Which Broken Chip Inventory Is the Greatest Purchase?

[ad_1]

It didn’t take lengthy for AI chip shares (like ASML, AMD, and MU) to fall so drastically out of favor, with a few of this 12 months’s greatest winners now on the receiving finish. As demand for AI chips marches forward, with or with out the shares of the highest AI chip performs, contrarians might have top-of-the-line probabilities to purchase the dip since this AI inventory rally started greater than a 12 months in the past.

Certainly, shopping for into one of many worst sector-based sell-offs in current reminiscence is rarely going to be simple. Nonetheless, when you had been bullish on AI a month in the past, when AI shares melted up, try to be much more bullish right now now that costs have come down whereas analyst suggestions and value targets have stayed largely unchanged.

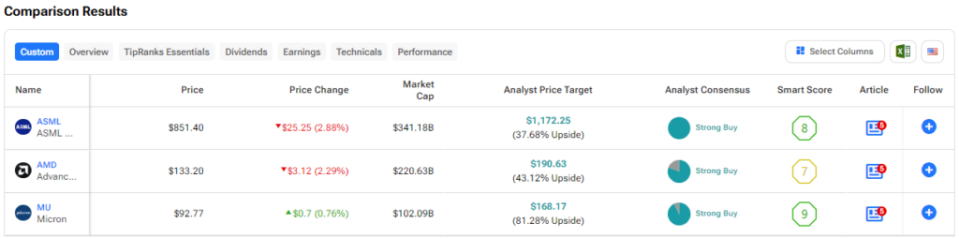

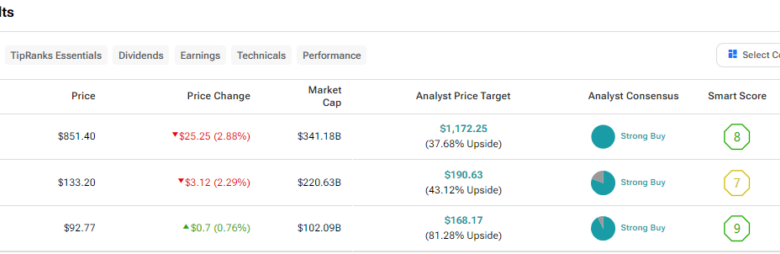

Subsequently, let’s use TipRanks’ Comparison Tool to see where analysts stand on the next broken chip shares.

ASML is a European semiconductor gear maker that simply tanked 23% from its peak hit lower than one month in the past. It’s been a sudden plunge, and whereas there could also be a “double-top” technical sample within the works, some analysts, like Georges Debbas of BNP Paribas, view ASML inventory not simply as an excellent dip purchase however as one in all his agency’s “high AI calls.” If that’s not a vote of confidence amid a turbulent flip, I don’t know what’s. With so many analysts standing by the photolithography machine producer, I’m inclined to stay bullish.

Decrease a number of apart, ASML stands out as an excellent stronger firm than it was when shares had been buying and selling within the quadruple digits. Lately, ASML inventory caught a bid increased because it made “breakthroughs” with a brand new chip-printing system created in collaboration with a European nanoelectronics group named imec.

The Excessive Numerical Aperture (excessive NA) Excessive Ultraviolet (EUV) lithography machine (sure, that’s a mouthful) can reportedly make smaller higher-performance chips. Relating to chips, it’s both about shrinking the shape issue, growing velocity, lowering energy consumption, or lowering prices of manufacturing. The brand new machine appears to be making progress on all fronts.

In gentle of the brand new innovation, I discover present ranges to be an excellent entry level for buyers looking for a cut price amid the extreme promoting. At 40 instances ahead price-to-earnings (P/E), ASML inventory can be less expensive than it was on the finish of Q1 and Q2, when it had multiples of 45 and 46 instances, respectively.

