2 No-Brainer Excessive-Yield Shares to Purchase With $500 Proper Now

Do you will have some cash in your pocket, say $500 (or extra), simply ready to be put to work out there? In case you are an revenue investor that could be an issue, because the raging bull market has left the common inventory yield at painfully low ranges. The S&P 500 index’s yield is a miserly 1.3%! Do not fret; there are nonetheless loads of engaging yield choices on the market, and this pair of excessive yielders rises to the highest, with yields of 4.8% and seven%, respectively.

Enterprise Merchandise Companions: The boring vitality firm

The vitality sector isn’t precisely identified for being a secure haven for traders, on condition that oil and pure fuel costs have a protracted historical past of volatility. However not all vitality firms are created equal. The upstream (oil producers) and the downstream (chemical compounds and refining) are, certainly, liable to wild swings in monetary efficiency. However the midstream (pipelines, storage, processing, and transportation) isn’t. That is the area of interest the place Enterprise Merchandise Companions (NYSE: EPD) and its lofty 7% distribution yield hail from.

The important thing right here is that Enterprise is a toll taker. It fees charges for the usage of its important vitality infrastructure belongings, which results in pretty dependable money flows in good vitality markets and dangerous ones. Oil and pure fuel are important to the world economic system, and even when energy costs are low there’s nonetheless strong demand. For this reason Enterprise has been capable of enhance its distribution for 25 consecutive years, proving that it’s a dependable revenue inventory.

To be honest, 7% is a big yield, and traders should settle for that the yield will make up the lion’s share of their return. However add in distribution progress within the low to mid-single digits, which is cheap to count on, and your return will stand up to across the 10% you’d count on from the broader market fairly shortly.

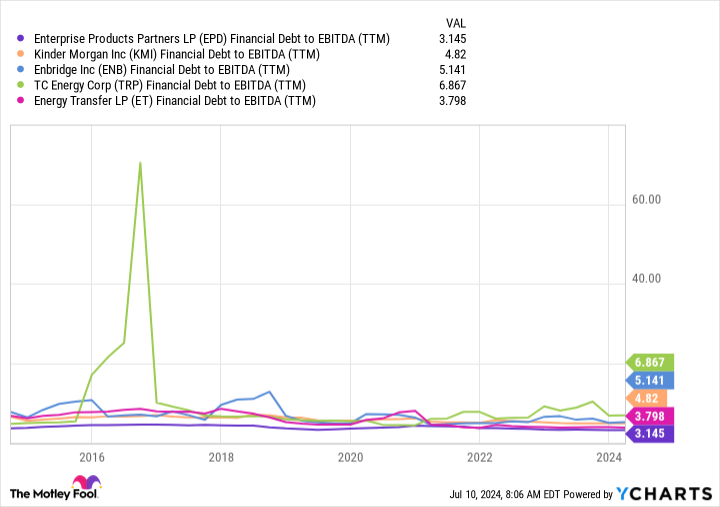

Including to the attract right here, and why Enterprise stands above higher-yielding midstream choices, is the grasp restricted partnership’s (MLP) concentrate on being fiscally conservative. For instance, because the chart beneath highlights, Enterprise’s debt-to-EBITDA (earnings earlier than curiosity, taxes, depreciation, and amortization) ratio has lengthy been among the many lowest of its closest friends. On prime of that, its stability sheet is investment-grade rated, and distributable money flows cowl the distribution by 1.7 instances. Rather a lot must go mistaken earlier than Enterprise minimize its lofty and engaging disbursement.

Black Hills is an out-of-favor Dividend King

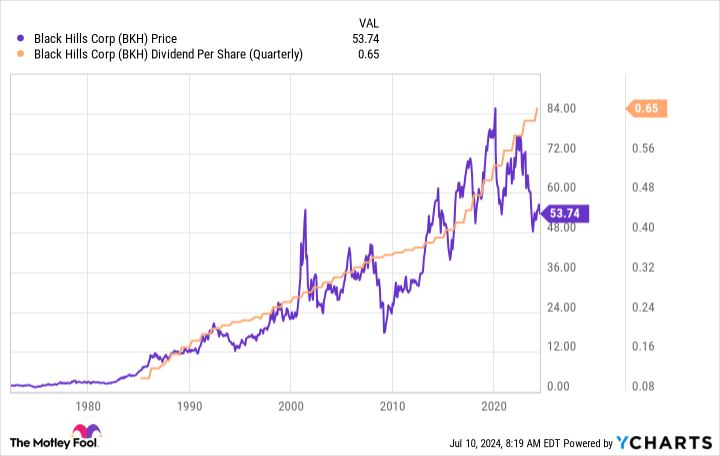

Compared to Enterprise, Black Hills‘ (NYSE: BKH) roughly 4.8% dividend yield will in all probability look slightly low. Do not be fooled; the yield of the Utilities Choose Sector Index, an approximation of a mean utility, is simply 3.3%. So Black Hills remains to be a really high-yielding possibility for traders to think about.

The dividend is not significantly dangerous, nonetheless. For starters, Black Hills is a Dividend King with over 5 many years of annual hikes underneath its belt. The corporate’s stability sheet can also be investment-grade-rated, and it operates in areas the place buyer progress is roughly 3 times as quick as inhabitants progress in the US. Merely put, it is a pretty well-positioned utility.

The issue is that Black Hills tends to make use of a bit extra leverage than a few of its friends, which has traders frightened concerning the current rise in rates of interest. That can in all probability be a near-term headwind, however regulators will take larger charges under consideration after they approve the corporate’s charges and funding plans. Over the long run, this, too, shall cross.

It is usually value noting that administration is projecting 4% to six% earnings progress over the subsequent few years, with dividends rising roughly together with earnings. Add about 5% dividend progress to the approximate 5% yield and, as soon as once more, you get to 10%, a good long-term return.

Excessive yields could be value digging for

It could be simple to have a look at the present market’s lofty heights and assume you simply cannot discover good dividend shares on this atmosphere. That will be a mistake. You simply need to do some extra legwork. However as Enterprise and Black Hills show, the additional effort is prone to be nicely rewarded. If you happen to do not personal these two high-yield shares, you must take into account including them to your portfolio at the moment — even when you solely have $500 to place to work.

Do you have to make investments $1,000 in Enterprise Merchandise Companions proper now?

Before you purchase inventory in Enterprise Merchandise Companions, take into account this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they consider are the 10 best stocks for traders to purchase now… and Enterprise Merchandise Companions wasn’t certainly one of them. The ten shares that made the minimize may produce monster returns within the coming years.

Contemplate when Nvidia made this checklist on April 15, 2005… when you invested $1,000 on the time of our advice, you’d have $791,929!*

Inventory Advisor supplies traders with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of July 8, 2024

Reuben Gregg Brewer has positions in Black Hills and Enbridge. The Motley Idiot has positions in and recommends Enbridge and Kinder Morgan. The Motley Idiot recommends Enterprise Merchandise Companions and Tc Vitality. The Motley Idiot has a disclosure policy.

2 No-Brainer High-Yield Stocks to Buy With $500 Right Now was initially printed by The Motley Idiot