3 Dependable Dividend Shares Yielding Up To eight.7%

Within the present local weather of market volatility and financial uncertainty, traders are looking for stability and dependable revenue streams. Dividend shares, identified for his or her constant payouts, can supply a reliable supply of returns even when markets fluctuate.

High 10 Dividend Shares

|

Title |

Dividend Yield |

Dividend Ranking |

|

Tsubakimoto Chain (TSE:6371) |

4.04% |

★★★★★★ |

|

Allianz (XTRA:ALV) |

5.33% |

★★★★★★ |

|

Enterprise Mind Showa-Ota (TSE:9658) |

4.00% |

★★★★★★ |

|

Warranty Belief Holding (NGSE:GTCO) |

7.03% |

★★★★★★ |

|

Huntington Bancshares (NasdaqGS:HBAN) |

4.60% |

★★★★★★ |

|

China South Publishing & Media Group (SHSE:601098) |

4.25% |

★★★★★★ |

|

Premier Monetary (NasdaqGS:PFC) |

5.39% |

★★★★★★ |

|

KurimotoLtd (TSE:5602) |

5.12% |

★★★★★★ |

|

James Latham (AIM:LTHM) |

5.85% |

★★★★★★ |

|

Banque Cantonale Vaudoise (SWX:BCVN) |

4.63% |

★★★★★★ |

Click here to see the full list of 2082 stocks from our Top Dividend Stocks screener.

Right here we spotlight a subset of our most popular shares from the screener.

Merely Wall St Dividend Ranking: ★★★★★☆

Overview: Banco Macro S.A. gives a variety of banking services and products to retail and company clients in Argentina, with a market cap of ARS4.34 trillion.

Operations: Banco Macro S.A. generates ARS3.81 billion in income from its banking enterprise section, serving each retail and company purchasers in Argentina.

Dividend Yield: 8.8%

Banco Macro’s dividend yield of 8.76% ranks within the prime 25% of Argentine market payers, supported by a low payout ratio of 48.7%, indicating sustainability. Regardless of current earnings development and good relative worth, its dividend historical past is marked by volatility and unreliability over the previous decade. Latest affirmations affirm continued money dividends with notable payouts scheduled by July 2024, although future earnings are forecasted to say no barely over the following three years.

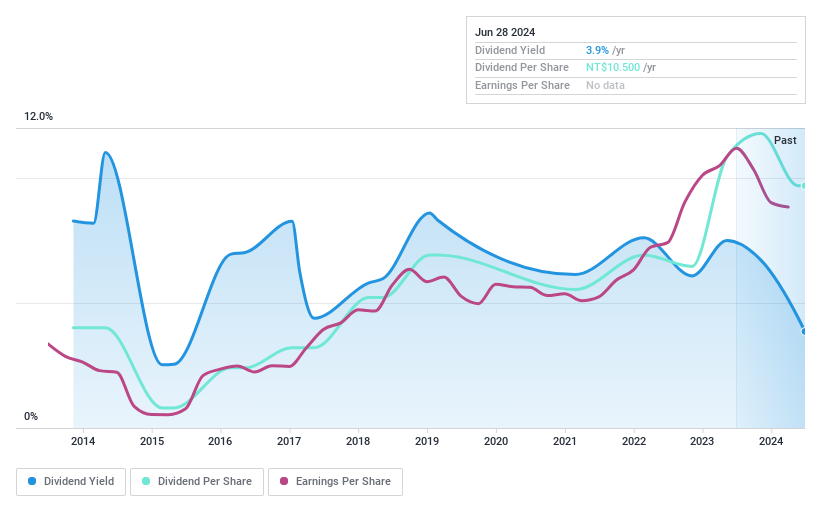

Merely Wall St Dividend Ranking: ★★★★☆☆

Overview: Acter Group Company Restricted gives engineering companies throughout Taiwan, Mainland China, and different Asian nations with a market cap of NT$34.74 billion.

Operations: Acter Group Company Restricted’s income segments are derived from engineering companies supplied in Taiwan, Mainland China, and different Asian nations.

Dividend Yield: 3.7%

Acter Group’s dividend funds are properly coated by earnings (payout ratio: 35.5%) and money flows (money payout ratio: 38.8%), indicating sustainability regardless of a risky dividend historical past over the previous decade. Latest information features a confirmed money dividend of TWD 744.49 million for H2 2023, payable on July 26, 2024. Moreover, Acter Group is buying and selling at a big low cost to its estimated truthful worth, enhancing its enchantment for value-focused traders.

Merely Wall St Dividend Ranking: ★★★★☆☆

Overview: Ferrotec Holdings Company operates in semiconductor equipment-related and digital system companies each in Japan and internationally, with a market cap of ¥102.08 billion.

Operations: Ferrotec Holdings Company’s income segments embody ¥67.60 billion from digital gadgets and ¥130.07 billion from semiconductor equipment-related enterprise.

Dividend Yield: 4.2%

Ferrotec Holdings’ dividend yield of 4.17% is among the many prime 25% within the JP market, however its funds have been risky over the previous decade. Whereas dividends are properly coated by earnings (payout ratio: 31%), they aren’t supported by free money flows, elevating issues about sustainability. The corporate’s valuation seems engaging with a P/E ratio of seven.4x in comparison with the market’s 13x, although current revenue margins have declined from final yr’s figures.

Seize The Alternative

Considering Different Methods?

This text by Merely Wall St is normal in nature. We offer commentary primarily based on historic knowledge and analyst forecasts solely utilizing an unbiased methodology and our articles aren’t meant to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your targets, or your monetary state of affairs. We goal to deliver you long-term centered evaluation pushed by basic knowledge. Word that our evaluation could not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.

Corporations mentioned on this article embody BASE:BMA TPEX:5536 and TSE:6890.

Have suggestions on this text? Involved concerning the content material? Get in touch with us instantly. Alternatively, e-mail editorial-team@simplywallst.com