Why I Lastly Threw within the Towel and Bought This Extremely-Excessive-Yield Dividend Inventory

Passive earnings is certainly one of my passions. My high monetary purpose is to develop my passive earnings to the purpose the place it will possibly cowl my recurring bills. I nonetheless have a solution to go, which is why I am normally including to my passive earnings sources, not subtracting from them.

Nonetheless, I just lately closed my place in Annaly Capital Administration (NYSE: NLY), which I’ve owned for a few years. The primary draw was its profitable dividend, which yields almost 13%, nearly 10 occasions greater than the S&P 500. This is why I lastly threw within the towel and bought the high-yielding dividend stock.

The dividend will most likely proceed heading down

Annaly Capital Administration was one of many first actual property funding trusts (REITs) I ever purchased. I’ve held these preliminary shares all the time. Whereas I’ve added to my place a couple of occasions over time, I have never purchased extra shares in over a decade. As an alternative, I’ve simply sat again and picked up the dividend earnings.

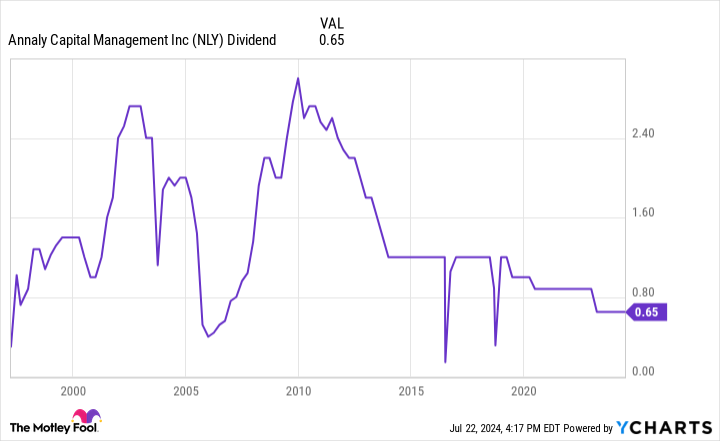

Sadly, that earnings stream has steadily fallen over time because the mortgage REIT lowered its payout:

I’ve avoided promoting as a result of the earnings stream was nonetheless first rate sufficient. Moreover, given the decline within the inventory value over time, it might be onerous to seek out another that would generate the identical degree of earnings as I presently earn.

Nonetheless, I’ve determined to throw within the towel in spite of everything these years. One of many largest elements driving that call is the probability that Annaly’s dividend will proceed falling.

Annaly’s current dividend payment is $0.65 per share every quarter, or $2.60 yearly. That compares with the corporate’s $0.64-per-share earnings obtainable for distribution within the first quarter. The REIT’s earnings have been in a gradual decline. They had been $0.81 per share in final 12 months’s first quarter and averaged over $1.00 per share in 2022. The decline from that degree led Annaly to chop its dividend from $0.88 per share on the finish of 2022 to its present degree in early 2023. Whereas the REIT believed it might earn sufficient to cowl its dividend this 12 months, it appears more and more seemingly that one other minimize is within the playing cards. My earnings from this place is more likely to hold falling.

Excessive yield, low return

My funding technique has advanced over time. Whereas I’ve at all times preferred accumulating dividend earnings, I’ve come to the customarily painful realization {that a} excessive dividend yield is not as enticing because it appears. Most of the high-yield dividend shares I purchased over time have minimize or lowered their dividends. These reductions have acted as a headwind to my purpose of ultimately producing sufficient passive earnings to cowl my bills.

Along with falling dividend funds, these shares have additionally tended to have falling share costs. My Annaly Capital funding has misplaced about two-thirds of its worth over time. Whereas the outsized dividend funds have helped offset a few of this decline, the general complete returns had been lackluster. For instance, my preliminary Annaly Capital buy delivered solely a 7.1% annualized return. That compares with a ten.6% return for the S&P 500 throughout that interval.

That efficiency aligns with the general information on dividend shares. In keeping with information from Ned Davis Analysis and Hartford Funds, firms that ship flat or falling dividends have underperformed the market over time. Corporations with no change of their dividend coverage have delivered a 6.7% annualized complete return over the past 50 years, whereas the return of cutters and eliminators is negative-0.6%. That compares with a 7.7% annualized return for an equal-weight S&P 500 index. However, firms that develop their dividends have considerably outperformed, with a ten.2% annualized complete return.

That information, together with my observations, has pushed me to shift my focus away from a inventory’s dividend yield to the corporate’s means to develop its payout. I’ve began promoting positions the place dividend progress is unlikely, like Annaly, to redeploy the proceeds into firms that ought to have the ability to enhance their payouts sooner or later. Whereas this may trigger a near-term hit to my passive earnings, I count on it to develop sooner sooner or later as I profit from rising dividends and my continued buy of extra shares of dividend progress shares. These twin progress drivers ought to assist me attain my passive earnings purpose sooner.

An overdue sale

I had held on to Annaly Capital for much too lengthy. Whereas the mortgage REIT nonetheless provided me with a significant quantity of dividend earnings, the funds have fallen over time. That downward development appeared seemingly to proceed. That is why I am falling by the wayside and promoting. I plan to redeploy the proceeds into firms that may pay a rising dividend, which ought to improve my earnings and returns over the long run.

Do you have to make investments $1,000 in Annaly Capital Administration proper now?

Before you purchase inventory in Annaly Capital Administration, think about this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they consider are the 10 best stocks for traders to purchase now… and Annaly Capital Administration wasn’t certainly one of them. The ten shares that made the minimize might produce monster returns within the coming years.

Think about when Nvidia made this record on April 15, 2005… in the event you invested $1,000 on the time of our suggestion, you’d have $751,180!*

Inventory Advisor supplies traders with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of July 22, 2024

Matt DiLallo has no place in any of the shares talked about. The Motley Idiot has no place in any of the shares talked about. The Motley Idiot has a disclosure policy.

Why I Finally Threw in the Towel and Sold This Ultra-High-Yield Dividend Stock was initially printed by The Motley Idiot