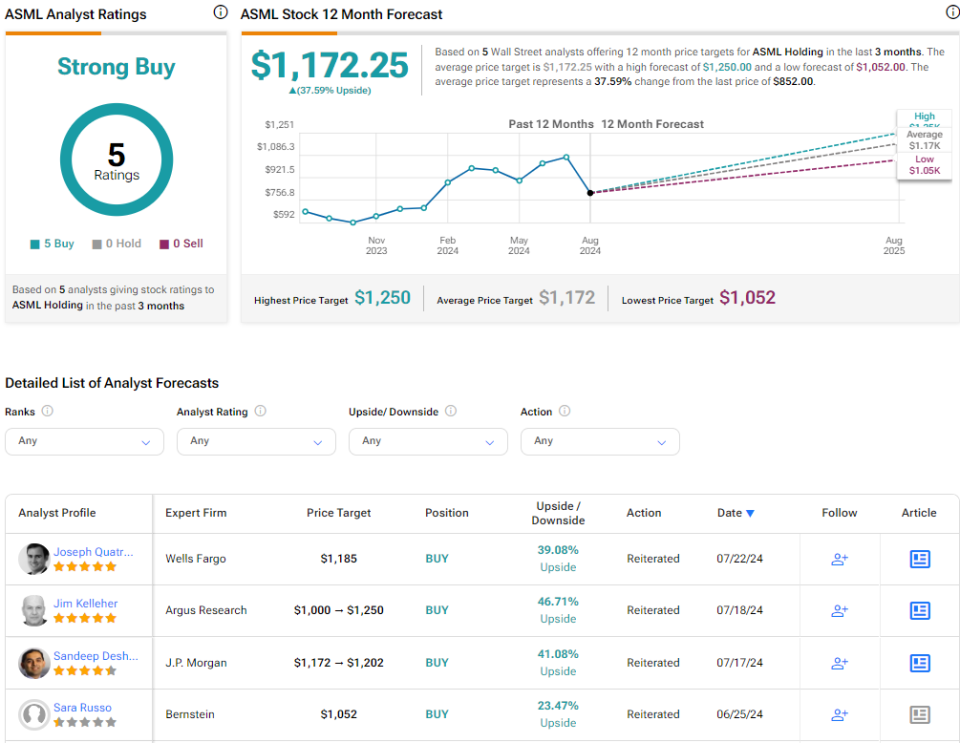

What Is the Worth Goal for ASML Inventory?

ASML inventory is a Robust Purchase, in line with analysts, with 5 unanimous Buys assigned prior to now three months. The average ASML stock price target of $1,172.25 implies 37.6% upside potential.

Superior Micro Gadgets (AMD)

CPU and GPU maker AMD has been rolling over once more, now down 41% from its all-time excessive hit again in March 2024. Undoubtedly, there’s a little bit of unease since that brutal Intel (INTC) quarter sent shivers down the spines of chip inventory buyers. As AMD finds the best steadiness between efficiency and affordability, I’m inclined to remain bullish on the inventory because it appears to be like to nibble away at Intel’s lunch.

Piper Sandler appears to suppose Intel’s loss may very well be AMD’s achieve. Undoubtedly, Intel’s mass layoff may set again innovation fairly a bit. In the meantime, AMD nonetheless appears to be like as hungry as ever because it readies for its personal next-generation line of choices.

Moreover, current Blackwell manufacturing delays (of round three months) over at Nvidia (NVDA) may additionally enable AMD an opportunity to swoop in. The Intuition MI325X GPU, specifically, may be capable of give Nvidia a greater run for its cash.

In gentle of current setbacks of business rivals, AMD has arguably by no means seemed this good. At 41% cheaper than the place it was at its peak, maybe AMD inventory is likely one of the greatest bargains to choose up as tech tumbles. At the moment, the Road-high value goal of $250 per share entails a large 88% achieve from right here.

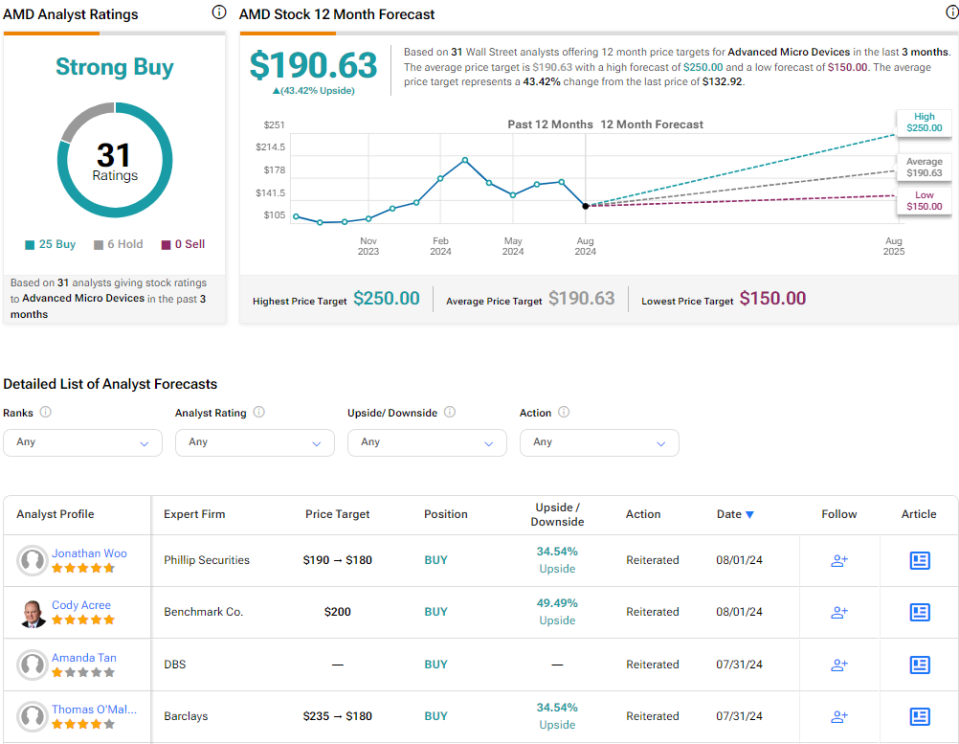

What Is the Worth Goal for AMD Inventory?

