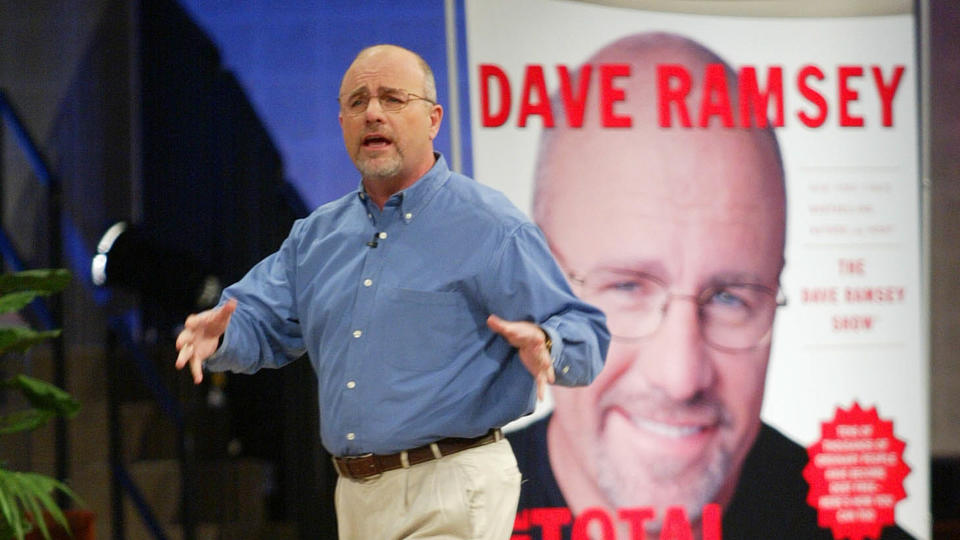

This Recommendation From Dave Ramsey May Assist You Make Hundreds

With complete private debt reaching an all-time excessive of $17.5 trillion and credit card balances hitting $1.13 trillion within the remaining quarter of 2023, it’s evident that many American shoppers will want Dave Ramsey’s recommendation to assist repay debt earlier than the scenario will get worse.

Learn Subsequent: I Followed Mark Cuban’s Genius Advice and Am on Track To Become a Millionaire

Be taught Extra: 7 Reasons You Should Consider a Financial Advisor — Even If You’re Not Wealthy

Ramsey has been a serious advocate for saving cash, paying down debt and getting your funds so as, however his recommendation will also be used to earn money and construct wealth. GOBankingRates reached out to cash knowledgeable, Mike Manalac, to learn how you need to use Ramsey’s recommendation to earn money and build wealth.

Rich individuals know the perfect cash secrets and techniques. Learn how to copy them.

Can Ramsey Assist You Make Hundreds?

“You can also make hundreds by following Ramsey’s recommendation and growing a customized finances and financial savings system,” stated Mike Manalac, a Licensed Public Accountant (CPA) with expertise at prime accounting corporations and Fortune 500 firms.

Manalac summarized the formulation for the way followers of Dave Ramsey’s recommendation can construct wealth:

“Begin along with your month-to-month take-home pay and allocate funds to cowl your housing, car and every other important month-to-month bills. Break up the remaining funds between a month-to-month enjoyable finances, a high-yield financial savings account and shares in an S&P 500 index fund.”

Based on Manalac, “By sticking to your finances and financial savings system, you’ll begin constructing wealth over time.”

Ramsey’s Greatest Recommendation for Constructing Wealth

Right here’s recommendation from Ramsey that may provide help to make hundreds and construct wealth.

Have a Monetary Plan

“Dave discovered that the easiest way to construct wealth is to have a process-oriented money management technique,” remarked Manalac. “Create guidelines and observe them, equivalent to residing by a finances, residing on lower than you make, avoiding debt and investing early and usually.”

Earlier than you deal with making more cash, you wish to guarantee that you’ve a monetary plan so that you simply’re prepared for any new earnings streams or a rise in money circulate. You’ll battle to get your funds so as with out a plan or finances.

You Don’t Want To Make Thousands and thousands To Be Wealthy

Manalac famous that the recommendation would possibly sound primary initially, but it surely shatters the parable that it’s worthwhile to make some huge cash to construct wealth.

“A 3rd of millionaires make lower than $100,000 a 12 months, and most had been self-made,” shared Manalac. “Actually, lecturers usually tend to develop into millionaires than medical doctors or legal professionals, not due to how a lot cash they make, however due to how they spend their cash.”

This recommendation from Ramsey encourages you to deal with what you do along with your cash, reasonably than how a lot you make. Keep in mind, you don’t should earn a million-dollar wage to develop into a millionaire in the future.

Use Your Present Profession Abilities To Construct Wealth

Earlier than you attempt to change jobs or look into some elaborate income-generating system, you wish to reap the benefits of your present profession.

“Most millionaires have careers that contain setting and following a algorithm,” stated Manalac. “Lecturers observe a lesson plan, accountants have regulatory tips to observe and engineers have design specs to make sure buildings are structurally sound.”

Manalac talked about that these are additionally the highest three professions of millionaires seemingly as a result of they use an analogous strategy of their funds. Wealth constructing begins with setting and making a finances based mostly in your earnings and bills.

At all times Make investments Your Financial savings

When you’ve created a budget, it’s important that you simply depart house for financial savings and investments.

Manalac elaborated, saying, “As a substitute of spending the remaining quantity on unplanned bills, allocate a portion of your take-home pay to financial savings, equivalent to placing a small portion of every paycheck right into a high-yield financial savings account and an S&P 500 index fund.”

Improve Your Revenue

So, you could have a plan on your cash and are sticking to it. Now could be the time to start out discovering methods to earn extra.

Ramsey emphasizes sticking to the fundamentals, like asking for a elevate, working time beyond regulation or attempting to land a greater gig. If these choices don’t work out, you may strive the next:

-

Pursue a Aspect Hustle. In the case of bringing in more cash, Ramsey’s a proponent of pursuing some type of a facet hustle. Irrespective of your expertise or pursuits, odds are there’s a facet gig that’s completely fitted to you.

-

Promote stuff. You in all probability have objects round the home that you simply now not want that you may record on Fb Market for some further money.

-

Discover freelance work. When you’ve got any distinctive expertise like graphic design or writing, you may search for freelance gigs.

-

Repay your debt. As all the time, Ramsey desires you to deal with paying down your debt so that you simply spend much less on curiosity and maintain extra of your cash sooner or later.

“This steerage from Ramsey will assist individuals who earn a modest residing make hundreds and finally flip that into thousands and thousands,” stated Manalac.

Extra From GOBankingRates

This text initially appeared on GOBankingRates.com: I’m a Financial Advisor: This Advice From Dave Ramsey Could Help You Make Thousands