended whereas, the USA is critical about rising home semiconductor (“chip”) manufacturing. For years, the U.S. has been hyper-reliant on Taiwan for chip manufacturing; nevertheless, the menace that China will search to reunify with the island, probably by drive, makes this a large financial threat.

Due to this, the U.S. launched the CHIPS and Science Act, which supplies financial incentives to firms that enhance manufacturing capability domestically.

The Semiconductor Business Affiliation (SIA) just lately launched a report predicting that home manufacturing capability will triple by 2032. This can be a gigantic boon, contemplating that U.S. capability solely elevated by 11% from 2012 to 2022. The SIA experiences 83 new endeavors, $447 billion in investments in 25 states, and over 50,000 jobs created for the reason that CHIPS Act was launched in 2020.

Maybe essentially the most thrilling growth is the anticipated enhance in home manufacturing of superior logic chips utilized in synthetic intelligence (AI). In 2022, the U.S. held a whopping 0% of the world’s capability. American superior logic chip capability will enhance to twenty-eight% by 2032, in keeping with SIA projections.

Listed below are some firms that may profit from the upcoming explosion in home manufacturing.

Intel

In keeping with the SIA, Intel (NASDAQ: INTC) has acquired the most important grant of any firm so far at $8.5 billion. It additionally acquired $11 billion in loans for tasks in Oregon, Arizona, New Mexico, and Ohio. The whole funding in these tasks, which embody new fabrication vegetation, expansions, and modernization, is anticipated to be $100 billion. These tasks ought to have vital long-term advantages for Intel as a result of elevated capability and effectivity.

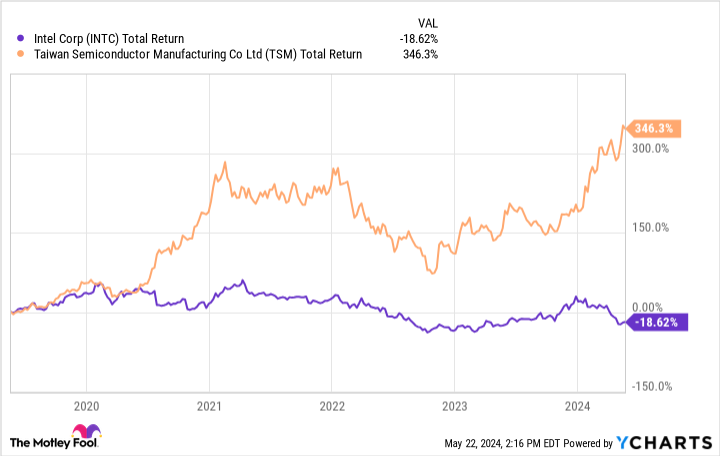

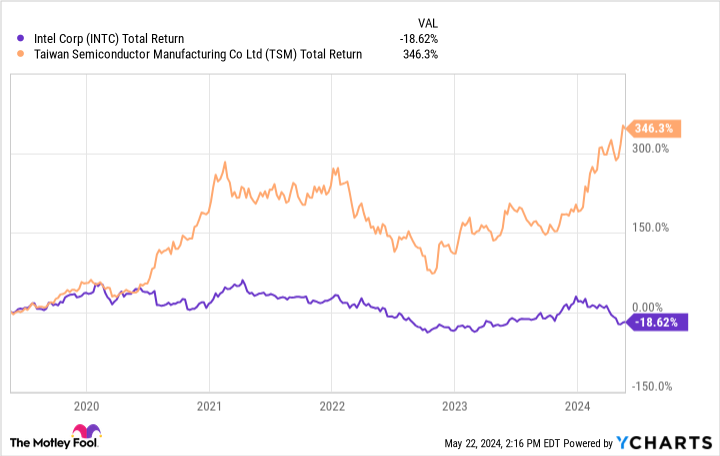

Intel has fallen from its former glory after lacking out on the smartphone revolution (the overwhelming majority use Arm Holdings-designed chips as an alternative of Intel’s) and falling behind opponents like Taiwan Semiconductor Manufacturing (NYSE: TSM). The proof is within the pudding, or, on this case, the inventory efficiency:

Investing billions in modernization and elevated capability is vital as Intel performs catch-up within the trade. The query is whether or not it could possibly do that successfully to catch the AI wave washing over the market. Superior logic chips are vital to AI, and Intel is the one U.S. firm that designs and manufactures them. The grants and loans will present an necessary enhance and defray a number of the prices of growth.

