Nvidia Inventory Is Up 150% in 2024. Historical past Says the AI Inventory Will Do This within the Second Half of the 12 months (Trace: It Could Shock You).

Nvidia (NASDAQ: NVDA) dominates the marketplace for information heart graphics processing models (GPUs), chips used to hurry up demanding workloads like synthetic intelligence (AI) functions. The Wall Avenue Journal lately reported that “Nvidia’s chips underpin all the most superior AI methods, giving the corporate a market share estimated at greater than 80%.”

The corporate has been gaining steam for the reason that launch of ChatGPT in November 2022. That occasion thrust generative AI into the highlight and impressed unprecedented demand for AI {hardware}. Nvidia shares have surged 150% this yr alone, accounting for practically one-third of the good points within the S&P 500.

Considerably surprisingly, historical past says Nvidia shareholders may earn more money within the second half of 2024, even after triple-digit good points within the first half of the yr. Learn on to be taught extra.

Historical past says Nvidia may proceed hovering within the second half of 2024

Nvidia turned a public firm in 1999. The chart beneath reveals its share-price appreciation (or depreciation) within the first and second halves of every full yr since its preliminary public providing (IPO). Nvidia has typically carried out higher within the second half of the yr, as evidenced by the median values listed on the backside of every column.

|

12 months |

First-Half Return |

Second-Half Return |

|---|---|---|

|

2000 |

171% |

(48%) |

|

2001 |

183% |

44% |

|

2002 |

(74%) |

(33%) |

|

2003 |

99% |

1% |

|

2004 |

12% |

15% |

|

2005 |

13% |

37% |

|

2006 |

16% |

74% |

|

2007 |

12% |

24% |

|

2008 |

(45%) |

(57%) |

|

2009 |

40% |

65% |

|

2010 |

(45%) |

51% |

|

2011 |

3% |

36% |

|

2012 |

0% |

(11%) |

|

2013 |

15% |

14% |

|

2014 |

16% |

43% |

|

2015 |

0% |

64% |

|

2016 |

43% |

127% |

|

2017 |

35% |

34% |

|

2018 |

22% |

(44%) |

|

2019 |

23% |

43% |

|

2020 |

61% |

37% |

|

2021 |

53% |

47% |

|

2022 |

(48%) |

(4%) |

|

2023 |

190% |

17% |

|

Median |

15% |

36% |

Information supply: YCharts.

Previous efficiency is rarely a assure of future outcomes, however we will use the data within the chart to make educated guesses about Nvidia’s efficiency within the remaining months of 2024.

First, Nvidia has hardly ever adopted an upbeat first half with a downbeat second half. Particularly, the inventory has produced a constructive first-half return in 18 years and a constructive second-half return in 16 of these 18 years, or 89% of the time. In different phrases, historical past says Nvidia shareholders are more likely to generate income within the remaining months of 2024.

Second, Nvidia has returned a median of 36% in the course of the second half of the yr, greater than doubling its median return within the first half. Nevertheless, when good points have exceeded 100% within the first half of the yr, the inventory has returned a median of 17% within the second half. So historical past implies Nvidia shareholders may see a 17% return on their investments within the remaining months of 2024.

Sadly, analyzing Nvidia’s previous share-price appreciation is a poor technique of predicting the longer term. It overlooks consequential variables like present monetary outcomes, valuation, and market sentiment. However Wall Avenue analysts have thought-about these variables and haven’t got an ideal view.

Wall Avenue analysts see little or no upside for Nvidia shareholders

Among the many 60 analysts who observe Nvidia, 90% charge the inventory a purchase and 10% charge the inventory a maintain. Not one at present recommends promoting. Nevertheless, the median 12-month value goal of $127.50 per share implies simply 3% upside from its present value of $124 per share.

Analysts have persistently revised their targets larger as Nvidia has crushed income and earnings estimates. However the firm can solely beat estimates so many instances earlier than the market expects that end result — and we could have reached that time already. Nvidia has beat income and earnings estimates by at the very least 6% and 10%, respectively, in 4 straight quarters.

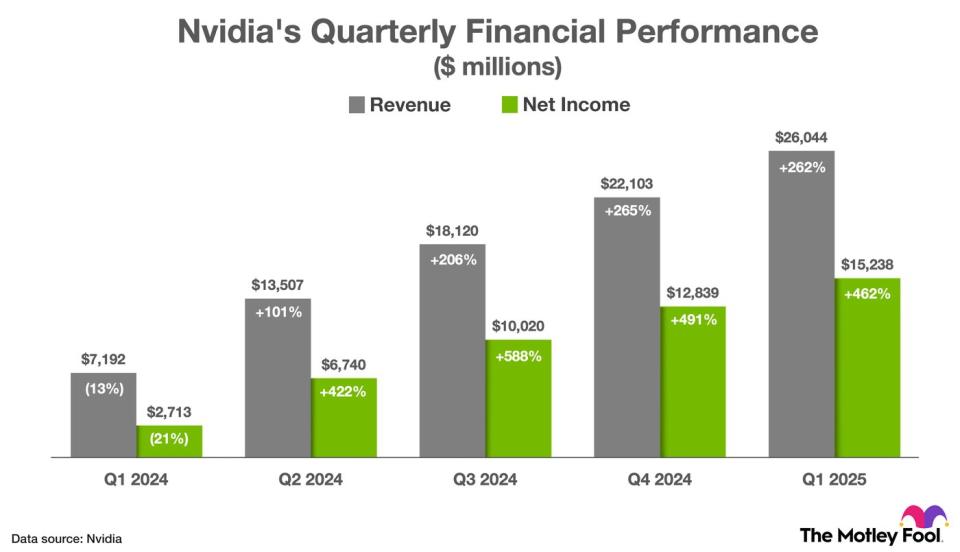

That’s significantly spectacular, provided that income and non-GAAP internet earnings elevated at a triple-digit tempo in these quarters, as proven within the chart beneath.

This is the underside line: Sooner or later, traders shall be upset when Nvidia studies its monetary outcomes both as a result of income and/or earnings beat estimates too modestly or these metrics miss estimates. When that day comes, shares will most likely fall sharply, at the very least briefly.

Even so, the bull case for Nvidia is simple. UBS analysts lately predicted that artificial intelligence shall be “probably the most profound innovation and one of many largest funding alternatives in human historical past.” Nvidia’s graphics processing models are the gold customary in accelerating AI workloads. Analysts at Forrester Analysis lately wrote, “With out Nvidia GPUs, trendy AI would not be attainable.”

Wall Avenue analysts count on Nvidia to develop earnings per share at 33% yearly over the following three to 5 years. That forecast makes its present valuation of 70 instances earnings look pretty affordable.

Nvidia could or might not be a worthwhile funding within the second half of 2024. From its present value, nonetheless, I feel the inventory can beat the market over the following three to 5 years.

Must you make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, think about this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they imagine are the 10 best stocks for traders to purchase now… and Nvidia wasn’t considered one of them. The ten shares that made the reduce may produce monster returns within the coming years.

Take into account when Nvidia made this record on April 15, 2005… should you invested $1,000 on the time of our advice, you’d have $772,627!*

Inventory Advisor supplies traders with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of June 24, 2024

Trevor Jennewine has positions in Nvidia. The Motley Idiot has positions in and recommends Nvidia. The Motley Idiot has a disclosure policy.

Nvidia Stock Is Up 150% in 2024. History Says the AI Stock Will Do This in the Second Half of the Year (Hint: It May Shock You). was initially printed by The Motley Idiot