Coca-Cola Inventory Soars to a New Peak. Here is Why I am Doubling Down.

[ad_1]

It has been a tough previous few weeks for traders. Though shares are up from final week’s low, the S&P 500 continues to be down fairly a bit from July’s peak. It is also doable that the market might make a decrease low earlier than all is alleged and accomplished.

Not each ticker is on the defensive, although. A handful of shares are at or close to report highs, as a result of traders perceive these few names provide one thing that almost all different shares do not proper now — relative security — and so people are submitting into such firms simply in case the current market weak spot is an omen.

Coca-Cola (NYSE: KO) is one in all these names. And I am shopping for extra of it regardless of the current run-up. Here is why you may need to do the identical.

Coca-Cola is the epitome of resilience

Coca-Cola is the world’s best-known beverage producer. In addition to its namesake tender drink, it owns manufacturers like Minute Maid juice, Gold Peak tea, Dasani water, and Powerade sports activities drink to call a number of.

However it is not fairly the corporate you may suppose it’s. Though it used to do quite a lot of its personal bottling, it has been more and more delegating this to third-party bottlers that purchase flavored syrups from Coca-Cola itself. Whereas this finally means much less income, it additionally means higher-margin income. Most essential, this shift has freed up the corporate to concentrate on doing what it does finest. That is advertising and marketing.

However why is the inventory rallying to report highs when most others are on the defensive? And greater than that, can this uptrend final?

The reply to the primary query: We may be getting into a interval of financial lethargy that truly works within the firm’s favor.

The nation’s unemployment fee is beginning to inch increased, and on a worldwide foundation, the Worldwide Financial Fund is dialing again its expectations for near-term financial progress.

Customers, nevertheless, are unlikely to surrender their favourite drinks simply because money could be getting tighter. In truth, it is debatable that individuals will decide to take pleasure in these easier, lower-cost treats extra than they usually may in the event that they’re not spending on bigger-ticket purchases. (For perspective, regardless of 2008’s subprime-mortgage meltdown and subsequent recession, Coca-Cola loved an 11% enchancment in income on a 5% improve in quantity.)

As for the second query, sure, there’s room and motive to anticipate extra progress from this inventory even when we see a bit profit-taking from right here. It’s nonetheless a bit under the analysts’ common value goal of $70.73. Most of those analysts additionally nonetheless fee it as a powerful purchase.

That is nonetheless not the chief motive I am doubling down on Coca-Cola presently, although.

An excellent time to develop into income-minded

There’s by no means a foul time to personal Coca-Cola. It is a model customers know and love, and administration additionally clearly is aware of the beverage enterprise. If nothing else, it is not prone to do your long-term portfolio any hurt.

My curiosity proper now could be much more particular, although. In anticipation of the aforementioned financial headwind, I am seeking to beef up my publicity to dividend-paying shares. There may be none higher than shares of Coca-Cola.

The forward-looking dividend yield of two.8% is not precisely a showstopper; yow will discover increased yields with different holdings. You will not discover a higher-yielding choose that is as dependable, although, or with a comparable threat profile. The inventory’s beta, which measures volatility, is about as little as they arrive at 0.59 (the decrease this quantity, the decrease the volatility).

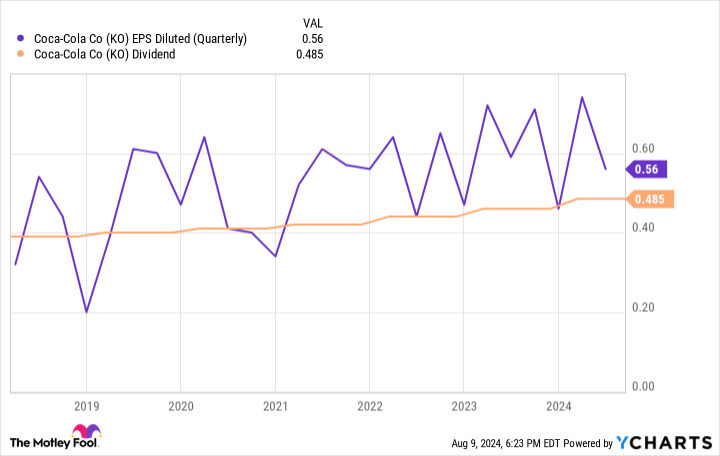

Customers’ model loyalty even when instances get powerful means they are going to maintain shopping for Coke, Minute Maid, Gold Peak, and many others., and the corporate will proceed turning about one-fourth of its income right into a web revenue. In flip, it would proceed incomes greater than sufficient to totally fund its future dividends. Of the $2.79 per share Coke earned over the previous 4 quarters, solely $1.91 of it was consumed by dividend funds. That is a snug margin.

The kicker: Coca-Cola is not only a regular dividend grower, it has raised its annual dividend for 62 consecutive years. It isn’t prone to let that streak be damaged now.

You also needs to know that I am not essentially going to reinvest these dividends in additional shares of Coca-Cola. I would as a substitute construct up an even bigger stash of money so I can buy groceries within the occasion of a extra severe pullback.

It seals the deal

Am I overpreparing for an economic system which may by no means take form? Probably. However I would reasonably play pointless protection with a high quality firm like Coca-Cola than follow an excessive amount of aggressive stuff and find yourself regretting it. Danger-management is a crucial a part of being a profitable investor, in any case.

There’s additionally the easier bullish argument that Coca-Cola is a high quality holding whatever the previous or future backdrop. It has a long-term report of income and earnings progress that mirrors its dividend historical past.

So I would say do not overthink this one, and do not sweat the inventory’s current excessive bullishness. Nice shares have a humorous approach of logging beneficial properties that do not appear doable on the time.

Do you have to make investments $1,000 in Coca-Cola proper now?

Before you purchase inventory in Coca-Cola, contemplate this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they consider are the 10 best stocks for traders to purchase now… and Coca-Cola wasn’t one in all them. The ten shares that made the minimize might produce monster returns within the coming years.

Contemplate when Nvidia made this listing on April 15, 2005… if you happen to invested $1,000 on the time of our suggestion, you’d have $641,864!*

Inventory Advisor supplies traders with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of August 12, 2024

James Brumley has positions in Coca-Cola. The Motley Idiot has no place in any of the shares talked about. The Motley Idiot has a disclosure policy.

Coca-Cola Stock Soars to a New Peak. Here’s Why I’m Doubling Down. was initially printed by The Motley Idiot

[ad_2]

Source