Have $100,000? Right here Are 3 Methods to Develop That Cash Into $1 Million for Retirement Financial savings

[ad_1]

Monetary targets can fluctuate broadly from individual to individual. Some individuals merely need monetary safety, whereas others have extra lofty targets like a beachside mansion. Neither is inherently higher or worse than the opposite. What issues is that you just set monetary targets which are in keeping with your wants and values.

That stated, the $1 million mark has lengthy been thought of an enormous milestone on the way in which to monetary freedom in retirement. That sum of money could not go so far as it did a long time in the past, but it surely’s nonetheless a considerable sum, and price aiming to attain. And the great thing about aiming for the million-dollar mark is that it isn’t out of attain for many individuals. Time generally is a nice assistant.

For individuals seeking to develop $100,000 right into a $1 million retirement nest egg, the next three steps can velocity up your progress.

1. Make investments the lump sum and let compound development do a lot of the work

I am going to by no means miss an opportunity to get on my soapbox and discuss how highly effective compound development is in investing. It occurs when the positive factors you have already made in your investments — whether or not by means of rising share costs, dividend reinvestment, or each — earn positive factors of their of personal. Then these positive factors begin to accrue positive factors, and so forth. It is a profitable, wealth-building cycle.

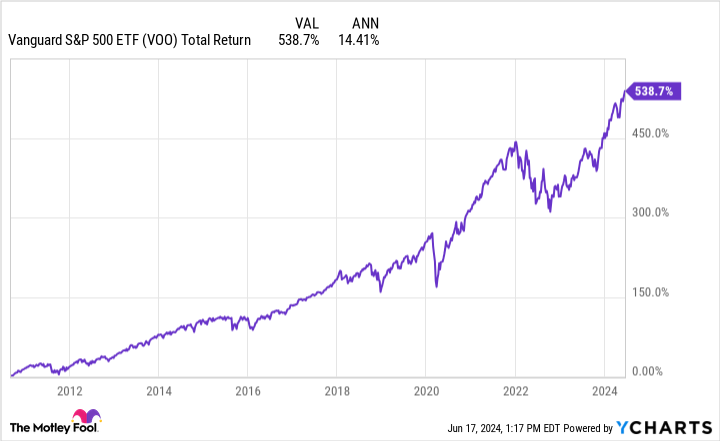

If you are going to make investments a lump sum, I like to recommend a diversified exchange-traded fund (ETF) just like the Vanguard S&P 500 ETF (NYSEMKT: VOO). The S&P 500 incorporates a lot of the largest U.S. corporations from all main sectors, and lots of view an funding in it as much like an funding within the nationwide financial system. In the event you’re in it for the long term, that is one of many higher investments you may make.

For the reason that Vanguard S&P 500 ETF’s inception in 2010, it has averaged an annual complete return of greater than 14%. The S&P 500 index has traditionally averaged an annual return of round 10% over the long term.

If one splits the distinction and assumes that from right here, the ETF will common a 12% annual return, a one-time funding of $100,000 would take round 21 years to cross the $1 million mark, even after taking out the ETF’s low annual charges — simply 0.03% of property being managed.

After all, no person can reliably predict how any inventory or fund will carry out, and we should not assume that an asset will hold delivering the identical outcomes because it did beforehand, however specifics apart, this illustration exhibits the effectiveness of letting time and compound development do a whole lot of the heavy lifting for you.

2. Reap the benefits of the facility of dividends

I at all times advocate individuals make the most of their brokerage platform’s dividend reinvestment program (DRIP). As a substitute of taking your dividends as money payouts, you need to use a DRIP to mechanically reinvest them again into extra shares of the shares that paid them out.

Utilizing a DRIP is a good way to double down on the compound development impact. There’s nothing improper with taking your dividends in money, however the quantities are typically comparatively small until you personal many shares. By reinvesting dividends, you improve the variety of shares you personal, setting your self up for bigger money payouts in retirement.

To see the effectiveness of a DRIP in motion, let’s go to the Rule of 72, which notes that, roughly talking, if you happen to divide 72 by the annualized development charge of an funding, the outcome would be the variety of years it is going to take that funding to double.

So, for instance, an funding averaging 10% annual development would double in about 7.2 years. Now, let’s assume that this identical funding additionally paid a dividend with a median yield of two%. In the event you reinvested all of your dividends in that point (bringing your complete annualized returns to 12%), you can shave off round 1.2 years and double your cash in six years.

Ideally, you may use a DRIP to maximise the variety of shares in your portfolio whilst you’re constructing your subsequent egg, after which start taking money payouts in retirement to cowl a few of your bills. A 2% yield on $1 million value of shares would provide you with $20,000 in annual dividend revenue.

3. Including contributions is at all times an choice

Having $100,000 to speculate is a wonderful begin, however you do not have to cease with that lump sum funding in your strategy to the million-dollar mark. Contributing extra money to your portfolio frequently, even in seemingly small quantities, can enormously velocity up the method.

Constructing on our first instance, the place a lump sum funding of $100,000 took round 21 years to develop right into a $1 million place, at a median annual return charge of 12%, this is how a lot time can be shaved off that course of by investing extra money persistently every month.

|

Further Month-to-month Contributions |

Years Till $1 Million |

|---|---|

|

$250 |

19 |

|

$500 |

18 |

|

$1,000 |

16 |

Calculations by writer. Rounded to the closest complete yr.

Investing $100,000 is a unbelievable begin, however do not cease there. Preserve contributing to your portfolio persistently and let your investments develop.

The $22,924 Social Safety bonus most retirees fully overlook

In the event you’re like most Individuals, you are just a few years (or extra) behind in your retirement financial savings. However a handful of little-known “Social Safety secrets and techniques” may assist guarantee a lift in your retirement revenue. For instance: one simple trick may pay you as a lot as $22,924 extra… annually! When you learn to maximize your Social Safety advantages, we expect you can retire confidently with the peace of thoughts we’re all after. Simply click here to discover how to learn more about these strategies.

View the “Social Security secrets” ›

Stefon Walters has positions in Vanguard S&P 500 ETF. The Motley Idiot has positions in and recommends Vanguard S&P 500 ETF. The Motley Idiot has a disclosure policy.

Have $100,000? Here Are 3 Ways to Grow That Money Into $1 Million for Retirement Savings was initially revealed by The Motley Idiot

[ad_2]

Source