Right here Is My High Synthetic Intelligence (AI) ETF to Purchase Proper Now

[ad_1]

Between work, household, hobbies, and different commitments, most individuals haven’t got hours to commit to inventory analysis. Plus, let’s face it. Picking individual stocks is harder and riskier than shopping for a basket of corporations. This makes exchange-traded funds, or ETFs, a gorgeous car. ETFs commerce identical to shares, however the funds maintain dozens of shares linked by a selected theme. A number of ETFs cater to the market’s hottest sector: synthetic intelligence (AI).

There’s a number of hype round AI, and the passion is warranted. Firms are spending billions of {dollars} researching real-world options and bringing them to market, and organizations in lots of industries are already integrating generative AI and enormous language fashions (LLMs) into workflows. The efficiencies these instruments present and our ultra-competitive enterprise world will encourage extra corporations to undertake them.

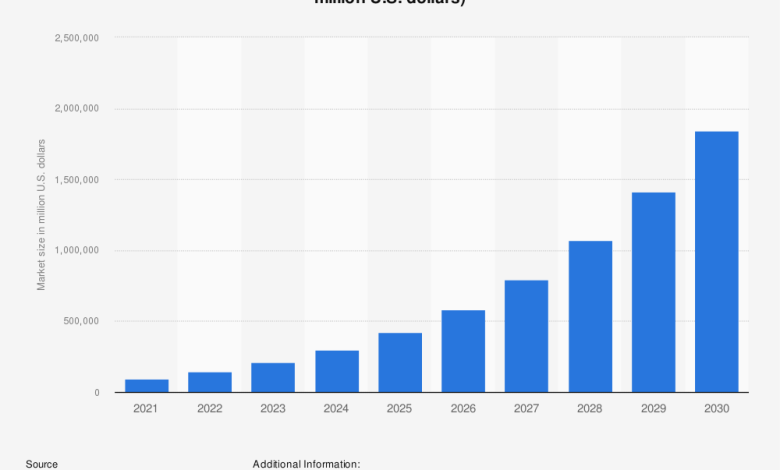

One estimate forecasts that the worldwide market measurement will strategy $2 trillion by the tip of this decade, as proven beneath.

What are one of the best synthetic intelligence ETFs?

Not all ETFs are created equal. Components like diversification, property beneath administration, historic efficiency, and the expense ratio are vital. The World X Robotics & Synthetic Intelligence ETF (NASDAQ: BOTZ) is a well-liked AI fund. It has $2.8 billion in property beneath administration and an expense ratio of 0.68%, which is aggressive. Its portfolio at the moment holds 43 corporations, specializing in these that can “profit from elevated adoption and utilization of robotics and synthetic intelligence.”

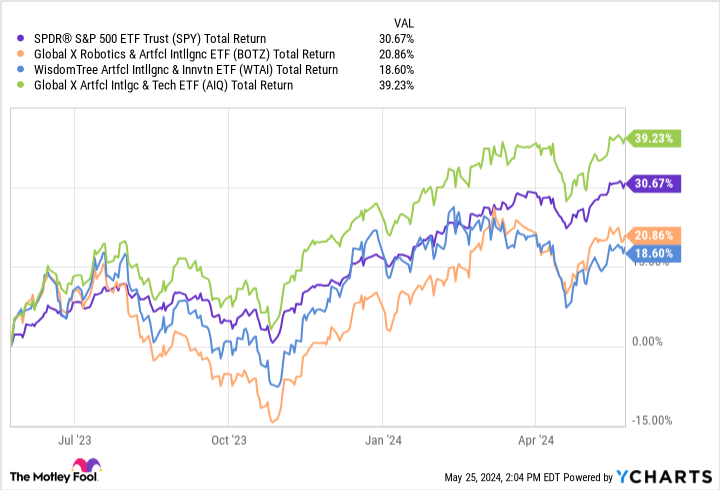

BOTZ is closely weighted towards its high holdings. Nvidia (NASDAQ: NVDA) makes up greater than 10% of the fund, and its high 4 holdings account for greater than 35%. The fund has underperformed the SPDR S&P 500 ETF (NYSEMKT: SPY) over the previous yr, regardless of Nvidia gaining 248%.

