U.S. Cash Provide Is Doing One thing So Scarce That It Hasn’t Occurred For the reason that Nice Melancholy — and a Huge Transfer in Shares Might Be Forthcoming

Over lengthy stretches, Wall Avenue has demonstrated that it is a wealth-creating powerhouse. In comparison with different asset courses, together with gold, oil, housing, and Treasury bonds, shares have handily outperformed on an annualized return foundation over the past century.

However when the lens is narrowed to just some months or a few years, the efficiency of the broad-market indexes turns into a lot more durable to forecast. In truth, the ageless Dow Jones Industrial Common (DJINDICES: ^DJI), benchmark S&P 500 (SNPINDEX: ^GSPC), and development stock-powered Nasdaq Composite (NASDAQINDEX: ^IXIC) traded off bear and bull markets in successive years for the primary 4 years of this decade.

When the inventory market is risky, it is solely pure for traders to hunt out clues which may sign which course shares will head subsequent. Whereas there is no such factor as a predictive indicator or metric that may, with concrete accuracy, forecast the place the foremost inventory indexes are headed, it would not cease traders from attempting to realize a bonus.

Nevertheless, there are a small variety of indicators which have strongly correlated with historic strikes larger or decrease within the Dow, S&P 500, and Nasdaq Composite.

One such predictive device, which hasn’t signaled the warning we’re seeing now since the Great Depression, seems to portend hassle for the U.S. economic system and a giant transfer to return for shares.

It is a first for the U.S. cash provide in additional than 90 years

The forecasting metric I’ve alluded to above is the U.S. cash provide. Although the U.S. cash provide has 5 completely different measures, the 2 with essentially the most advantage are typically M1 and M2.

M1 cash provide takes under consideration money and cash in circulation, in addition to demand deposits in a checking account. Consider it as cash that is very accessible and may be spent on the drop of a hat. In the meantime, M2 elements in all the pieces in M1 and provides in financial savings accounts, cash market accounts, and certificates of deposit (CDs) below $100,000. It is nonetheless cash that is accessible, nevertheless it takes a bit extra work to get to and spend. It is this class, M2 cash provide, which is trigger for concern.

Usually, little consideration is paid to M2 cash provide. That is as a result of it has been rising with just about no interruption for the final 9 many years. With the U.S. economic system rising over time, it isn’t shocking that extra capital has been wanted to facilitate transactions.

What’s irregular is a decline within the U.S. cash provide — which is precisely what we’re witnessing proper now with M2.

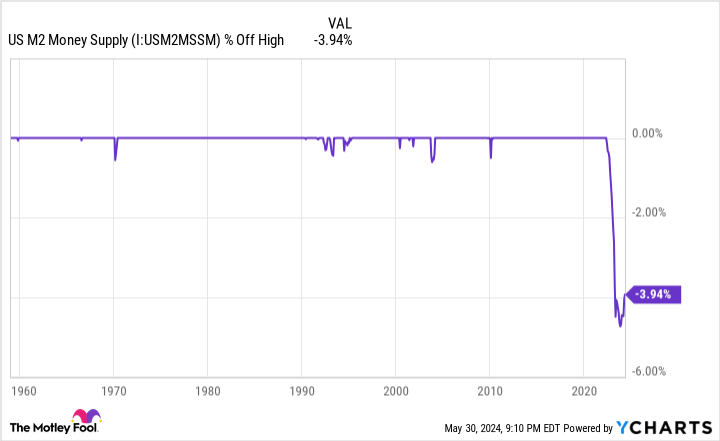

In April 2022, the Board of Governors of the Federal Reserve reported that M2 peaked at an all-time excessive of $21.722 trillion. For some context, that is up from $286.6 billion in January 1959 and represents a compound annual development price of roughly 7%. However as of April 2024, M2 got here in at $20.867 trillion, representing a decline of practically $855 billion — 3.94% on a share foundation — in two years. It is the primary time M2 cash provide has backed off greater than 2% from its all-time excessive because the Nice Melancholy.

The stipulation to this decline that should not be ignored is that M2 exploded larger by 26% on a year-over-year foundation in the course of the peak of the COVID-19 pandemic. A number of rounds of fiscal stimulus from the federal authorities, coupled with low rates of interest, flooded the U.S. economic system with capital that quickly expanded the cash provide. An argument may be made that the practically 4% retracement in M2 over the past two years is nothing greater than a normalization after a historic growth.

I will additionally level out that M2 has truly risen on a year-over-year foundation. Regardless of being down 3.94% from its all-time excessive in April 2022, M2 is larger by a really modest 0.14% from the place issues stood one yr in the past.

However, historical past has been fairly clear about what occurs anytime the M2 cash provide retraces by no less than 2% from its excessive — and it isn’t excellent news for Wall Avenue or the U.S. economic system.

