With EPS Progress And Extra, Perenti (ASX:PRN) Makes An Fascinating Case

Buyers are sometimes guided by the concept of discovering ‘the following large factor’, even when meaning shopping for ‘story shares’ with none income, not to mention revenue. Generally these tales can cloud the minds of buyers, main them to speculate with their feelings moderately than on the advantage of excellent firm fundamentals. Loss making corporations can act like a sponge for capital – so buyers must be cautious that they are not throwing good cash after unhealthy.

Regardless of being within the age of tech-stock blue-sky investing, many buyers nonetheless undertake a extra conventional technique; shopping for shares in worthwhile corporations like Perenti (ASX:PRN). Whereas revenue is not the only real metric that must be thought of when investing, it is value recognising companies that may constantly produce it.

See our latest analysis for Perenti

Perenti’s Bettering Earnings

Over the past three years, Perenti has grown earnings per share (EPS) at as spectacular fee from a comparatively low level, leading to a 3 12 months share progress fee that is not significantly indicative of anticipated future efficiency. Thus, it is smart to concentrate on more moderen progress charges, as a substitute. Perenti’s EPS skyrocketed from AU$0.081 to AU$0.13, in only one 12 months; a end result that is certain to deliver a smile to shareholders. That is a incredible acquire of 59%.

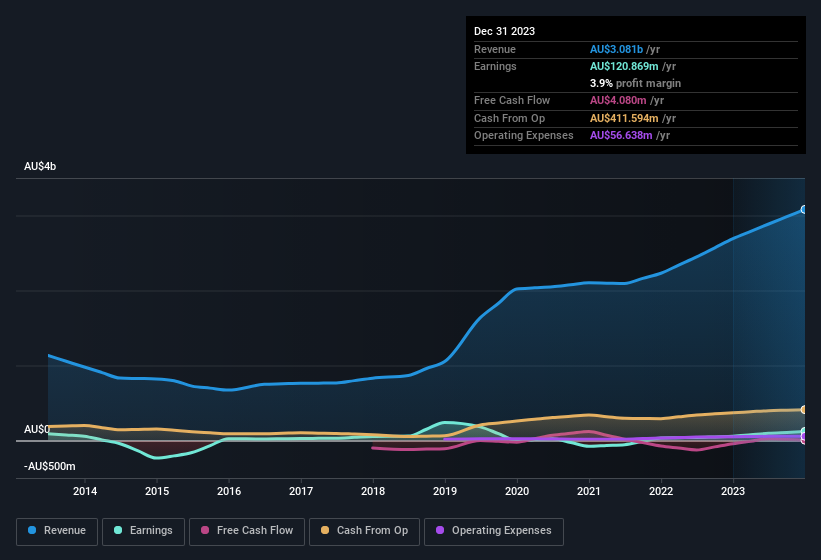

High-line progress is a good indicator that progress is sustainable, and mixed with a excessive earnings earlier than curiosity and taxation (EBIT) margin, it is an effective way for a corporation to keep up a aggressive benefit available in the market. Whereas we word Perenti achieved related EBIT margins to final 12 months, income grew by a stable 14% to AU$3.1b. That is encouraging information for the corporate!

You possibly can check out the corporate’s income and earnings progress pattern, within the chart beneath. To see the precise numbers, click on on the chart.

Whereas we reside within the current second, there’s little doubt that the long run issues most within the funding choice course of. So why not verify this interactive chart depicting future EPS estimates, for Perenti?

Are Perenti Insiders Aligned With All Shareholders?

Buyers are all the time trying to find a vote of confidence within the corporations they maintain and insider shopping for is likely one of the key indicators for optimism in the marketplace. This view is predicated on the likelihood that inventory purchases sign bullishness on behalf of the client. Nonetheless, insiders are typically mistaken, and we do not know the precise pondering behind their acquisitions.

Within the final 12 months insider at Perenti had been each promoting and shopping for shares; however fortunately, as a bunch they spent AU$250k extra on inventory, than they netted from promoting it. On stability, that is a superb signal. We additionally word that it was the Impartial Non-Government Director, Craig Laslett, who made the largest single acquisition, paying AU$80k for shares at about AU$1.06 every.

On high of the insider shopping for, it is good to see that Perenti insiders have a priceless funding within the enterprise. Certainly, they maintain AU$69m value of its inventory. That exhibits vital buy-in, and will point out conviction within the enterprise technique. That quantities to 7.2% of the corporate, demonstrating a level of high-level alignment with shareholders.

Does Perenti Deserve A Spot On Your Watchlist?

For progress buyers, Perenti’s uncooked fee of earnings progress is a beacon within the night time. Not solely that, however we will see that insiders each personal a variety of, and are shopping for extra shares within the firm. So it is honest to say that this inventory might nicely deserve a spot in your watchlist. It is nonetheless mandatory to contemplate the ever-present spectre of funding threat. We’ve identified 3 warning signs with Perenti , and understanding them must be a part of your funding course of.

There are many different corporations which have insiders shopping for up shares. So should you just like the sound of Perenti, you may in all probability love this curated collection of companies in AU that have an attractive valuation alongside insider buying in the last three months.

Please word the insider transactions mentioned on this article check with reportable transactions within the related jurisdiction.

Have suggestions on this text? Involved concerning the content material? Get in touch with us straight. Alternatively, electronic mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is normal in nature. We offer commentary primarily based on historic knowledge and analyst forecasts solely utilizing an unbiased methodology and our articles will not be meant to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your aims, or your monetary state of affairs. We purpose to deliver you long-term centered evaluation pushed by elementary knowledge. Observe that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.