Social Safety’s 2025 Price-of-Residing Adjustment (COLA) Has Narrowed — This is How A lot the Common Examine Is Forecast to Rise Subsequent Yr

For many retirees, Social Safety is greater than a examine. It represents a crucial supply of earnings that the majority retired-worker beneficiaries could not reside with out.

Over the past 23 years, nationwide pollster Gallup has been surveying seniors to find out how reliant they’re on their Social Security benefit. At no level on this better than two-decade stretch of annual polling has the proportion of retirees needing their Social Safety earnings to make ends meet fallen under 80%. In 2024, 88% of retirees famous their Social Safety profit represents both a “main” or “minor” supply of earnings.

Given the important thing function America’s high retirement program performs in laying a monetary basis for America’s growing old workforce, it ought to come as no shock that Social Safety’s cost-of-living adjustment (COLA) reveal, which is slated for Oct. 10 at 8:30 a.m. ET, is the most-awaited announcement of the 12 months.

As we have moved nearer to this reveal, the 2025 COLA forecast has meaningfully narrowed, offering both promise and disappointment to beneficiaries.

What goal does Social Safety’s COLA maintain?

Social Safety’s often-talked-about COLA is the mechanism the Social Safety Administration (SSA) makes use of to regulate advantages on a year-to-year foundation to account for modifications within the value of products and companies.

For instance, if a broad basket of products and companies which might be frequently bought by seniors cumulatively will increase in value by 2%, 3%, or 5%, Social Safety advantages ought to ideally rise by a commensurate quantity to make sure that no buying energy is misplaced. The annual cost-of-living adjustment goals to maintain this system’s beneficiaries on par with the inflation (i.e., rising costs) they’re contending with.

From the primary mailed retired-worker profit examine in January 1940 by means of 1974, changes to advantages had been fully arbitrary and handed alongside by particular periods of Congress. Following no COLAs through the entirety of the Forties, 11 somewhat massive changes had been administered from 1950 by means of 1974.

Beginning in 1975, the Shopper Value Index for City Wage Earners and Clerical Staff (CPI-W) was tasked with monitoring inflation for Social Safety and successfully grew to become its inflationary tether chargeable for figuring out the annual COLA. The CPI-W has greater than a half-dozen main spending classes and a laundry record of subcategories, all of which have their very own respective proportion weightings. It is these weightings that permit the CPI-W to be expressed as a single, concise determine every month.

Most significantly, solely trailing-12-month CPI-W readings from July by means of September issue into the COLA calculation. If the typical third-quarter (July to September) CPI-W studying within the present 12 months is greater than the typical CPI-W studying through the comparable interval final 12 months, inflation has taken place and advantages will rise.

How a lot of a rise to count on is set by the year-over-year proportion enhance in common third-quarter CPI-W readings, rounded to the closest tenth of a %.

Social Safety’s 2025 cost-of-living adjustment has considerably narrowed

Over the past 20 years, the typical COLA has been a somewhat mediocre 2.6%. This era contains three years when deflation (falling costs) occurred and no COLA was handed alongside (2010, 2011, and 2016), in addition to the smallest optimistic COLA on report (0.3% in 2017).

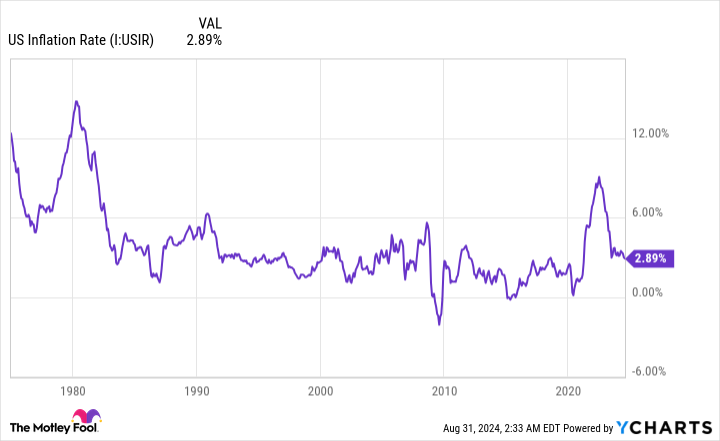

Nevertheless, the final three years have considerably damaged this anemic COLA pattern. The quickest uptick within the prevailing inflation fee in 4 a long time led to a 5.9% COLA in 2022, 8.7% COLA in 2023, and three.2% COLA in 2024. Specifically, the 8.7% cost-of-living adjustment in 2023 was the best on a proportion foundation in 41 years.