WARNING: the Cash Provide is formally contracting. 📉

This has solely occurred 4 earlier occasions in final 150 years.

Every time a Melancholy with double-digit unemployment charges adopted. 😬 pic.twitter.com/j3FE532oac

— Nick Gerli (@nickgerli1) March 8, 2023

As you’ll be able to see within the publish above from Reventure Consulting CEO Nick Gerli on social media platform X (previously Twitter), year-over-year drops of no less than 2% in M2 are fairly scarce. Utilizing knowledge from the Federal Reserve and U.S. Census Bureau, Gerli was in a position to back-test these share adjustments in U.S. cash provide since 1870. Over this span, simply 5 cases have been famous the place M2 declined by no less than 2% on a year-over-year foundation: 1878, 1893, 1921, 1931-1933, and 2023.

All 4 earlier cases of M2 dropping by no less than 2% correlated with depressions and double-digit unemployment charges for the U.S. economic system.

The excellent news is that the Federal Reserve and federal authorities are much more educated now about methods to deal with financial turbulence than they have been a century in the past. The Fed did not exist in the course of the depressions of 1878 and 1893, and it was nonetheless getting its proverbial toes moist in 1921 and in the course of the Nice Melancholy. In brief, there is a very low likelihood of a steep downturn within the U.S. economic system in fashionable occasions.

However what this decline in U.S. M2 cash provide does recommend is an efficient probability of the U.S. economic system weakening within the not-too-distant future. If there’s much less capital in circulation, the expectation can be for customers to pare again their discretionary spending. That is typically a recipe for a recession.

Traditionally talking, the majority of the S&P 500’s downturns have occurred after, not previous to, a U.S. recession taking form.

Statistically talking, time is an undefeated ally for traders

With the Dow Jones Industrial Common, S&P 500, and Nasdaq Composite all roaring to record-closing highs in 2024, the very last thing you in all probability need is somebody raining in your parade with a prognostication that requires doubtlessly significant draw back to return in shares. Fortunately, this can be a forecast with little bearing on traders with a long-term mindset.

One of the crucial evident examples of time being a robust ally may be seen within the financial cycle.

As a lot as you may dislike the thought of financial contractions and recessions, they are a regular and unavoidable a part of the boom-and-bust nature of the financial cycle. However what’s necessary to acknowledge is that booms and busts aren’t linear (i.e., they don’t seem to be mirror photos of each other).

Whereas solely three out of 12 U.S. recessions have reached the 12-month mark since World Battle II resulted in September 1945, virtually each financial growth has endured a number of years. Two intervals of development truly hit the 10-year mark. Whereas recessions may cause unemployment to rise and wage development to gradual, these results are typically short-lived.

You may see this similar non-linear variance between bear and bull markets on Wall Avenue, too.

Practically one yr in the past, the analysts at Bespoke Funding Group printed a knowledge set on X that examined the size of bear and bull markets for the S&P 500 relationship again to the beginning of the Nice Melancholy. What Bespoke discovered was that the common S&P 500 bull market lasted roughly 3.5 occasions longer than the everyday bear market over a 94-year stretch: 1,011 calendar days (bull market) versus 286 calendar days (bear market).

Moreover, there have been 13 separate S&P 500 bull markets that endured longer than the lengthiest S&P 500 bear market because the Nice Melancholy started.

Need extra proof that point is an undefeated ally for affected person traders?

Earlier this yr, Crestmont Analysis refreshed its knowledge set from a report that analyzed the rolling 20-year whole returns, together with dividends paid, of the S&P 500 relationship again to 1900. Though the S&P did not formally come into existence till 1923, its parts (and their whole returns) could possibly be present in different main indexes previous to 1923 — thus, the flexibility to hint rolling 20-year whole returns again to 1900.

The analysts at Crestmont Analysis discovered that each one 105 rolling 20-year intervals they examined (1919-2023) produced a constructive annualized common return. In easy phrases, in the event you, hypothetically, bought an S&P 500 monitoring index at any level since 1900 and held that place for 20 years, together with dividends, you’d have made cash each single time.

It doesn’t matter what Wall Avenue has in retailer for traders over the approaching months, affected person traders have the posh of time as an undefeated ally of their nook.

The place to speculate $1,000 proper now

When our analyst crew has a inventory tip, it might probably pay to hear. In spite of everything, the e-newsletter they have run for over a decade, Motley Idiot Inventory Advisor, has practically tripled the market.*

They simply revealed what they consider are the 10 best stocks for traders to purchase proper now…

*Inventory Advisor returns as of Might 28, 2024

Sean Williams has no place in any of the shares talked about. The Motley Idiot has no place in any of the shares talked about. The Motley Idiot has a disclosure policy.

U.S. Money Supply Is Doing Something So Scarce That It Hasn’t Happened Since the Great Depression — and a Big Move in Stocks May Be Forthcoming was initially printed by The Motley Idiot