Traders who’ve held Ithaca Vitality (LON:ITH) during the last yr have watched its earnings decline together with their funding

Whereas it is probably not sufficient for some shareholders, we expect it’s good to see the Ithaca Vitality plc (LON:ITH) share worth up 11% in a single quarter. However in fact the final yr hasn’t been good for the share worth. The truth is the inventory is down 17% within the final yr, properly under the market return.

The current uptick of 5.9% could possibly be a optimistic signal of issues to come back, so let’s check out historic fundamentals.

View our latest analysis for Ithaca Energy

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share costs don’t at all times rationally mirror the worth of a enterprise. One imperfect however easy solution to take into account how the market notion of an organization has shifted is to check the change within the earnings per share (EPS) with the share worth motion.

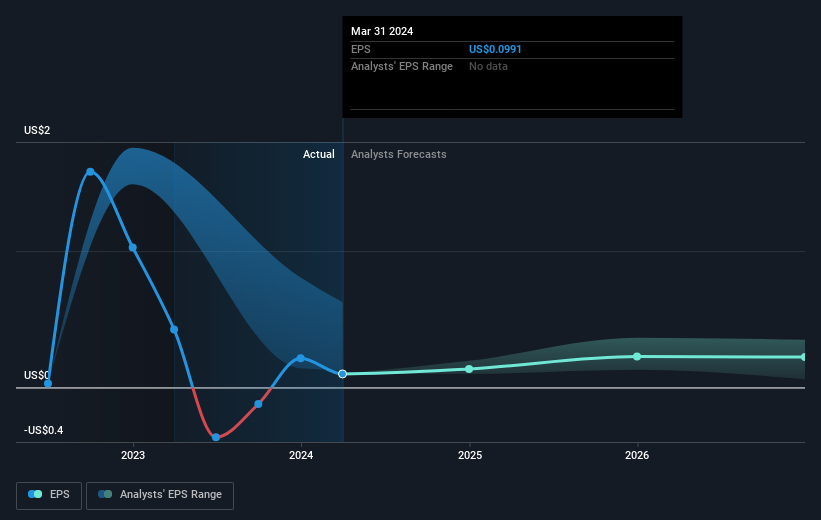

Ithaca Vitality managed to extend earnings per share from a loss to a revenue, during the last 12 months.

The end result seems to be like a robust enchancment to us, so we’re shocked the market has offered down the shares. If the improved profitability is an indication of issues to come back, then proper now might show the right time to pop this inventory in your watchlist.

The corporate’s earnings per share (over time) is depicted within the picture under (click on to see the precise numbers).

It is most likely price noting that the CEO is paid lower than the median at related sized corporations. It is at all times price maintaining a tally of CEO pay, however a extra essential query is whether or not the corporate will develop earnings all through the years. Earlier than shopping for or promoting a inventory, we at all times advocate a detailed examination of historic growth trends, available here..

What About Dividends?

You will need to take into account the whole shareholder return, in addition to the share worth return, for any given inventory. The TSR incorporates the worth of any spin-offs or discounted capital raisings, together with any dividends, based mostly on the idea that the dividends are reinvested. Arguably, the TSR offers a extra complete image of the return generated by a inventory. Within the case of Ithaca Vitality, it has a TSR of -4.1% for the final 1 yr. That exceeds its share worth return that we beforehand talked about. And there is not any prize for guessing that the dividend funds largely clarify the divergence!

A Completely different Perspective

On condition that the market gained 18% within the final yr, Ithaca Vitality shareholders is perhaps miffed that they misplaced 4.1% (even together with dividends). Whereas the intention is to do higher than that, it is price recalling that even nice long-term investments generally underperform for a yr or extra. It is nice to see a pleasant little 11% rebound within the final three months. Let’s simply hope this is not the widely-feared ‘lifeless cat bounce’ (which might point out additional declines to come back). It is at all times fascinating to trace share worth efficiency over the long run. However to grasp Ithaca Vitality higher, we have to take into account many different components. Contemplate dangers, as an example. Each firm has them, and we have noticed 3 warning signs for Ithaca Energy it’s best to learn about.

In fact, you may discover a implausible funding by trying elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please observe, the market returns quoted on this article mirror the market weighted common returns of shares that presently commerce on British exchanges.

Have suggestions on this text? Involved concerning the content material? Get in contact with us immediately. Alternatively, e-mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is basic in nature. We offer commentary based mostly on historic information and analyst forecasts solely utilizing an unbiased methodology and our articles usually are not meant to be monetary recommendation. It doesn’t represent a suggestion to purchase or promote any inventory, and doesn’t take account of your goals, or your monetary state of affairs. We intention to convey you long-term centered evaluation pushed by elementary information. Observe that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.