With the July inflation report from the Bureau of Labor Statistics within the books, and the August inflation report due on Sept. 11, we have witnessed forecasts for the 2025 COLA slender considerably.

The Senior Residents League (TSCL), a nonpartisan senior advocacy group, started the 12 months forecasting a paltry 2025 COLA of 1.4%. Following the July inflation report, this estimate has risen to 2.57%, which by definition would spherical as much as 2.6%.

In the meantime, unbiased Social Safety and Medicare coverage analyst Mary Johnson, who not too long ago retired from TSCL, has had her 2025 COLA forecast drop from 3.2% following the April inflation report back to 2.6% after the newest report.

Regardless of ranging from reverse ends of the spectrum, TSCL and Johnson at the moment are successfully in settlement that the 2025 cost-of-living adjustment might be 2.6%.

For the typical Social Safety beneficiary — i.e., practically 68 million recipients — a 2.6% COLA would translate into an additional $46.35 per examine, primarily based on the typical payout of $1,782.74 in July 2024. Nevertheless, this enhance in advantages can fluctuate from individual to individual, in addition to primarily based on beneficiary kind.

For retired staff, who account for greater than 51 million of this system’s near 68 million beneficiaries, a 2.6% COLA interprets into a mean month-to-month enhance of $49.90.

By comparability, the typical examine for the roughly 7.2 million staff with disabilities and shut to five.8 million survivor beneficiaries would rise by $40.01 and $39.25, respectively, subsequent 12 months.

The 2025 COLA might make historical past and disappoint on the identical time

Assuming TSCL’s and Johnson’s aligned forecasts are right, a 2.6% cost-of-living adjustment would mark the smallest proportion enhance in 4 years. Whereas this may sound disappointing, it might nonetheless match the typical COLA over the past 20 years.

Extra impressively, it might mark the primary time since 1997 that Social Safety’s COLA has reached not less than 2.6% in 4 consecutive years. On a cumulative foundation, advantages can have risen by nearly 22% from the tip of 2021, primarily based on a 2.6% cost-of-living adjustment subsequent 12 months.

Whereas it is nice on paper to see advantages rising at a sooner tempo than at any level in latest reminiscence, there are additionally two disappointing realizations to be made about Social Safety’s 2025 COLA.

To start out with, a 2.6% COLA is prone to lead to a lack of buying energy for beneficiaries, which sadly has been a standard prevalence since this century started.

TSCL has launched two research the place they’ve in contrast cumulative COLAs over choose time frames to the combination enhance in value for a basket of products and companies frequently bought by seniors. Between January 2000 and February 2023, it estimates the shopping for energy of a Social Safety greenback plummeted by 36%. In a separate examine launched in July 2024, TSCL discovered that the buying energy of Social Safety earnings has fallen 20% since 2010.

With two of a very powerful prices for seniors — shelter and medical care companies — sporting trailing-12-month charges of inflation which might be notably above 2.6%, a lack of shopping for energy appears all however assured.

The opposite disappointment comes within the type of Medicare Half B premiums quickly rising for a second consecutive 12 months. Half B is the phase of Medicare that covers outpatient companies.

In Might, the Medicare Trustees Report predicted month-to-month half B premiums would rise to $185 in 2025, which equates to a 5.9% enhance. This matches the proportion bump skilled in 2024.

Most Social Safety beneficiaries who’re enrolled in Medicare have their Half B premiums routinely deducted from their month-to-month profit. In different phrases, a second consecutive 12 months and not using a silver lining from Medicare Half B will reduce the impression of Social Safety’s upcoming COLA.

Subsequent 12 months is trying like a kind of uncommon cases the place historical past is made, however disappointment looms massive.

The $22,924 Social Safety bonus most retirees fully overlook

Should you’re like most People, you are a number of years (or extra) behind in your retirement financial savings. However a handful of little-known “Social Safety secrets and techniques” might assist guarantee a lift in your retirement earnings. For instance: one simple trick might pay you as a lot as $22,924 extra… annually! When you learn to maximize your Social Safety advantages, we predict you could possibly retire confidently with the peace of thoughts we’re all after. Simply click here to discover how to learn more about these strategies.

View the “Social Security secrets” »

The Motley Idiot has a disclosure policy.

Social Security’s 2025 Cost-of-Living Adjustment (COLA) Has Narrowed — Here’s How Much the Average Check Is Forecast to Rise Next Year was initially revealed by The Motley Idiot