Revised labor information ‘underscores’ Fed’s want to chop: Strategist

[ad_1]

US equities (^GSPC, ^DJI, ^IXIC) closed larger on Wednesday, with a number of mega-cap shares regaining a lot of what they misplaced within the latest sell-off. Can the markets proceed to climb again to their all-time highs or will the Federal Reserve throw a monkey wrench into features?

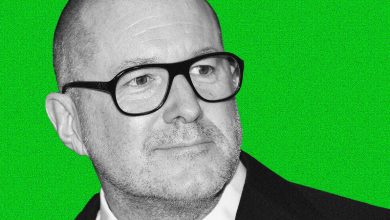

State road world advisors world chief funding officer Lori Heinel joins Market Domination Time beyond regulation to provide perception into the present market actions and what buyers can anticipate shifting ahead.

The US Labor Division revealed that, for the 12 months via March 2024, 818,000 fewer jobs have been created than anticipated. Heinel argues the information “underscores the Fed’s have to act,” saying she expects a 25 foundation level reduce in September.

By way of how the Fed will proceed to function after September: “They’ve to stay information dependent. That is been the best way that this Fed has operated below the Powell administration actually for the reason that inception. So for them to desert that might create different challenges for market members.”

Heindel advises purchasers: “We nonetheless are a bit of chubby on equities as a result of we do assume that there is a bit extra room to run right here, however we expect that we’ll see extra breadth out there. And we did see earnings are available, away from the Magazine Seven, being optimistic for the primary time in lots of, many quarters. In order that was a constructive signal. If the Fed does take this measured motion towards lowering charges, we expect that the delicate touchdown state of affairs is unbroken. And that provides us extra confidence.”

For extra knowledgeable perception and the most recent market motion, click on here to observe this full episode of Market Domination Time beyond regulation.

This put up was written by Nicholas Jacobino

[ad_2]

Source