2 Hovering Shares I would Purchase Now With No Hesitation

[ad_1]

The inventory market surged over the past yr, with the Nasdaq Composite up greater than 27% since final June. The expansion is a welcome improvement after the COVID-19 pandemic and an financial downturn in 2022, which noticed the identical index plunge 33% through the difficult yr.

Buyers have grown bullish as easing inflation and advances in budding markets like synthetic intelligence (AI) may spell a profitable future for a lot of firms.

As leaders within the shopper market with billions of loyal customers, Costco Wholesale (NASDAQ: COST) and Amazon (NASDAQ: AMZN) have promising outlooks. Their shares are up 61% and 45% respectively over the past 12 months, but appear nowhere close to hitting their ceilings. Costco is increasing quickly and has barely scratched the floor of its enterprise overseas. In the meantime, Amazon’s on-line retail enterprise is booming alongside heavy funding in AI.

So, listed below are two hovering shares I would purchase now with no hesitation.

1. Costco

Costco has come a good distance since its founding 40 years in the past, when it opened its first retailer in San Diego, California. The retail large has gained over shoppers worldwide with its distinctive mannequin of providing entry to wholesale pricing for the price of an annual membership.

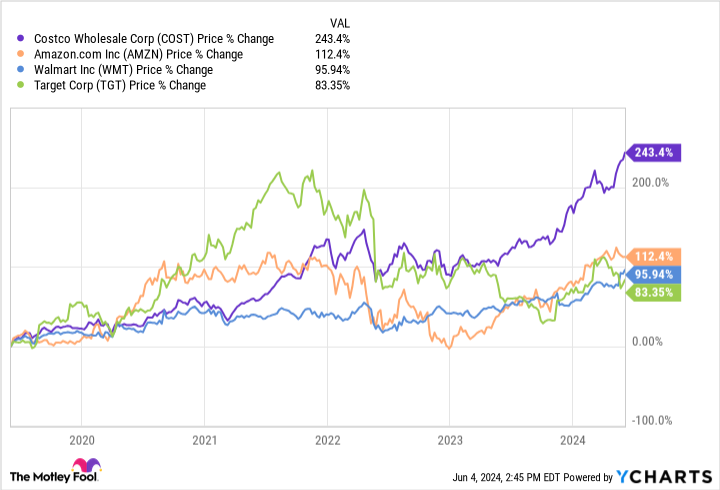

The corporate’s success has made it probably the greatest retail investments of the final 5 years, outperforming rivals like Amazon, Walmart, and Goal in inventory progress. Whereas previous features aren’t all the time a sign of what is to come back, latest earnings counsel a profitable future for Costco.

The retail large posted its earnings outcomes for the fiscal third quarter of 2024 on Could 30. Income for the interval ended Could 12 popped 9% yr over yr to $57 billion. Worldwide gross sales continued to be its greatest progress driver, with income from overseas rising near 9% in comparison with 6% domestically.

Costco memberships elevated by 8% to greater than 74 million in Q3, a promising achievement as its worldwide renewal charge is at 90%. The corporate boasts 878 places throughout 14 international locations and is including extra yearly.

Costco is on an thrilling progress trajectory you will not need to miss. And with a price-to-sales (P/S) ratio of 1.4, the corporate’s inventory is a superb worth and one I would purchase with no hesitation.

2. Amazon

Amazon has created various bulls over the past yr, rallying buyers with a booming e-commerce enterprise and an increasing function in AI.

Macroeconomic headwinds in 2022 induced steep declines in shopper spending, with Amazon’s retail gross sales hit particularly arduous. Nevertheless, a powerful restoration has confirmed the reliability of the corporate’s enterprise mannequin and its value as a long-term funding.

Amazon reported its first-quarter 2024 earnings on April 30. Income for the quarter elevated by 13% yr over yr, beating analysts’ forecasts by $750 million. Nevertheless, essentially the most spectacular progress got here within the type of working earnings, which soared 221% to greater than $15 billion.

The retail firm’s earnings skyrocketed over the past yr due to optimistic progress in its retail segments and cost-cutting measures. For example, Q1 2024 noticed Amazon’s worldwide phase return to profitability by reaching $903 million in working earnings, considerably enhancing on the $1 billion in losses it posted the yr earlier than. In the meantime, North American working earnings elevated 454% yr over yr.

Amazon’s e-commerce segments are quickly increasing and present no indicators of slowing. Nevertheless, one of the best cause to contemplate a long-term funding in Amazon is its extremely worthwhile cloud business, Amazon Internet Providers (AWS). The platform holds a number one market share in cloud computing, an trade with huge progress potential amid a increase in AI.

In Q1 2024, AWS was accountable for 62% of Amazon’s working earnings regardless of incomes the smallest portion of income between its three segments. The cloud service offers the corporate a strong function in tech and AI and can possible proceed to spice up earnings for years.

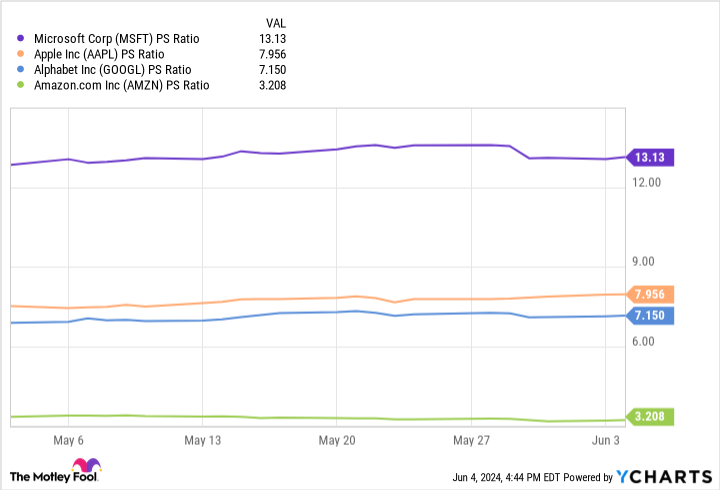

This chart reveals Amazon’s P/S is decrease than a lot of its greatest rivals, indicating its inventory might be buying and selling at a discount. That truth, mixed with a thriving retail enterprise and a promising place in AI, makes Amazon a no brainer proper now.

Must you make investments $1,000 in Costco Wholesale proper now?

Before you purchase inventory in Costco Wholesale, take into account this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they consider are the 10 best stocks for buyers to purchase now… and Costco Wholesale wasn’t one in every of them. The ten shares that made the reduce may produce monster returns within the coming years.

Think about when Nvidia made this record on April 15, 2005… should you invested $1,000 on the time of our advice, you’d have $741,362!*

Inventory Advisor gives buyers with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of June 3, 2024

Suzanne Frey, an government at Alphabet, is a member of The Motley Idiot’s board of administrators. John Mackey, former CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Dani Cook has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Alphabet, Amazon, Apple, Costco Wholesale, Microsoft, Goal, and Walmart. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and quick January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure policy.

2 Soaring Stocks I’d Buy Now With No Hesitation was initially printed by The Motley Idiot

[ad_2]

Source