1 Unstoppable Inventory Powering Nvidia and the AI Revolution

You possibly can’t go 5 minutes with out listening to about Nvidia as of late. The pc chip big not too long ago grew to become the most important firm on this planet by market capitalization and at present is valued at over $3.34 trillion. Traders are betting that the large capital spending on synthetic intelligence (AI) will proceed, with Nvidia sustaining its dominant market place.

However what corporations energy Nvidia? There’s one which rises above all the remainder, and it’s the spine of most superior semiconductor manufacturing across the globe. Enter Taiwan Semiconductor Manufacturing (NYSE: TSM), an organization powering Nvidia and the AI revolution.

Is the inventory a purchase? Let’s take a more in-depth look and discover out.

Taiwan Semiconductor: The spine for contemporary computing

Taiwan Semiconductor (TSMC for brief) has risen above the pack in chipmaking resulting from its progressive foundry mannequin. What this implies is TSMC doesn’t promote the chips it makes on to prospects — Intel‘s previous enterprise mannequin — however aggregates orders from laptop chip designers. This permits it to focus solely on manufacturing experience and hold a lead within the most-advanced semiconductor manufacturing on this planet.

It has few if any rivals akin to Intel, Samsung, and homegrown Chinese language gamers. Clients embrace Apple, Alphabet, Amazon, and the aforementioned Nvidia. With the rise of computing demand for brand new AI instruments, corporations have needed to buy chips from gamers like Nvidia or design their very own. Virtually all of them outsource this manufacturing to TSMC.

With minimal competitors and large switching prices, the corporate has an enormous lock-in with prospects and a ton of pricing energy that enable it to generate outsized earnings. Up to now 1 years, working revenue has grown by near 300% and hit $30 billion over the previous 12 months. It generates simply over $70 billion in income and noticed 30% income progress in Might as extra orders are available in for the increase in AI capital spending.

Traders guess on AI and geographical diversification

TSMC inventory is up 439% within the final 5 years and has hit a number of all-time highs in 2024. Traders are betting that the AI revolution will proceed to drive progress for the corporate over the subsequent few years. But, anybody seeking to purchase the inventory at present ought to marvel if the market is getting a bit overexcited with AI corporations proper now.

Some would possibly see parallels to the dot-com bubble with AI shares. Regardless that the web become one of the crucial necessary applied sciences ever, that didn’t stop overpriced shares from falling 90% when the bubble burst. Given its diversification throughout your entire semiconductor market, it’s arduous to see a 90% drawdown occurring for TSMC, however the threat of an AI bubble persists nonetheless.

One other potential tailwind for TSMC is geographical diversification. The corporate has its manufacturing centered on its house turf, which faces an growing threat of Chinese language aggression. Clearly, this could be dangerous for shareholders.

To alleviate this threat, TSMC is working with nations like the US to construct factories exterior of Taiwan. It was not too long ago awarded $6.6 billion from the U.S. authorities and is constructing factories value tens of billions of {dollars} within the nation. This may assist deliver down the China invasion threat and spur progress over the subsequent decade.

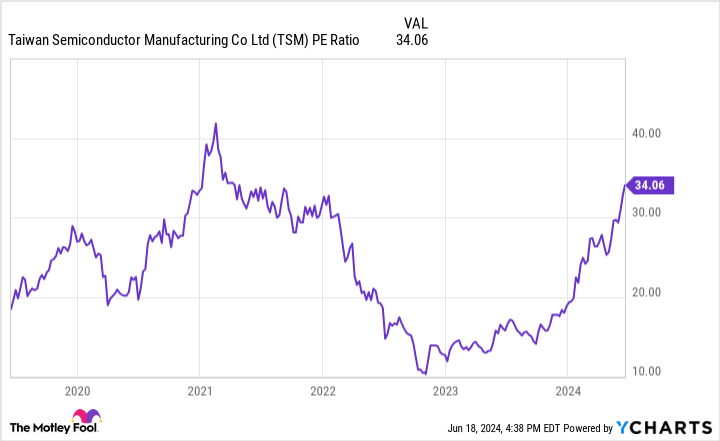

TSM PE Ratio information by YCharts.

However is the inventory low cost?

Lower than two years in the past, TSMC traded at a price-to-earnings (P/E) ratio simply above 10. Now, the ratio is about to breach 35. In hindsight, TSMC was clearly undervalued at a P/E within the low teenagers.

It’s arduous to make the identical argument with the inventory climbing now to all-time highs. This isn’t a hypergrowth enterprise that may immediately triple its income. Sure, it’s at the moment rising income resulting from AI spending, however that additionally comes with the bubble threat of latest applied sciences. Let’s not overlook the China threat, both.

The S&P 500 trades at a P/E of about 28. TSMC is nicely above this stage, and it isn’t just like the market is reasonable both. Taking all these elements into consideration, TSMC inventory doesn’t seem like an excellent inventory to purchase at these costs despite the fact that it’s the spine of the AI revolution.

Must you make investments $1,000 in Taiwan Semiconductor Manufacturing proper now?

Before you purchase inventory in Taiwan Semiconductor Manufacturing, think about this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they imagine are the 10 best stocks for traders to purchase now… and Taiwan Semiconductor Manufacturing wasn’t certainly one of them. The ten shares that made the minimize may produce monster returns within the coming years.

Take into account when Nvidia made this listing on April 15, 2005… in the event you invested $1,000 on the time of our suggestion, you’d have $801,365!*

Inventory Advisor offers traders with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of June 10, 2024

Suzanne Frey, an government at Alphabet, is a member of The Motley Idiot’s board of administrators. John Mackey, former CEO of Entire Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Brett Schafer has positions in Alphabet and Amazon. The Motley Idiot has positions in and recommends Alphabet, Amazon, Apple, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Idiot recommends Intel and recommends the next choices: lengthy January 2025 $45 calls on Intel and brief August 2024 $35 calls on Intel. The Motley Idiot has a disclosure policy.

1 Unstoppable Stock Powering Nvidia and the AI Revolution was initially revealed by The Motley Idiot