This Small-Cap Inventory Might Experience the AI Tailwinds to Market-Beating Returns. Time to Purchase?

Freelance market Fiverr Worldwide (NYSE: FVRR) has fallen dramatically from its former glory as a darling of the early pandemic period. The inventory is down 93% from the excessive it touched in February 2021, which has traders (understandably) doubting its deserves as a long-term funding.

The corporate’s newest woes stem from the market’s concern that artificial intelligence (AI) may substitute lots of the jobs that freelancers supply to do on Fiverr, which might spell hassle for {the marketplace}’s long-term prospects.

However that concern seems misplaced to me, and this small-cap inventory is much from down and out.

Pandemic skepticism is misplaced

Fiverr’s freelance platform connects patrons (procuring companies) and sellers (offering companies). It additionally provides worth to every transaction in quite a few methods, providing a handy ecosystem for dealing with funds, correspondence, troubleshooting, and many others. This creates a pleasing person expertise for each events. In trade, Fiverr takes a slice of every transaction.

Each demand and provide for freelancing surged throughout COVID-19 when lockdowns and social distancing efforts shuttered many places of work. That resulted in a progress spurt for Fiverr that pushed its income and the share worth to nice heights. Nevertheless, its progress price slowed to a crawl because the social distancing interval receded, which triggered the inventory’s decline.

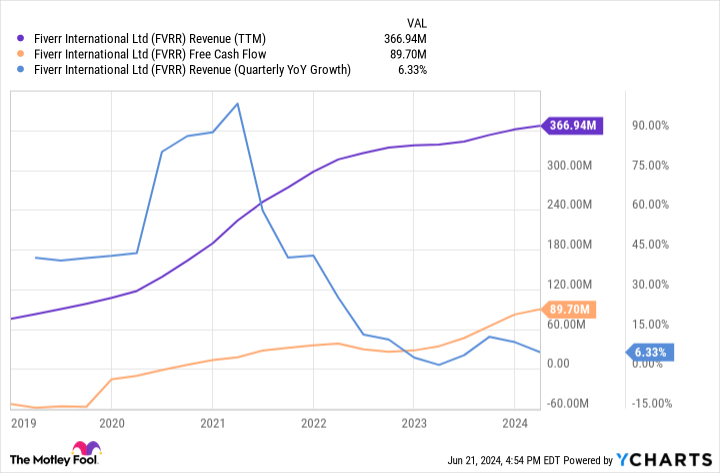

Importantly, nonetheless, Fiverr did not give again income. Its progress slowed, however income by no means contracted.

It is comprehensible that such up-and-down progress charges would spark skepticism in regards to the inventory. The excellent news is that Fiverr has completed some vital issues over the previous a number of years. For starters, it turned free cash flow optimistic in 2020 and GAAP worthwhile a yr in the past. Moreover, the corporate has elevated its take price from 27.1% in Q1 2020 to 32.3% in Q1 2024.

That rising take price alerts that its platform nonetheless brings worth. You might nearly take a look at it as “pricing energy.” Fiverr could not frequently enhance its take price if patrons and sellers did not see it as a worthwhile choice; in any other case, they would go away. This bodes nicely for the corporate’s future.

Why AI is sweet for Fiverr

Synthetic intelligence has emerged as the newest threat to Fiverr’s enterprise mannequin. The concern is that the patrons of companies will begin to use AI programs for extra of these duties, decreasing the variety of jobs supplied on the platform, which might result in an exodus amongst companies sellers as nicely. That argument has some advantage. Generative AI can rapidly write copy, analyze paperwork, or create pictures. However, the rise of AI programs also can create new alternatives.

Administration touched on this within the firm’s Q1 earnings name, noting that AI has been a web optimistic for the platform as a result of it is creating progress in additional advanced duties which are extra worthwhile for Fiverr and more durable to copy elsewhere. Demand for AI-related companies grew by 95% yr over yr in Q1. Fiverr acknowledged that on its platform, there are 10,000 AI specialists providing their companies to assist purchasers implement AI know-how of their companies. Additionally, spending-per-buyer grew by 8% yr over yr in Q1, indicating continued momentum in going “upstream.” (That is jargon for bigger patrons that pay extra for companies.)

Zooming out, Fiverr’s skill to transition into being a facilitator for extra advanced work arguably reinforces the platform’s long-term sturdiness as a result of it is more and more changing into a go-to choice for firms that wish to outsource labor as a substitute of hiring staff. Small companies will possible stay a core consumer group for Fiverr, however it’s clear the corporate needs to seize extra {dollars} from enterprise-level prospects.

A low-risk guess with large upside potential

Fiverr’s funding potential appears compelling for a few causes. First, it may see renewed income progress because the pandemic-driven progress spurt strikes additional into the previous. Analysts estimate Fiverr’s income will enhance by a mid-single-digit proportion this yr. Nevertheless, analysts additionally consider income progress will speed up to 10% subsequent yr and 15% in 2026. On condition that the corporate is now worthwhile, these upticks in top-line progress ought to produce comparable jolts in earnings.

In the meantime, Fiverr inventory trades at a ahead P/E ratio of beneath 10 in the present day. That valuation is acceptable for a dying firm, not one which simply turned worthwhile and will see income progress speed up within the coming years. Such a low valuation makes it extra possible that Fiverr’s progress will trickle out to shareholders as share worth good points. There is not a lot room for the inventory’s valuation to go decrease.

Keep in mind that that is all primarily based on estimates — solely time will inform how issues really shake out. However given the corporate’s robust financials and administration’s feedback on how AI is benefiting it, it is onerous to not just like the setup for Fiverr inventory right here.

Do you have to make investments $1,000 in Fiverr Worldwide proper now?

Before you purchase inventory in Fiverr Worldwide, take into account this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they consider are the 10 best stocks for traders to purchase now… and Fiverr Worldwide wasn’t certainly one of them. The ten shares that made the minimize may produce monster returns within the coming years.

Take into account when Nvidia made this listing on April 15, 2005… for those who invested $1,000 on the time of our advice, you’d have $723,729!*

Inventory Advisor supplies traders with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of June 24, 2024

Justin Pope has positions in Fiverr Worldwide. The Motley Idiot has positions in and recommends Fiverr Worldwide. The Motley Idiot has a disclosure policy.

This Small-Cap Stock Could Ride the AI Tailwinds to Market-Beating Returns. Time to Buy? was initially revealed by The Motley Idiot