AMD simply spent $4.9 billion to purchase hyperscale server maker ZT Methods

In a nutshell: One of many methods AMD goals to problem Nvidia’s dominance is by increasing its programs choices, and this week it made a major stride towards that purpose with an settlement to buy ZT Methods. The acquisition is a key a part of AMD’s technique to seize a bigger share of the AI information heart market. However it stays to be seen whether or not this deal will considerably shut the hole between AMD and Nvidia when it comes to market share and technological capabilities.

AMD has agreed to acquire ZT Methods, an AI infrastructure firm, for $4.9 billion in a money and inventory transaction. This acquisition is a strategic transfer by AMD to bolster its capabilities within the AI sector and instantly compete with Nvidia.

ZT Methods, identified for constructing customized computing infrastructure for main AI hyperscalers like Microsoft, Meta, and Amazon, will allow AMD to supply end-to-end programs options.

“Combining our high-performance Intuition AI accelerator, EPYC CPU, and networking product portfolios with ZT Methods’ industry-leading information heart programs experience will allow AMD to ship end-to-end information heart AI infrastructure at scale with our ecosystem of OEM and ODM companions,” mentioned AMD’s chief government Lisa Su. She described the acquisition because the third leg of a stool that consists of AMD’s silicon and software program options, explaining to CNBC that including the programs options piece “actually wraps all of it collectively.”

Nvidia’s success within the AI sector is partly attributable to its system-level method, which incorporates not solely GPUs but in addition complete infrastructure options reminiscent of server racks, networking tools, and software program instruments. To compete, AMD plans to combine ZT Methods into its information heart enterprise by 2025, pending regulatory approval.

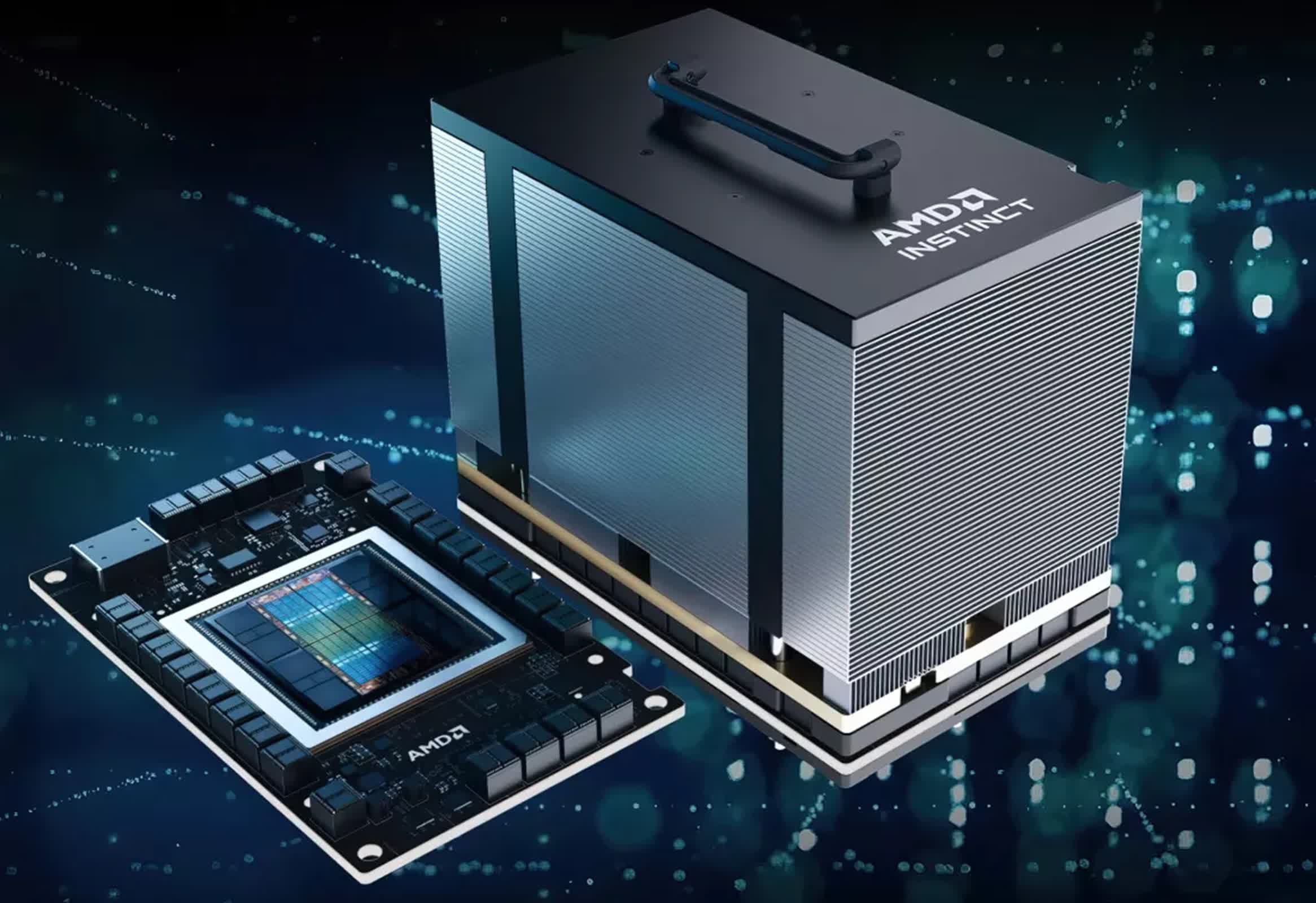

AMD’s efforts to increase its “programs” choices have been ongoing, together with the introduction of its MI300 AI chips final 12 months. These chips are set to be adopted by the MI350 chips in 2025, aiming to compete with Nvidia’s upcoming Blackwell GPUs.

The chips have seen some success: In Might, Microsoft turned one of many first main AI firms to incorporate the MI300 into its Azure cloud platform, utilizing it to energy AI fashions like OpenAI’s GPT-4. And for the primary time, AMD’s income from these chips exceeded $1 billion within the quarter ending June 30. Nonetheless, AMD’s information heart income stays considerably smaller than Nvidia’s, which reached $22.6 billion within the quarter ending in April.

The acquisition of ZT Methods is AMD’s largest since its $35 billion buy of Xilinx in 2022. That acquisition was a strategic transfer to reinforce AMD’s capabilities in high-performance and adaptive computing, permitting the corporate to increase its product choices to incorporate FPGAs, Adaptive SoCs, and AI engines, complementing its present CPUs and GPUs.

Since then, AMD has centered its acquisition technique on constructing out its AI capabilities. In July, it introduced the purchase of Finnish AI startup Silo AI, which introduced substantial AI experience to the corporate, together with over 300 AI consultants and 125 Ph.D. holders. This infusion of expertise is essential for AMD, which has been lagging behind Nvidia when it comes to AI abilities and expertise.

Along with Silo AI, AMD has acquired Nod.ai and Mipsology to strengthen its AI software program ecosystem. Nod.ai supplies important instruments, libraries, and fashions for AI growth, whereas Mipsology gives AI inference and optimization options tailor-made for AMD {hardware}.