3 High Excessive-Yield Oil Shares to Purchase in September

There is a main fault line operating by the U.S. oil and gasoline sector, and I am not speaking about geology right here. Merely put, Devon Vitality (NYSE: DVN), Vitesse Vitality (NYSE: VTS), and Chord Vitality (NASDAQ: CHRD) are buying and selling on lowly valuations and colossal dividend yields as a result of buyers are pricing in Bakken oil discipline belongings at a reduction to different belongings comparable to within the Permian Basin. Nonetheless, all three shares now commerce on enticing valuations and are value selecting up.

The highest 5 oil-producing areas within the U.S.

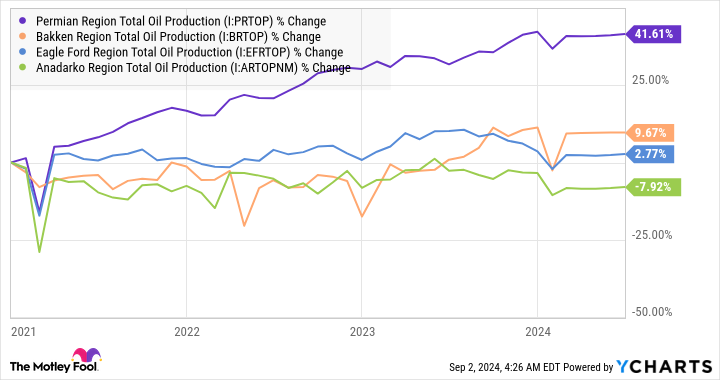

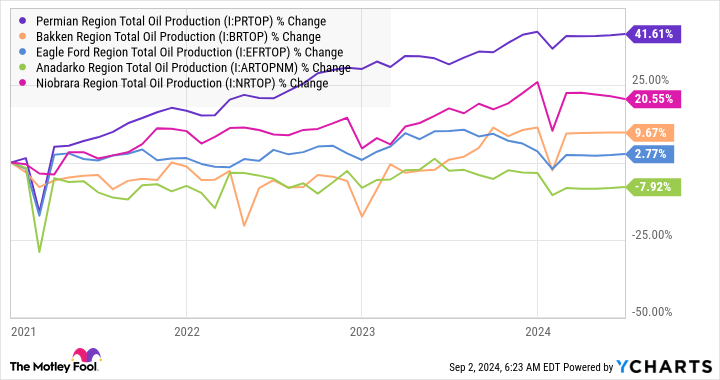

This is a have a look at the highest 5 oil-producing areas within the U.S. to get a way of why buyers favor the Permian over different belongings.

|

Area |

Location |

Oil Manufacturing in June 2024 (1000’s of barrels per day) |

|---|---|---|

|

Permian |

Texas and New Mexico |

6,187 |

|

Bakken |

North Dakota and Montana |

1,313 |

|

Eagle Ford |

Texas |

1,106 |

|

Niobrara |

Northeast Colorado and Southeast Wyoming |

697 |

|

Anadarko |

Texas and Oklahoma |

383 |

Knowledge: U.S. Vitality Info Administration.

Not solely is the Permian area crucial by way of manufacturing, but it surely has additionally elevated manufacturing essentially the most in recent times. This stands in distinction to the mediocre development in manufacturing within the Bakken.

The maturing nature of the Bakken oil discipline is acknowledged within the North Dakota Vitality Report 2023: “The Bakken formation is now thought-about “mature” by the trade — that means that most of the operators within the state are devoted to producing their acreage on a constant and regular tempo however that radical development in manufacturing is much less probably.

Devon Vitality, Vitesse Vitality, and Chord Vitality

It isn’t exhausting to see that buyers might take a glass-half-empty viewpoint of those shares. Whereas Vitesse Vitality is up 18% this 12 months, it nonetheless trades on an 8.1% dividend yield, and shares do not commerce on such yields until the market is worried about one thing.

Equally, Devon Vitality and Chord Vitality additionally commerce on enticing yields, and a part of that purpose most likely comes right down to vital offers each corporations have performed so as to add belongings within the Bakken oil discipline. All three have introduced offers within the Bakken this 12 months. It is a part of a present development within the trade whereby oil and gasoline corporations are utilizing money flows gushing from a comparatively excessive value of oil to accumulate belongings at a time when the market continues to accord vitality corporations lowly valuations.

It isn’t exhausting to see what all three have in frequent this 12 months.

|

Firm |

Market Cap |

Deal Introduced in 2024 |

|

|---|---|---|---|

|

Vitesse Vitality |

$763 million |

Agreed to accumulate $40 million value of belongings within the Williston Basin (Bakken). |

|

|

Chord Vitality |

$9.2 billion |

Mixed with Williston Basin-focused Enerplus in an $11 billion enterprise deal, Chord shareholders personal 67% of the brand new firm, and Enerplus shareholders maintain 33%. |

|

|

Devon Vitality |

$28 billion |

Buying Grayson Mills’ Williston Basin belongings for $5 billion, consisting of $3.25 billion in money and $1.75 billion in shares. |

|

Knowledge supply: Firm shows.

All three shares appear like an important worth, and it seems that the market is being overly pessimistic right here.

Vitesse Vitality

Vitesse Energy is an unusual oil and gas company that does not totally personal or function belongings. As a substitute, it makes use of a proprietary expertise system and administration’s expertise to put money into curiosity in wells operated by bigger corporations, primarily within the Bakken. These embrace Chord Vitality and Grayson Mill.

As well as, it makes use of hedging to guard in opposition to a fall within the value of oil. The technique supplies diversification throughout 7,000 producing wells, and Vitesse is sort of an ETF on Bakken.

Chord Vitality

Chord Vitality now expects $1.2 billion in adjusted free money circulate (FCF) in 2024, and administration believes it has a “footprint of 10 years of low breakeven areas delivering peer-leading oil-weighted manufacturing” within the Williston Basin. On condition that the $1.2 billion in FCF represents greater than 13% of its market cap, the inventory appears able to delivering its complete market cap and extra in FCF inside a decade.

Devon Vitality

It is a related story at Devon Vitality, the place Wall Road expects the corporate will generate $10.9 billion in FCF over the subsequent three years. Administration expects the Grayson Mill deal will add 15% to FCF era. With the present market cap at simply $28 billion, it will not take lengthy for Devon to generate a big a part of its market cap in FCF, both.

All advised, whereas the Bakken is maturing, and there is not any assure the worth of oil will keep excessive, these three high-yield shares appear like a wonderful worth.

Must you make investments $1,000 in Devon Vitality proper now?

Before you purchase inventory in Devon Vitality, take into account this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they consider are the 10 best stocks for buyers to purchase now… and Devon Vitality wasn’t considered one of them. The ten shares that made the lower might produce monster returns within the coming years.

Contemplate when Nvidia made this listing on April 15, 2005… in case you invested $1,000 on the time of our suggestion, you’d have $656,938!*

Inventory Advisor supplies buyers with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 3, 2024

Lee Samaha has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Chord Vitality and Vitesse Vitality. The Motley Idiot has a disclosure policy.

3 Top High-Yield Oil Stocks to Buy in September was initially revealed by The Motley Idiot