AMD inventory is a Robust Purchase, in line with analysts, with 25 Buys and 6 Holds assigned prior to now three months. The average AMD stock price target of $190.63 implies 43.4% upside potential.

Lastly, we’ve got reminiscence chip maker Micron, which has the best implied upside of the names on this piece (at the moment at 82%). Regardless of crashing greater than 40% in a matter of weeks, analysts don’t appear to be operating for the hills like buyers. With its share repurchase program recently resumed and Ninth-generation (G9) NAND chips going out, I’m not about to show any much less bullish on the title.

Undoubtedly, high-performance reminiscence chips will nonetheless be in excessive demand if the AI growth is to hold on. The corporate’s newest G9 NANDs are reportedly “73% denser” than the competitors, no less than in line with Scott DeBoer, EVP of Know-how and Merchandise at Micron. Certainly, the brand new G9 providing units the bar that a lot increased in a market that’s more and more leaning towards high-bandwidth choices to feed AI wants.

With sturdy free cash flow (FCF) generation of $425 million within the final quarter and the foot on the innovation pedal, the most recent inventory value implosion appears extra like a present for buyers who missed the year-to-date run. After such a pummelling, shares of MU are up just 9% year-to-date.

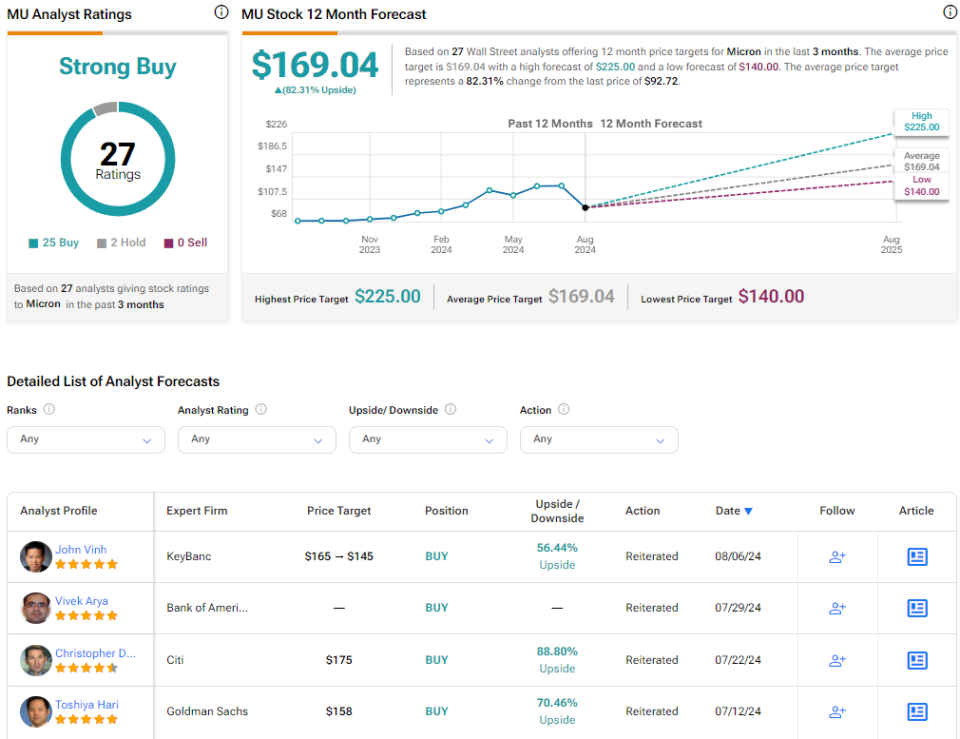

What Is the Worth Goal for MU Inventory?

MU inventory is a Robust Purchase, in line with analysts, with 25 Buys and two Holds assigned prior to now three months. The average MU stock price target of $169.04 implies 82.3% upside potential.

The Takeaway

The chip business is underneath strain, and it doesn’t look like the most recent AI improvements are sufficient to reignite enthusiasm. Regardless, the next three names appear value sticking with as their narratives inform a far totally different story than current motion of their shares.

Whether or not we’re speaking about ASML and its newest breakthrough chip-printing system, AMD’s alternative to realize share as its rivals face setbacks, or Micron and its newest and biggest G9 NAND chips, every agency has so much going for it. It’s simply that buyers don’t appear to care as a lot anymore when shares are in correction mode.

Of the three names, analysts see MU inventory as having probably the most room to run, with 82% in implied year-ahead upside. And if downgrades don’t begin flowing in quickly (I see no motive for them to), MU inventory might show to be a steal.

[ad_2]

Source