Intel reported improved financials within the first quarter, with gross sales up 9% to $12.7 billion and a narrower working loss. Nonetheless, the corporate isn’t free-cash-flow-positive and is saddled with $48 billion in long-term debt. The inventory trades with a ahead price-to-earnings (P/E) ratio of 28, which is larger than TSMC’s 25 P/E. Nonetheless, Intel has formidable plans and vital backing from the federal government because it seeks to extend home capability. The market alternative is big, so it can finally come right down to Intel’s execution.

Taiwan Semiconductor

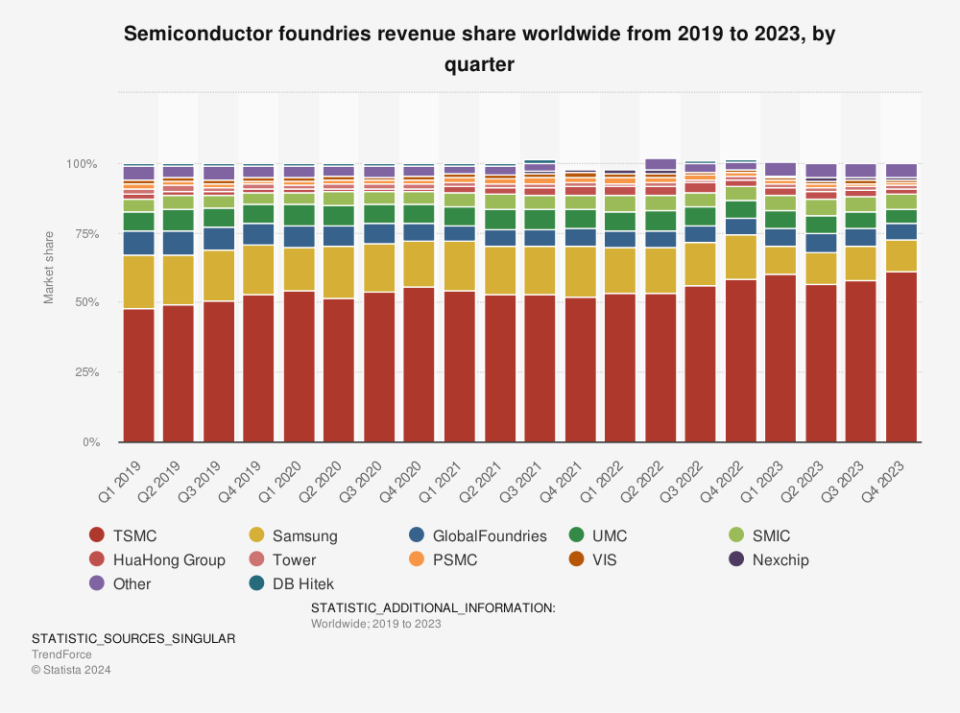

As you’ll be able to see beneath, TSMC dominates the worldwide foundry market share with greater than 60%, however it is not resting on its laurels. The corporate is constructing three new fabrication vegetation in Arizona, a $65 billion challenge financed partly by the CHIPS Act, with $6.6 billion in grants and $5 billion in loans. This diversification to U.S. manufacturing is vital as a result of Taiwan’s geopolitical realities with China.

TSMC’s Q1 income elevated 13% 12 months over 12 months to $19 billion when measured in U.S. {dollars}. The corporate has a terrific enterprise mannequin with a 42% working margin, $14 billion in money generated from operations, and complete belongings that outweigh complete liabilities by nearly three to 1.

