This is Why Nvidia Surpasses AMD because the Optimum Selection for Synthetic Intelligence (AI) Traders

[ad_1]

There is not any doubt about it: AMD (NASDAQ: AMD) has been getting crushed by Nvidia (NASDAQ: NVDA) within the synthetic intelligence (AI) arms race. AMD has been busy attempting to shut the hole, however Nvidia continues to be a lot additional forward.

AMD not too long ago introduced its acquisition of ZT Programs, one other try to shut the hole on Nvidia. Nonetheless, I do not assume AMD is the optimum alternative for buyers, as Nvidia nonetheless has a number of key benefits.

AMD’s acquisition is a great one, however is it too late?

AMD’s $4.9 billion acquisition of ZT Programs will enable it to raised design methods with hundreds of graphics processing models (GPUs). That is key as a result of Nvidia has had a long-standing benefit on this space. By bettering its providing to massive cloud computing corporations and others that need an industry-leading supercomputer devoted to coaching AI fashions, AMD might be able to compete with Nvidia.

Nevertheless, the outlet AMD has to dig itself out of could also be too deep.

Within the second quarter, AMD’s knowledge middle division (the section encompassing the {hardware} most intently related to AI mannequin growth) noticed report income of $2.8 billion, which grew at a 115% 12 months over 12 months. These are unbelievable leads to a vacuum that might thrill most buyers.

However the issue is that these figures pale compared to Nvidia’s.

Within the first quarter of its fiscal 12 months 2025 (ended April 28), Nvidia’s knowledge middle income rose 427% 12 months over 12 months to $22.6 billion. There is not any sugar coating it: AMD is getting smoked by Nvidia, with its knowledge middle enterprise solely a tenth the dimensions of Nvidia’s.

The opposite downside is that as a result of Nvidia has already confirmed its product and established relationships with many purchasers and finish customers, it has constructed itself a little bit of a switching-cost moat. AMD must show its product has higher efficiency than Nvidia’s or supplies a a lot better worth proposition. If it struggles to do this, then Nvidia will proceed consuming AMD’s lunch.

Whereas the ZT Programs acquisition is a step in the suitable route, it is not anticipated to shut till the primary half of 2025, which suggests Nvidia will proceed constructing on its current lead.

This does not bode nicely for AMD buyers, and as of proper now, I see no cause to purchase it over Nvidia’s inventory, particularly when valuation is factored in.

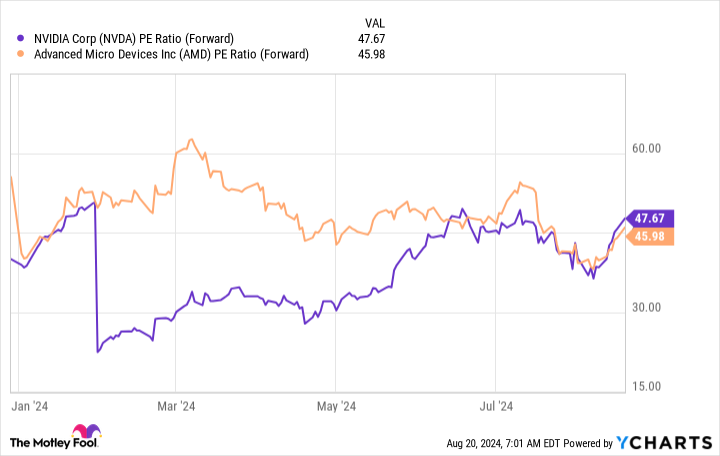

There is not an enormous valuation distinction within the shares proper now

Often, if you see two corporations competing towards one another in the identical {industry} and one is dominating the opposite, it earns the premium price ticket. However that is not the case right here.

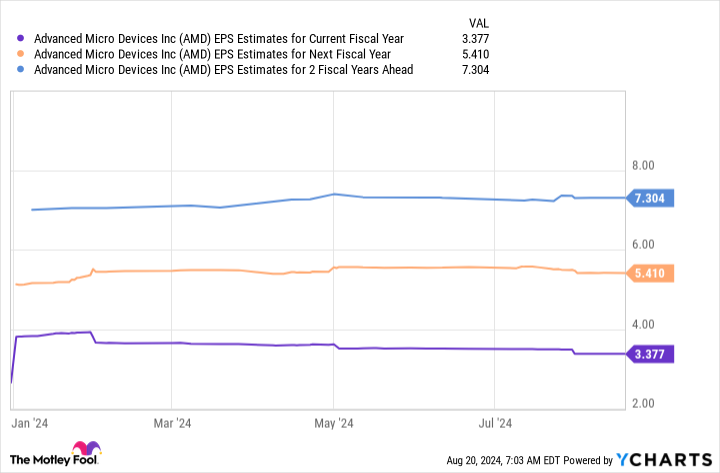

Nvidia and AMD commerce for almost the identical price ticket on a forward price-to-earnings (P/E) basis. A part of it is because AMD’s ancillary companies are in a hunch, and its knowledge middle enterprise hasn’t considerably outgrown its different segments. That is why AMD’s earnings are anticipated to develop considerably over the subsequent few years.

So, in case you contemplate analyst-estimated 2026 earnings, AMD’s inventory is priced at 21 instances ahead earnings. That is an costly price ticket, contemplating you need to wait almost two and a half years to realize it.

The identical evaluation for Nvidia’s inventory yields a two-year ahead P/E of 30.2, which can also be actually costly. Nevertheless, the distinction between AMD and Nvidia is that Nvidia has confirmed that it could generate large development by capturing the biggest clients.

AMD continues to be engaged on that, and it could be a while earlier than it could go toe-to-toe with Nvidia.

Contemplating that each corporations are buying and selling across the similar price ticket, I have to give the nod to Nvidia, as AMD is simply too far behind to warrant an funding, even when it could look cheaper wanting forward two years.

Must you make investments $1,000 in Superior Micro Gadgets proper now?

Before you purchase inventory in Superior Micro Gadgets, contemplate this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they consider are the 10 best stocks for buyers to purchase now… and Superior Micro Gadgets wasn’t certainly one of them. The ten shares that made the lower may produce monster returns within the coming years.

Think about when Nvidia made this listing on April 15, 2005… in case you invested $1,000 on the time of our advice, you’d have $792,725!*

Inventory Advisor supplies buyers with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of August 22, 2024

Keithen Drury has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Superior Micro Gadgets and Nvidia. The Motley Idiot has a disclosure policy.

Here’s Why Nvidia Surpasses AMD as the Optimal Choice for Artificial Intelligence (AI) Investors was initially revealed by The Motley Idiot

[ad_2]

Source