Nvidia beats Microsoft to grow to be world’s most respected firm

[ad_1]

By Mitchell Labiak, Enterprise reporter

Getty Photos

Getty PhotosChip-maker Nvidia grew to become the world’s most respected firm after its share value climbed to an all-time excessive on Tuesday.

It’s now price $3.34tn (£2.63tn), with the value having practically doubled for the reason that begin of this yr.

The inventory ended the buying and selling day at practically $136, up 3.5%, making it extra invaluable than fellow tech large Microsoft. It overtook Apple earlier this month.

The Californian firm’s meteoric rise has been fuelled by its dominance of what analysts name the “new gold or oil within the tech sector” – the chips wanted for synthetic intelligence (AI).

Talking at occasion in Copenhagen, Chris Penrose, world head of enterprise improvement for telco at Nvidia, mentioned the file valuation was the fruits of greater than 30 years of labor within the fields of computing and AI.

He additionally predicted additional development within the sector.

“The generative AI journey is absolutely remodeling companies and telcos all over the world,” he mentioned.

“We’re simply in the beginning.”

Analysts Wedbush Securities agreed.

“We imagine over the subsequent yr the race to $4 trillion market cap in tech will likely be entrance and heart between Nvidia, Apple, and Microsoft,” it mentioned in a observe earlier this week.

Different commentators although have questioned whether or not there will likely be huge future beneficial properties, given the rising competitors Nvidia faces.

Rise and rise

What is just not unsure although is how spectacularly it has grown.

Eight years in the past, the inventory was price lower than 1% of its present value.

Again then, Nvidia’s worth got here from its competitors with rival AMD, in a race to make one of the best graphics playing cards.

Lately although it has benefited from a increase in demand for chips that practice and run generative AI fashions, essentially the most well-known of which being OpenAI’s ChatGPT.

The agency additionally benefitted considerably from a rush to mine Bitcoin in 2020, which noticed a pointy uptick in gross sales of its graphics playing cards.

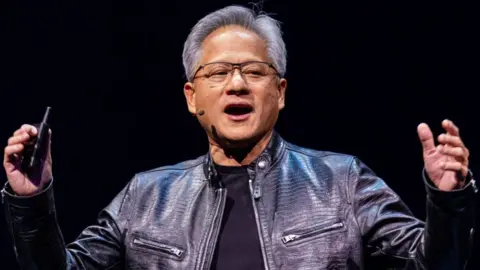

The rise and rise of the tech large has been mirrored by the more and more excessive profile of its boss, Jensen Huang.

Some have dubbed the 61-year-old electrical engineer the “Taylor Swift of tech” for the movie star standing he has achieved.

Competitors amongst AI builders is fierce. Microsoft, Google-owner Alphabet, Meta and Apple are simply a number of the tech heavyweights battling to create a world-beating product.

This competitors advantages Nvidia, which in addition to growing AI tech of its personal, dominates the overwhelming majority of the AI chip market.

Nvidia’s gross sales and revenue figures have surpassed many analyst expectations lately.

In Could, after its newest set of economic outcomes had been printed, Quilter Cheviot expertise analyst Ben Barringer mentioned the corporate had “as soon as once more cleared a really excessive hurdle”.

“Demand is exhibiting no indicators of switching off both,” he added.

Nevertheless, a minority are extra cautious.

In February, Barclays credit score analyst Sandeep Gupta argued that Nvidia’s giant market share can be arduous to take care of given the rising variety of rivals and questioned how Nvidia’s prospects would monetise AI software program.

[ad_2]

Source