CrowdStrike Outage Nets Quick Sellers $461 Million Windfall

[ad_1]

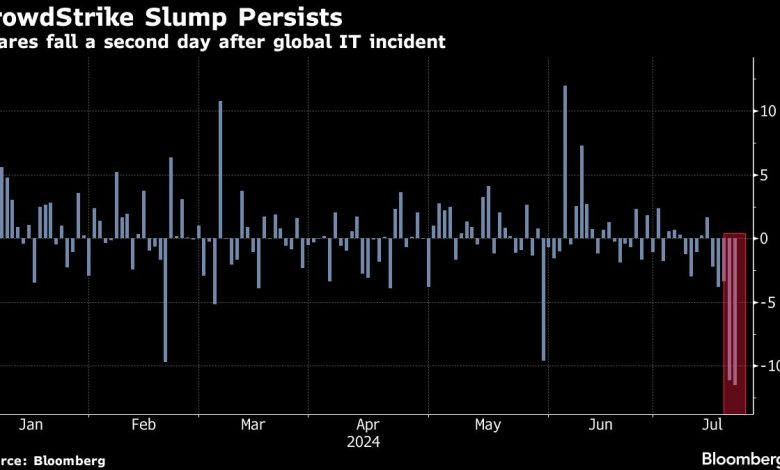

(Bloomberg) — Quick sellers piling into bets in opposition to CrowdStrike Holdings Inc. had been rewarded Friday when a botched software program replace from the agency sparked a world IT outage and despatched shares plunging to their worst day since November 2022.

Most Learn from Bloomberg

The contrarian group reaped paper income of $461 million on the cybersecurity software program firm’s 11% drop, in keeping with knowledge from S3 Companions LLC. The selloff was sufficient to swing CrowdStrike brief sellers to positive factors yr thus far. Shares of the corporate fell as a lot as 13% Monday, including much more to the cohorts’ mark-to-market income.

Complete brief curiosity within the techniques software program sector — or, the greenback quantity of bets that the shares will decline — has elevated by practically $12 billion up to now this yr, per S3 knowledge. Greater than $7 billion of that determine is made up of elevated brief promoting, whereas the rest is as a result of mark-to-market improve within the worth of shares shorted. CrowdStrike has seen the second-largest uptick in brief promoting within the sector this yr, trailing solely large Microsoft Corp.

“We should always see continued brief promoting on this sector, however as we noticed during the last 30 days, brief promoting and brief protecting will likely be identify particular,” Ihor Dusaniwsky, managing director of predictive analytics at S3, stated in a Friday report.

A number of analysts protecting the corporate downgraded rankings and bargain targets over the weekend, additional weighing on shares Monday.

“We discover it troublesome to inform buyers that they should purchase CRWD proper now,” Guggenheim analysts led by John DiFucci wrote in a word dated July 21, downgrading shares to impartial from purchase citing doable resistance to new offers within the near-term following the outage.

Whereas DiFucci eliminated his $424 worth goal on CrowdStrike shares, he stated he believes “that the corporate will ultimately develop into even stronger on account of this incident, and if buyers have a multi-year horizon, they will journey it out.”

Analysts at Scotiabank minimize shares to sector carry out from outperform, calling the outage a “black mark on a beforehand unblemished document.” In addition they minimize their worth goal to $300 from $393.

The incident provides to uncertainty forward of the corporate’s second quarter earnings, anticipated on the finish of August.

“CrowdStrike deserves a top-tier a number of, however we see the chance/reward as extra balanced at these ranges,” Scotiabank analysts led by Patrick Colville wrote in a Monday word.

Regardless of the worldwide IT debacle, Wall Road stays largely bullish on the corporate, which has 41 purchase rankings, eight holds and two sells. The typical analyst worth goal of round $390 a share represents a greater than 40% upside from the place the inventory at the moment trades. CrowdStrike shares are nonetheless up about 7% this yr even after the selloff.

Most Learn from Bloomberg Businessweek

©2024 Bloomberg L.P.

[ad_2]

Source