3 Shares That May Flip $1,000 Into $5,000 by 2030

Most buyers perceive the significance of endurance with regards to shopping for and holding shares. Investing is not a dash, in any case, it is a marathon. It is received by the gang able to preserving the larger image in thoughts when short-term noise turns downright distracting.

Nonetheless, in case you can rating some sizable features in a comparatively quick interval with out taking up an excessive amount of danger, that is not a nasty factor.

This is a more in-depth have a look at three inventory prospects with the potential to show a $1,000 funding now into $5,000 come 2030.

1. DraftKings

Provided that greater than two-thirds of states now permit sports activities betting of some kind because the federal ban on such playing was lifted in 2018, it could be simple to conclude DraftKings‘ (NASDAQ: DKNG) highest-growth section is within the rearview mirror. Ditto for DraftKings inventory.

That is unlikely, nevertheless.

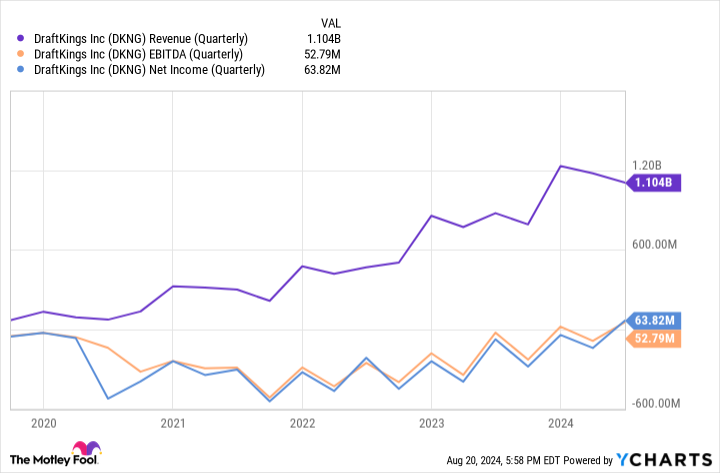

See, not solely have states solely staggered into the legalization camp since 2018, however it additionally takes a while for the sports activities betting trade to completely mature in a selected market as soon as DraftKings units up store. Within the states the place the corporate first supplied entry to its sports activities betting app 4 years in the past, actually, the corporate’s nonetheless seeing stable annual income progress. Profitability additionally continues to enhance the longer DraftKings operates in a selected market.

And it is price including that two of the states which have but to legalize sports-based wagering are huge Texas and California, that are collectively house to greater than 20% of the nation’s inhabitants. Legalization proponents have a harder row to hoe there, however it will likely be nicely well worth the effort if and when it lastly occurs in these two states.

Then there’s the abroad alternative. Whereas CEO Jason Robins is not planning a critical worldwide growth at the moment, it is all the time a chance price contemplating. Straits Analysis believes the worldwide on-line sports activities betting market is about to develop at an annualized tempo of 11.2% by means of 2032.

Then there’s the much less philosophical, less complicated motive DraftKings inventory’s acquired a very good shot at quintupling in worth over the subsequent six years. That’s, shares are now down roughly 26% from their March peak for no discernible good motive. Benefit from this volatility whereas it is working in buyers’ favor.

2. Arm Holdings

When buyers consider synthetic intelligence (AI)-focused expertise shares, names like Nvidia or perhaps C3.ai come to thoughts. The previous manufactures the computing processors present in most AI programs. The latter presents decision-making platforms to the enterprise market. And to be truthful, to date names of this ilk have deserved the extraordinary consideration they have been given.

As we enter the subsequent section of the AI period, nevertheless, the trade’s technological underpinnings are evolving. The chips initially designed for different makes use of are not ideally fitted to next-gen AI purposes. We’d like processors that do not eat huge quantities of electrical energy, processing options which can be versatile sufficient to deal with a variety of synthetic intelligence duties, and low-cost sufficient to stay marketable.

Enter chipmaker Arm Holdings (NASDAQ: ARM).

OK, it is not precisely a chipmaker in the identical sense that Taiwan Semiconductor Manufacturing or Intel are. It is extra correct to categorize Arm as a chip designer after which a licensor of chipmaking mental property. Apple‘s latest AI-capable smartphones and tablets are constructed round processors primarily based on Arm’s structure, for example.

It is not simply Apple although. Arm’s expertise is more and more present in chips from the aforementioned Nvidia, Intel, and Qualcomm simply to call a couple of. It is tough to fabricate a microchip with out not less than some Arm mental property inbuilt.

The kicker: Arm Holdings’ prime line is predicted to soar almost 23% this 12 months (regardless of financial headwinds) earlier than accelerating to a clip of 24% subsequent 12 months. Earnings progress is materializing even sooner. Each are anticipated to proceed rising firmly for not less than the subsequent a number of years, too.

3. Dutch Bros

Lastly, add espresso drive-thru chain Dutch Bros (NYSE: BROS) to your record of shares able to turning $1,000 into $5,000 by 2030.

Some buyers can be fast to level out the problem of penetrating a market that is already dominated by Starbucks. Whereas Dutch Bros was solely working 912 locales as of the top of June, Starbucks boasts a whopping 16,730 shops in the US alone. Starbucks shareholders are additionally excited to know Brian Niccol can be taking the helm as CEO subsequent month. Niccol turned Chipotle Mexican Grill again right into a wholesome progress identify after being named its chief govt in 2018, and Starbucks buyers anticipate an analogous (and much-needed) reinvigoration.

Dutch Bros presents shoppers one thing Starbucks merely cannot although. That is informal authenticity — workers are inspired to make every buyer’s expertise a private one. It is common for a selected kiosk to assist regionally primarily based causes, for instance.

It is a vibe that is working, too, notably with youthful shoppers. That is why same-store gross sales grew one other 4.1% final quarter, with new retailer openings driving the highest line 30% increased on a year-over-year foundation.

It is nonetheless just the start. Chief govt Christine Barone is on board with founders Dane and Travis Boersma’s imaginative and prescient of creating 4,000 Dutch Bros shops throughout the subsequent 10 to fifteen years. That is a tall order to make sure. However, provided that the corporate is already worthwhile and solely modestly indebted, it is actually doable with out placing buyers at critical danger.

Simply do not wait too lengthy in case you’re . Like DraftKings and Arm Holdings, Dutch Bros inventory is seeing a little bit of volatility and is presently down (off 27% from a current excessive), however it’s unlikely to remain that means for very lengthy.

Do you have to make investments $1,000 in Dutch Bros proper now?

Before you purchase inventory in Dutch Bros, take into account this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they imagine are the 10 best stocks for buyers to purchase now… and Dutch Bros wasn’t one in all them. The ten shares that made the reduce may produce monster returns within the coming years.

Take into account when Nvidia made this record on April 15, 2005… in case you invested $1,000 on the time of our advice, you’d have $792,725!*

Inventory Advisor gives buyers with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of August 22, 2024

James Brumley has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Apple, Chipotle Mexican Grill, Nvidia, Qualcomm, Starbucks, and Taiwan Semiconductor Manufacturing. The Motley Idiot recommends C3.ai, Dutch Bros, and Intel and recommends the next choices: lengthy January 2025 $45 calls on Intel, quick August 2024 $35 calls on Intel, and quick September 2024 $52 places on Chipotle Mexican Grill. The Motley Idiot has a disclosure policy.

3 Stocks That Could Turn $1,000 Into $5,000 by 2030 was initially printed by The Motley Idiot