This Hypergrowth House Inventory Will Be Price Extra Than SpaceX In 10 Years

[ad_1]

SpaceX has been a exceptional success during the last 15 years. It introduced the house flight trade in america — actually, all over the world — again to life and impressed loads of copycats alongside the way in which. The age of economic house flight is upon us and set to develop like gangbusters over the following 10 to twenty years. By 2050, the United Nations believes the house economic system might be price $3 trillion.

Trade consultants consider that SpaceX has a de facto monopoly on industrial rocket launches proper now, which is why its valuation has surpassed $200 billion. However that monopoly could also be turning right into a duopoly shortly. Enter Rocket Lab (NASDAQ: RKLB). Began by New Zealand entrepreneur Peter Beck, it’s now the one different firm, together with SpaceX, to reliably and safely carry out rocket launches for industrial clients.

Rocket Lab is rising like gangbusters and just lately hit a $3.5 billion market cap. However the social gathering would possibly simply be getting began. I feel Rocket Lab has an opportunity to be price greater than SpaceX in 10 years and be a house run for traders. Here is why.

Fast development, minimal competitors

Rocket Lab entered the rocket launch market with a small system it calls the Electron. It wanted to assault SpaceX on the edges, offering a nimbler, smaller, and cheaper launch car for purchasers on the lookout for this area of interest. The product has constructed a ton of momentum lately. Actually, it just lately hit 50 launches, making it the quickest commercially developed rocket to succeed in 50 launches in historical past. Development is accelerating, too, with a 100% launch frequency improve from the second half of 2023 to the primary half of 2024.

This momentum has led to loads of latest buyer wins. Yr thus far the corporate has signed 17 new Electron launches, elevated its backlog to over $1 billion, and grew income 71% yr over yr final quarter. The enterprise is buzzing in 2024.

Since SpaceX is concentrated on bigger launches, it’s unlikely to assault Rocket Lab’s place with small industrial launches. And, since no different rocket launch competitor has been capable of persistently carry out launches, Rocket Lab has a monopoly within the small launch market in the intervening time. Not a foul place to be.

Upscaling to bigger launches

The Electron isn’t all Rocket Lab needs to be. It’s at the moment engaged on the Neutron rocket (sense a sample in naming them?), which will likely be a lot bigger than the Electron and might carry round 40 occasions the payload for purchasers. Industrial launches are paid for by weight, which means we may see an enormous improve in income as soon as the Neutron system will get totally operational.

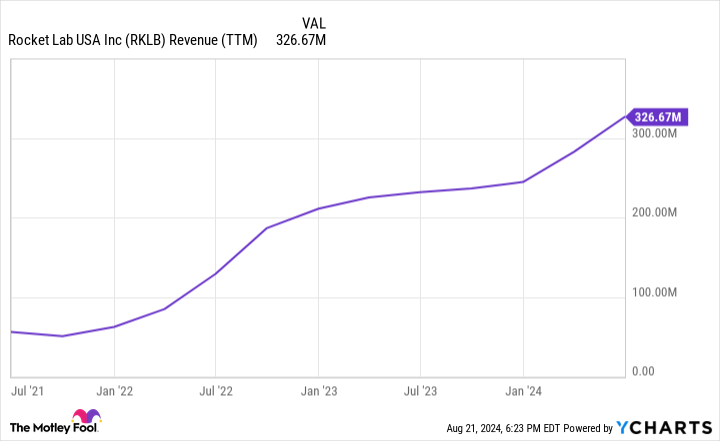

Over the past 12 months, Rocket Lab has generated $327 million in income. Not all of this comes from the Electron launch section (extra on this later), however a very good portion of it does. In keeping with insiders, SpaceX has been capable of cost $5,000 per kilogram or extra on its Falcon9 rocket to clients.

If the Neutron can cost the identical, it’ll generate $65 million in income per launch simply from the payload funds, or 20% of its complete income during the last 12 months. The excellent news is that the Neutron is slated to turn out to be open for industrial clients inside the subsequent few years.

Grand ambitions and a centered chief

Rocket Lab’s subsequent leg of development ought to come from the Neutron system. Nonetheless, it has grander ambitions than simply launching satellites into Earth orbit. The Neutron rocket will likely be able to housing people, which means Rocket Lab may take astronauts to the Moon and even Mars. It already has contracts for unmanned Mars missions with NASA and different U.S. authorities companies.

On prime of rocket launches, Rocket Lab is engaged on constructing and promoting house methods gear to clients. These embody issues like house photo voltaic panels and house capsules for missions.

Over the long term, it hopes to construct up a 3rd leg to its enterprise mannequin with house knowledge and companies. As one of many solely corporations vertically built-in for house launches, it has extraordinarily worthwhile knowledge from orbit. This might be essentially the most worthwhile a part of Rocket Lab’s enterprise mannequin, as software program and knowledge companies include excessive revenue margins.

One other constructive for Rocket Lab is its centered chief. Elon Musk constructed SpaceX, however he owns and operates many different companies together with Tesla, Twitter, and Neuralink. It isn’t a stretch to name him distracted. Rocket Lab’s visionary founder Peter Beck’s sole focus is on constructing this firm, which I consider is a bonus because it tries to interrupt into SpaceX’s monopoly.

It may not seem like it right now, however I feel there’s a good likelihood that Rocket Lab can take its $327 million in income and rework right into a enterprise producing tens of billions of {dollars} in income per yr 10 years from now. Even when it takes longer than 10 years, Rocket Lab has an opportunity of taking its $3.5 billion market worth and finally surpassing SpaceX’s $200 billion valuation.

Spaceflight is way from a low-risk sector, however Rocket Lab appears like a promising development inventory with a ton of potential upside for traders proper now.

Must you make investments $1,000 in Rocket Lab USA proper now?

Before you purchase inventory in Rocket Lab USA, take into account this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they consider are the 10 best stocks for traders to purchase now… and Rocket Lab USA wasn’t one in every of them. The ten shares that made the lower may produce monster returns within the coming years.

Take into account when Nvidia made this listing on April 15, 2005… if you happen to invested $1,000 on the time of our suggestion, you’d have $792,725!*

Inventory Advisor offers traders with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of August 22, 2024

Brett Schafer has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Tesla. The Motley Idiot recommends Rocket Lab USA. The Motley Idiot has a disclosure policy.

Prediction: This Hypergrowth Space Stock Will Be Worth More Than SpaceX In 10 Years was initially printed by The Motley Idiot

[ad_2]

Source