Ohio lady wins $15M jackpot however will take dwelling simply $4.5M after taxes — did she throw cash down the drain?

[ad_1]

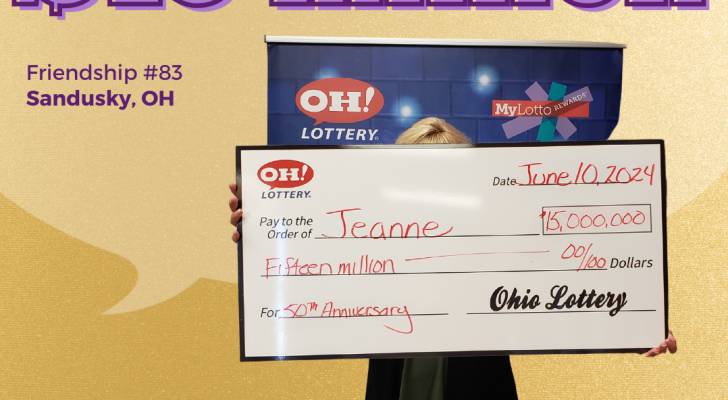

Girl Luck was current and accounted for when a girl from Sandusky, Ohio, gained huge within the state’s fiftieth Anniversary scratch-off sport in June.

The winner, recognized solely as Jeanne, dropped to the ground when she realized she’d gained a $15 million jackpot from a $50 scratch-off card, based on the Ohio Lottery Fee.

Do not miss

When she took the profitable card to the clerk at Friendship #83 in Sandusky, they “each simply cried,” Jeanne stated in a press release. “There have been individuals in line me like I misplaced my thoughts.”

Jeanne had two choices for the way to declare her monumental prize: she might take an annuity of $600,000 for 25 years (which might whole $15 million), or she might take a lump sum of about $7.5 million.

She opted for the $7.5 million money possibility, a sum that can truly shrink to round $4.5 million, Moneywise estimates, as soon as she’s paid her federal and state taxes.

That $10.5 million distinction between the marketed $15 million prize and her eventual winnings begs the query, did she throw cash down the drain by choosing the lump sum?

Taxing mega lottery wins

The IRS requires all lottery companies to withhold 24% of lottery winnings over $5,000 for federal taxes. On Jeanne’s $7.5 million purse, this quantities to tax of $1.8 million.

However as lottery winnings are taxed as unusual revenue, a windfall of this measurement would land Jeanne within the highest federal revenue tax bracket of 37%, that means she should progressively pay extra tax till she meets the bracket’s threshold. In the long run, her whole federal tax invoice will land at round $2.73 million.

The Buckeye State additionally taxes lottery winnings like regular revenue. Jeanne’s $7.5 million lump sum win would place her firmly within the high state revenue tax bracket of three.5% for 2024, which might eat roughly $262,000 from her whole.

In any case that, Jeanne’s whole tax legal responsibility associated to her win alone involves about $3 million — that means she’ll solely get to get pleasure from round $4.5 million from her $50 scratch-off win (which remains to be a shocking return-on-investment).

She has huge plans for her winnings. Jeanne says she needs to repay her finest pal’s mortgage, whom she’s stayed with for the previous two years, and he or she’d love to purchase a home in Florida.

However might she have achieved these targets and picked up extra money within the long-run by taking the annuity prize possibility?

Learn extra: Automobile insurance coverage charges have spiked within the US to a shocking $2,150/12 months — however you may be smarter than that. Here’s how you can save yourself as much as $820 annually in minutes (it is 100% free)

What if she took the annuity?

If Jeanne took the $600,000 per 12 months for 25 years, she would have obtained the total $15 million prize, ultimately. As a substitute of feeling instantly rich, she would have been comfortably wealthy for years to return.

When a lottery winner chooses the annuity possibility, they usually pay taxes primarily based on the annual fee (on this case, $600,000) relatively than on the entire prize quantity.

So, Jeanne could be signing as much as pay revenue taxes on $600,000 — plus some other revenue she earns by way of working, investments, advantages and so forth — for 2 and a half many years. That might place her within the highest federal and state revenue tax brackets. Nonetheless, Ohio Republicans in January proposed laws that might steadily cut back and ultimately remove state revenue tax by 2030.

When it comes to federal taxes, she would owe round $180,000 on her winnings in 2024, and in state taxes, she would owe about $20,000. However these figures could have modified over the length of the 25-year annuity if the federal revenue tax brackets are adjusted or the Ohio Republican invoice passes. This additionally assumes Jeanne doesn’t cut back her tax legal responsibility by way of varied intelligent methods and with assist from a financial adviser.

Annuity vs. lump sum debate

When you recover from the shock and elation of profitable a life-changing windfall, there are lots of essential issues to contemplate. First, you usually have to decide on between taking a lump sum or an annuity.

Many individuals take a lump sum as a result of they need instant entry to the money to purchase big-ticket gadgets like homes or vehicles — or maybe, like Jeanne, they need to use it to pay off debts or to assist family and friends.

With the lump sum, you even have the chance (after shelling out your taxes) to spend money on growth-oriented property like shares, real estate and even alternative investments like valuable metals, paintings and wine.

However there’s additionally a threat to picking this selection. Many individuals don’t have the monetary infrastructure in place to take care of such an enormous sum of money and will find yourself making irresponsible money decisions.

With an annuitized fee, lottery winners can benefit from the safety of regular revenue and peace of thoughts figuring out they will’t blow by way of it suddenly.

It may be price working with a monetary adviser on the way to maximize that cash stream. For instance, you might need to put it to work by way of tax-advantaged investing accounts, like a 401(k) or a standard or Roth particular person retirement account. You too can take into account making monetary items and donations that can cut back your tax legal responsibility.

What to learn subsequent

This text gives data solely and shouldn’t be construed as recommendation. It’s offered with out guarantee of any sort.

[ad_2]

Source