Intel Suspended Its Dividend, and This Inventory May Be the Subsequent One to Halt Its Excessive-Yielding Payout

[ad_1]

Dividend cuts and suspensions can typically come with out warning. Whereas traders might have suspicions about whether or not an organization will make a change to its dividend, there is no sure-fire formulation for figuring out when which may really occur.

However there are actually warning indicators that may assist traders gauge the general threat. When Intel (NASDAQ: INTC) introduced that it was suspending its dividend in August, it could have caught earnings traders off guard. Nonetheless, given the corporate’s aggressive progress technique and its poor financials, a discount or suspension of the dividend should not have been all that sudden — the writing was on the wall.

That is how I really feel about one other inventory proper now: Walgreens Boots Alliance (NASDAQ: WBA).

Walgreens may observe in Intel’s footsteps

Pharmacy retailer Walgreens is not making chips, however it does have a pricey progress technique of its personal, which incorporates getting deeper into healthcare with the launch of a whole bunch of major care clinics. That has been taking place as the corporate faces rising competitors from on-line retail big Amazon, which has made it simpler for sufferers to order drugs and have them delivered proper to their door. Slightly than going to your native Walgreens, you’ll be able to have Amazon ship drugs to you — in some markets, it may be delivered the identical day as your order.

Given the competitors and the huge want for money to develop its healthcare enterprise, Walgreens is in a troubling state of affairs. There are indicators that the enterprise could also be trying to take drastic measures below new CEO Tim Wentworth. He already slashed the corporate’s dividend earlier this yr, and Walgreens continues to be reportedly asset gross sales to assist liberate some money circulation.

There are even rumors that Walgreens may dump its entire stake in primary care company VillageMD, which has lengthy been key to its healthcare technique. Such a transfer would counsel a drastic change within the firm’s general progress technique. If Walgreens is contemplating that type of a transfer, then one other dividend reduce or outright suspension of the payout is probably going on the desk as effectively.

The place Walgreens differs from Intel

In contrast to Intel, which appears to be poised to construct out its foundry enterprise, Walgreens seems to have a extra questionable future forward — and there could also be extra playing cards it is keen to play than slashing or suspending its dividend. From promoting companies to lowering its retailer depend, there are lots of completely different levers the corporate may pull, which may assist strengthen its financials and probably keep away from the opportunity of suspending its dividend, which in the present day yields near 10%.

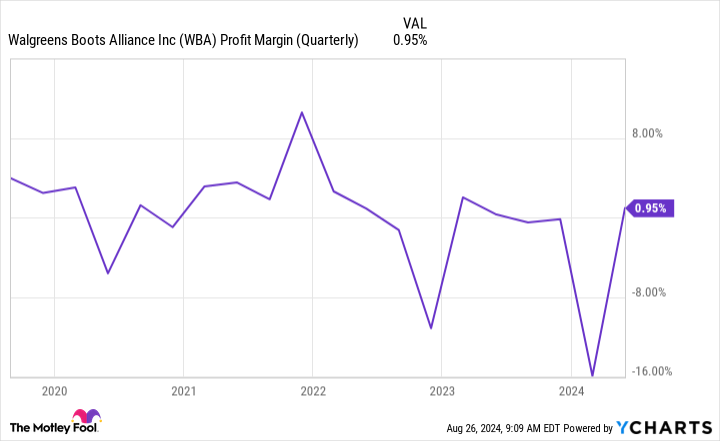

With a brand new CEO who’s keen to think about all choices, there’s hope that Walgreens can nonetheless discover a technique to flip issues round, however it actually will not be simple. The enterprise is struggling to develop, and its margins have been unimpressive, to say the least.

Buyers should not depend on Walgreens’ dividend

For many years, Walgreens was a high dividend progress inventory. That modified this yr with the discount of its dividend. That is now not a inventory that traders ought to really feel comfy with for its dividend. Walgreens is greater than only a dangerous inventory; this can be a enterprise with a largely unsure future forward. Consequently, income investors ought to contemplate wanting elsewhere for an excellent dividend.

At this stage, Walgreens could make for a dangerous contrarian choice, however not a lot else. It is a turnaround play that may possess loads of upside if Wentworth is ready to pull off an enormous transformation of the enterprise. But it surely will not be simple, and on the very least, it may be a particularly bumpy trip for traders.

The times of Walgreens being seen as a secure inventory to personal are lengthy over, and its decrease valuation would not change that reality. Except you have got a excessive threat tolerance, you are higher off going with different shares as an alternative.

Do you have to make investments $1,000 in Walgreens Boots Alliance proper now?

Before you purchase inventory in Walgreens Boots Alliance, contemplate this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they consider are the 10 best stocks for traders to purchase now… and Walgreens Boots Alliance wasn’t one in all them. The ten shares that made the reduce may produce monster returns within the coming years.

Think about when Nvidia made this checklist on April 15, 2005… in case you invested $1,000 on the time of our advice, you’d have $786,169!*

Inventory Advisor gives traders with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of August 26, 2024

John Mackey, former CEO of Entire Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. David Jagielski has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Amazon. The Motley Idiot recommends Intel and recommends the next choices: brief August 2024 $35 calls on Intel. The Motley Idiot has a disclosure policy.

Intel Suspended Its Dividend, and This Stock Could Be the Next One to Halt Its High-Yielding Payout was initially printed by The Motley Idiot

[ad_2]

Source