In addition to the reliance on a couple of high holdings, one other potential disadvantage is its lack of huge tech holdings. BOTZ traders miss out on Alphabet (NASDAQ: GOOG)(NASDAQ: GOOGL), Amazon (NASDAQ: AMZN), Meta (NASDAQ), and Microsoft (NASDAQ: MSFT), and even one in all my personal favorites, Arm Holdings (NASDAQ: ARM).

BOTZ is most applicable for traders searching for a well-managed portfolio that includes a couple of shares with a spotlight exterior huge tech.

World X additionally manages the Synthetic Intelligence & Know-how ETF (NASDAQ: AIQ). AIQ holds positions in 84 corporations, has a 0.68% expense ratio, and has crushed the S&P 500 over the previous yr, as you possibly can see beneath.

The Synthetic Intelligence & Know-how ETF has positions in the entire shares above apart from Arm Holdings. Its high inventory can be Nvidia, but it surely accounts for under 5% of the full. AIQ is greatest for many who search a diversified portfolio with an emphasis on huge tech. AIQ is a wonderful selection with an amazing current monitor report.

Here is my favourite

Nevertheless, my favourite AI ETF is the WisdomTree Synthetic Intelligence and Innovation Fund (NYSEMKT: WTAI). WTAI is the worst-performing fund within the chart above, however this does not imply it will not outperform shifting ahead. Nvidia and Microsoft account for nearly 13% of the S&P 500 and eight% of AIQ however beneath 5% of WTAI, which explains the underperformance. These shares exploded final yr, however they may quickly hit honest worth and stage off.

The WisdomTree Synthetic Intelligence and Innovation Fund is essentially the most diversified of the three funds I’ve chosen, with no firm making up greater than 3% of property. It at the moment holds 75 shares, together with huge tech names. It additionally has the bottom expense ratio at 0.45%. Its most vital investments are in semiconductors (33%) and AI software program (24%), thriving industries with severe room for progress as AI ramps up. Its current underperformance may change shortly, for the reason that semiconductor trade is cyclical and seems headed for one more up cycle after a troublesome 2022 and 2023.

WTAI is a terrific choose for many who need important diversification, a low expense ratio, and publicity to the trade’s greatest names.

You do not have to be a superb inventory picker to capitalize on a rising trade like AI. Typically, it is best to let these with extra time to devoted to following shares select. ETFs supply broad publicity with much less danger and volatility. There are tons of choices; maybe one talked about above is best for you.

Do you have to make investments $1,000 in WisdomTree Synthetic Intelligence and Innovation Fund proper now?

Before you purchase inventory in WisdomTree Synthetic Intelligence and Innovation Fund, think about this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they consider are the 10 best stocks for traders to purchase now… and WisdomTree Synthetic Intelligence and Innovation Fund wasn’t one in all them. The ten shares that made the lower may produce monster returns within the coming years.

Contemplate when Nvidia made this listing on April 15, 2005… in the event you invested $1,000 on the time of our suggestion, you’d have $671,728!*

Inventory Advisor supplies traders with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of Might 28, 2024

Suzanne Frey, an government at Alphabet, is a member of The Motley Idiot’s board of administrators. John Mackey, former CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Bradley Guichard has positions in Alphabet, Amazon, Arm Holdings, and Nvidia. The Motley Idiot has positions in and recommends Alphabet, Amazon, Microsoft, and Nvidia. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and quick January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure policy.

Here Is My Top Artificial Intelligence (AI) ETF to Buy Right Now was initially revealed by The Motley Idiot

[ad_2]

Source