‘Father of the 401(Okay)’ is ‘very disturbed’ by the company greed in office retirement plans — right here’s why

[ad_1]

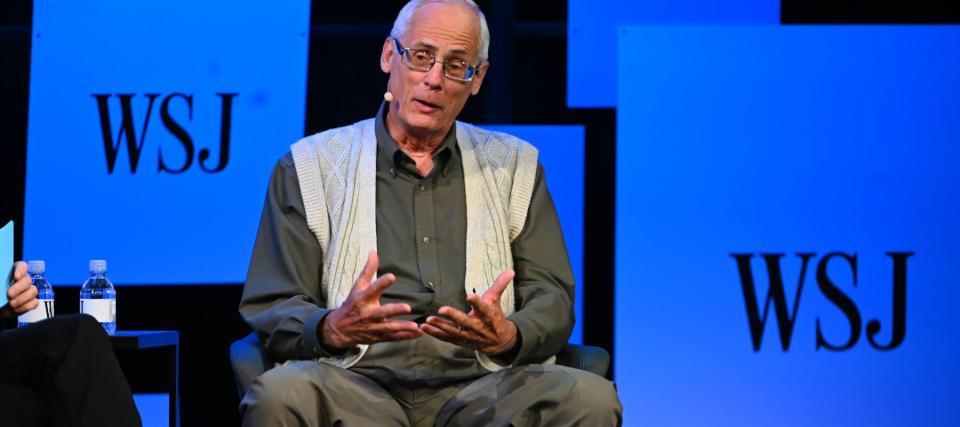

Ted Benna is taken into account the “father of the 401(okay),” due to his redesign of the favored funding car again in 1978 — a design that’s nonetheless used at present.

These days, 34.6% of working-age Americans have a 401(okay)-style account, with an general $7.4 trillion in property.

Do not miss

-

Beating the market is not any fantasy: These professional stock-pickers’ latest success might assist you to build generational wealth

-

‘It isn’t taxed in any respect’: Warren Buffett shares the ‘best investment’ you can make when battling rising prices — take benefit at present

-

These 5 magic cash strikes will enhance you up America’s web value ladder in 2024 — and you may full every step inside minutes. Here’s how

Regardless of the widespread adoption and recognition of the employer-sponsored retirement financial savings plan, Benna not too long ago told the Every day Mail that he has misgivings about among the developments in 401(okay)s.

‘Grasping’ employers are charging larger charges

In 1978, Benna was working as a advantages guide when he designed an worker retirement financial savings plan for a consumer utilizing an progressive interpretation of the 401(okay) part of the Inside Income Service (IRS) code. This part of the code permits staff to contribute a portion of their pay on a pre-tax foundation and employers to match these contributions with tax-deductible firm contributions.

The consumer didn’t use the plan, however Benna’s personal firm selected to start out one, and shortly after the Treasury and IRS sanctioned it.

Quick ahead to at present: considered one of Benna’s best misgivings is how plan charges have advanced.

“I’m very disturbed by what’s taking place with the funding bills,” Benna advised the Every day Mail.

Initially, he mentioned, the employer was imagined to cowl all the administrative charges. However that isn’t what’s taking place now, he says, as “grasping” employers cost excessive administrative charges.

Benna has seen charges as excessive as 2.75% — which might have a fabric affect on funding returns. For instance, after 20 years, the worth of a $100,000 portfolio incomes 4% with a 1% annual payment can be lowered by $30,000 versus the identical portfolio with a 0.25% annual payment.

To make issues worse, though the U.S. Division of Labor (DOL) requires plans to reveal their charges, the U.S. Authorities Accountability Workplace found that 4 in 10 members in 401(okay) plans don’t perceive the payment data in plan disclosures.

Learn extra: ‘You didn’t wish to threat it’: 80-year-old girl from South Carolina is searching for the most secure place for her household’s $250,000 financial savings. Dave Ramsey responds

So how are you going to cut back the charges in your 401(okay)?

First, you should perceive what charges you’re being charged. The DOL publication A Look at 401(k) Plan Fees is an efficient place to start out. It explains what charges are charged and the right way to interpret payment disclosure statements.

Principally, there are three kinds of charges charged by 401(okay) plans: administrative, service and funding charges.

Administrative charges assist to cowl the price of working the plan — and usually there’s not a lot you are able to do about these.

Service charges are much like administration charges, however relate to taking an motion, reminiscent of making an early withdrawal or rolling over your funding to an IRA. You’ll be able to preserve these charges to a minimal by taking as few actions as doable.

Funding charges are charged by the funds in your portfolio. You might be able to cut back these by transferring to funds that usually have decrease charges, reminiscent of passive index funds. If these funds aren’t among the many decisions your plan presents, you could wish to see in case your employer presents the choice for a self-directed 401(okay) plan, which will provide you with extra funding alternative.

If you happen to’re paying a excessive administrative payment in your 401(okay) — and may’t do something about it — one option to doubtlessly cut back the payment burden in your investments is to contribute to your 401(okay) plan solely to the quantity wanted to maximise employer contributions, then direct the remainder of your annual financial savings to a different plan, reminiscent of a person retirement account (IRA), the place it could be doable to pay much less in charges. Earlier than doing this, you could wish to seek the advice of a monetary planner.

You’ll be able to withdraw your complete plan — however you most likely shouldn’t

A second misgiving that Benna has about 401(okay) plans is which you could withdraw the full quantity whenever you change employers. This may be tempting, however can vastly cut back the scale of your future nest egg.

Relying on the scale of your portfolio, you could have a number of different choices: leaving it the place it’s, rolling it into the 401(okay) plan at your new employer or rolling it into a conventional or Roth IRA. If you happen to’re leaving your present job, it’s value chatting with a monetary adviser about your greatest transfer.

Though Benna has misgivings, 401(okay)s stay a strong software for reaching monetary safety in retirement. By understanding and managing your charges—and resisting the temptation to withdraw the funds earlier than you retire—you will get essentially the most out of your plan.

What to learn subsequent

This text offers data solely and shouldn’t be construed as recommendation. It’s offered with out guarantee of any sort.

[ad_2]

Source