Taiwan Semi inventory trades at a P/E of 30 (25 on a ahead foundation), in comparison with its five-year common P/E of 23. The market is pricing in the advantages of growth and a brand new wave of spending associated to AI. Nonetheless, this inventory is a superb long-term semiconductor play, so buyers ought to watch intently to capitalize on any short-term dips.

Vertiv Holdings

Together with the direct beneficiaries of presidency help, there shall be many adjoining firms that profit. AI functions want information facilities to course of gigantic quantities of data, and information facilities want high-performance chips produced by Intel and TSM. As extra information facilities come on-line, the businesses that make the infrastructure will see large demand.

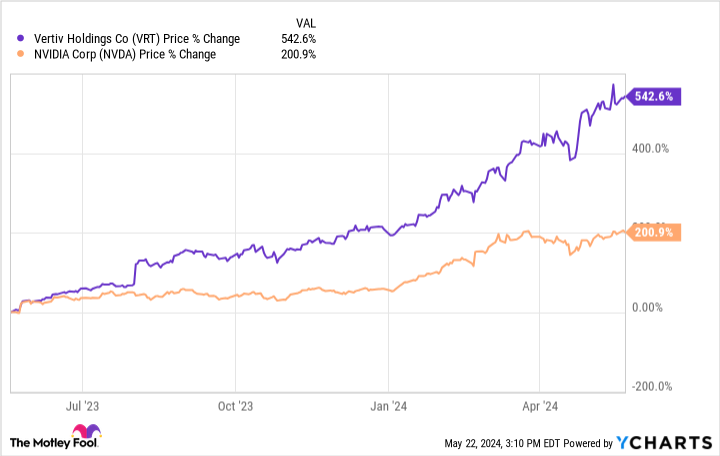

You might not have heard of Vertiv Holdings (NYSE: VRT), however the inventory has far outpaced Nvidia over the previous 12 months, as proven beneath.

Vertiv supplies information facilities with vital energy, cooling, racking, cabling, different infrastructure, and monitoring and administration software program. Its Vertiv 360AI product covers all of those challenges in a complete resolution.

The primary quarter noticed 8% year-over-year income progress for Vertiv, reaching $1.6 billion. However this wasn’t the total story. The corporate reported a 60% enhance in orders, pushing its backlog to $6.3 billion. This can be a large quantity for Vertiv, which earned $6.9 billion in complete income in 2023 and expects to earn as much as $7.7 billion this 12 months.

Vertiv’s market capitalization of $37 billion is not outrageous regardless of the inventory’s spectacular run, provided that the corporate is anticipating working income of $1.2 billion this 12 months — $1.35 billion on a non-GAAP (adjusted) foundation — and free money movement over $800 million. The corporate can also be shopping for again its inventory. It used $600 million to take greater than 9 million shares off the market in Q1.

Two of Vertiv’s companions are trade giants Nvidia and Intel, so this information heart infrastructure supplier seems to be like a long-term AI winner.

Must you make investments $1,000 in Intel proper now?

Before you purchase inventory in Intel, think about this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they imagine are the 10 best stocks for buyers to purchase now… and Intel wasn’t certainly one of them. The ten shares that made the reduce might produce monster returns within the coming years.

Contemplate when Nvidia made this checklist on April 15, 2005… should you invested $1,000 on the time of our advice, you’d have $697,878!*

Inventory Advisor supplies buyers with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of Could 28, 2024

Bradley Guichard has positions in Arm Holdings. The Motley Idiot has positions in and recommends Taiwan Semiconductor Manufacturing. The Motley Idiot recommends Intel and recommends the next choices: lengthy January 2025 $45 calls on Intel and brief Could 2024 $47 calls on Intel. The Motley Idiot has a disclosure policy.

U.S. Chip Manufacturing Could Triple in Less Than a Decade: 3 Artificial Intelligence (AI) Stocks Set to Benefit was initially revealed by The Motley Idiot

[ad_2]

Source