2 Unstoppable Vanguard ETFs to Purchase With $950 In the course of the S&P 500 Bull Market

[ad_1]

The S&P 500 set a brand new all-time excessive in early January 2024, offering the ultimate affirmation that the bull market (which started when the index bottomed in October 2022) was underway. Since then, the expertise sector has continued to drive the market increased, led by trillion-dollar giants like Nvidia, Microsoft, and Apple.

The S&P 500 was up 15% within the first half of this 12 months, with the 156% achieve in Nvidia inventory contributing about one-third of that complete return. In different phrases, traders who haven’t got publicity to the tech sector are prone to underperform the broader market. Shopping for exchange-traded funds (ETFs) which maintain a excessive focus of expertise shares could be a easy approach to get that publicity.

This is why traders with a spare $950 would possibly wish to allocate it towards shopping for a share of the Vanguard Progress ETF (NYSEMKT: VUG) and a share of the Vanguard Info Expertise ETF (NYSEMKT: VGT).

1. Vanguard Progress ETF

The Vanguard Progress ETF holds 188 completely different shares, however a whopping 59.8% of the fund is allotted to the expertise sector. For context, the S&P 500 assigns a 31.4% weighting to expertise, so this ETF is considerably concentrated by comparability.

That may be a blessing and a curse. When expertise shares lead the market, this ETF handily outperforms the S&P 500. However any sell-off within the tech sector results in a a lot steeper relative decline within the ETF.

The highest 5 holdings within the Progress ETF are precisely the identical as the highest 5 within the S&P 500. Nevertheless, be aware of the distinction in weightings:

|

Inventory |

Progress ETF Weighting |

S&P 500 Weighting |

|---|---|---|

|

1. Apple |

12.89% |

6.89% |

|

2. Microsoft |

12.39% |

6.70% |

|

3. Nvidia |

10.90% |

6.20% |

|

4. Amazon |

4.87% |

3.69% |

|

5. Meta Platforms |

4.15% |

2.24% |

Knowledge supply: Vanguard. Portfolio weightings are correct as of July 31, 2024, and are topic to alter.

All 5 corporations are betting massive on synthetic intelligence (AI). Apple just lately revealed its new Apple Intelligence software program, which was developed in partnership with ChatGPT creator OpenAI. It should rework current apps just like the Siri voice assistant, and add new capabilities to different apps like iMessage and Mail. With over 2.2 billion lively units worldwide, Apple might quickly change into the most important distributor of AI to shoppers.

Microsoft additionally used OpenAI’s expertise to develop its Copilot digital assistant. However Microsoft’s greater AI alternative is likely to be within the cloud as a result of its Azure platform is shortly changing into the go-to vacation spot for companies trying to develop AI purposes.

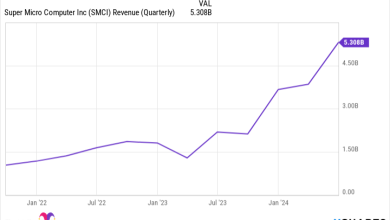

Nvidia’s graphics processors (GPUs) for the information middle are on the coronary heart of the whole AI revolution. They’re utilized by virtually each firm growing AI together with OpenAI, Microsoft, Amazon, and Meta, to call only a few. Demand for GPUs continues to outstrip provide, which is driving a surge in Nvidia’s revenue and earnings.

Outdoors of its prime 5, the Progress ETF holds a number of different vital tech shares. They embrace Alphabet, Tesla, and Superior Micro Units. But it surely does supply a sprinkle of diversification as a result of non-technology shares like Eli Lilly, Visa, and Costco Wholesale are among the many ETF’s prime 20 holdings.

The Progress ETF has generated a compound annual return of 11.3% because it was established in 2004, which beats the ten.1% common annual return within the S&P 500 over the identical interval. Nevertheless, the proliferation of applied sciences like enterprise software program, cloud computing, and AI have propelled the ETF to a compound annual achieve of 15.3% over the past 10 years. That represents a fair larger outperformance in comparison with the 13.2% annual return within the S&P 500 over the previous decade.

2. Vanguard Info Expertise ETF

The Info Expertise ETF is likely to be possibility for traders who’re comfy with extra danger in trade for a fair increased publicity to the main names within the S&P 500. It holds 317 completely different shares from 12 segments of the expertise sector, particularly.

The semiconductor sector is the most important on this ETF with a 29.1% weighting, which maybe isn’t surprising given the surge in worth of corporations like Nvidia and AMD over the previous 12 months.

The composition of its prime 5 holdings is barely completely different from that of the S&P 500. However its prime three holdings are the identical, with considerably increased weightings:

|

Inventory |

Info Expertise ETF Weighting |

|---|---|

|

1. Apple |

17.21% |

|

2. Microsoft |

15.83% |

|

3. Nvidia |

14.07% |

|

4. Broadcom |

4.74% |

|

5. Salesforce |

1.68% |

Knowledge supply: Vanguard. Portfolio weightings are correct as of July 31, 2024, and are topic to alter.

Shares like Adobe, AMD, and Oracle fall inside the highest 10 on this ETF, whereas they’re much additional down the order within the S&P 500. That makes the ETF’s efficiency extremely depending on the success of applied sciences like AI, since that is the place these corporations are investing an growing sum of money.

The Info Expertise ETF has delivered a compound annual return of 13.5% since its inception in 2004, so it has fared higher than each the Progress ETF and the S&P 500. The identical is true for its efficiency extra just lately, with a formidable compound annual achieve of 20.2% over the past 10 years.

One minor downside of the Info Expertise ETF is its expense ratio of 0.1%, which is the proportion of the fund deducted annually to cowl administration prices. It is barely dearer to personal than the Progress ETF which has an expense ratio of 0.03%, and that may negatively impression returns over time. Nevertheless, it is nonetheless considerably cheaper than comparable funds within the business, in accordance with Vanguard, which cost a median of 0.97%.

This ETF may very well be unstable given 47.1% of the worth of its complete portfolio is invested in simply three shares, so it is a good suggestion to personal it as a part of a balanced group of different ETFs. Alternatively, it may very well be addition to any portfolio which presently underweights the expertise sector.

Do you have to make investments $1,000 in Vanguard Index Funds – Vanguard Progress ETF proper now?

Before you purchase inventory in Vanguard Index Funds – Vanguard Progress ETF, contemplate this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they consider are the 10 best stocks for traders to purchase now… and Vanguard Index Funds – Vanguard Progress ETF wasn’t considered one of them. The ten shares that made the reduce might produce monster returns within the coming years.

Take into account when Nvidia made this checklist on April 15, 2005… for those who invested $1,000 on the time of our advice, you’d have $731,449!*

Inventory Advisor supplies traders with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 3, 2024

Randi Zuckerberg, a former director of market growth and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. John Mackey, former CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Suzanne Frey, an government at Alphabet, is a member of The Motley Idiot’s board of administrators. Anthony Di Pizio has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Adobe, Superior Micro Units, Alphabet, Amazon, Apple, Costco Wholesale, Meta Platforms, Microsoft, Nvidia, Oracle, Salesforce, Tesla, Vanguard Index Funds-Vanguard Progress ETF, and Visa. The Motley Idiot recommends Broadcom and recommends the next choices: lengthy January 2026 $395 calls on Microsoft and brief January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure policy.

2 Unstoppable Vanguard ETFs to Buy With $950 During the S&P 500 Bull Market was initially revealed by The Motley Idiot

[ad_2]

Source