3 US Shares That Might Be Undervalued In accordance To Analysts

[ad_1]

The U.S. inventory market has proven outstanding resilience, with the S&P 500 and Nasdaq Composite wrapping up their finest week of 2024 amid investor optimism about potential rate of interest cuts by the Federal Reserve. As main indexes get better from early-September losses, analysts are figuring out shares which may be undervalued regardless of the broader market rally. In such a dynamic surroundings, discovering undervalued shares can supply important alternatives for traders seeking to capitalize on potential progress at enticing costs.

High 10 Undervalued Shares Primarily based On Money Flows In America

|

Identify |

Present Value |

Honest Worth (Est) |

Low cost (Est) |

|

Kaspi.kz (NasdaqGS:KSPI) |

$123.95 |

$241.40 |

48.7% |

|

Phibro Animal Well being (NasdaqGM:PAHC) |

$21.99 |

$42.63 |

48.4% |

|

EQT (NYSE:EQT) |

$33.19 |

$65.85 |

49.6% |

|

Heartland Monetary USA (NasdaqGS:HTLF) |

$56.59 |

$111.54 |

49.3% |

|

Progress Software program (NasdaqGS:PRGS) |

$57.99 |

$114.81 |

49.5% |

|

ChromaDex (NasdaqCM:CDXC) |

$3.55 |

$7.10 |

50% |

|

EVERTEC (NYSE:EVTC) |

$33.38 |

$65.96 |

49.4% |

|

Vertex Prescription drugs (NasdaqGS:VRTX) |

$485.37 |

$961.23 |

49.5% |

|

Alnylam Prescription drugs (NasdaqGS:ALNY) |

$265.27 |

$514.78 |

48.5% |

|

Bilibili (NasdaqGS:BILI) |

$14.83 |

$28.74 |

48.4% |

Let’s uncover some gems from our specialised screener.

Overview: CrowdStrike Holdings, Inc. offers cybersecurity options in the USA and internationally, with a market cap of roughly $63.52 billion.

Operations: CrowdStrike’s income from Safety Software program & Providers quantities to $3.52 billion.

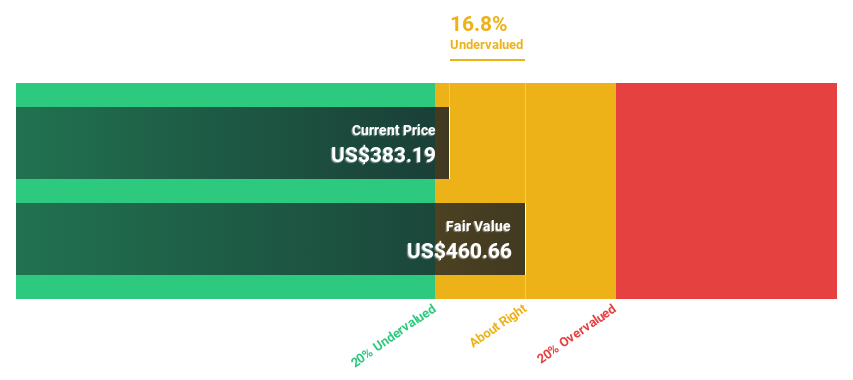

Estimated Low cost To Honest Worth: 37.1%

CrowdStrike Holdings is buying and selling at 37.1% beneath its estimated truthful worth of US$412.03, making it extremely undervalued primarily based on discounted money flows. Regardless of current authorized points and insider promoting, the corporate has proven strong earnings progress, turning into worthwhile this 12 months with a web earnings of US$47.01 million for Q2 2024 in comparison with US$8.47 million a 12 months in the past. Earnings are forecast to develop considerably quicker than the market at 35.84% yearly over the following three years, supported by strategic partnerships and product improvements like Falcon Go for SMBs and Falcon Full Subsequent-Gen MDR for enterprise safety.

Overview: Micron Expertise, Inc. designs, develops, manufactures, and sells reminiscence and storage merchandise worldwide with a market cap of roughly $101.15 billion.

Operations: Micron Expertise’s income segments embody the Cell Enterprise Unit ($5.69 billion), Storage Enterprise Unit ($3.65 billion), Embedded Enterprise Unit ($4.30 billion), and Compute and Networking Enterprise Unit ($7.70 billion).

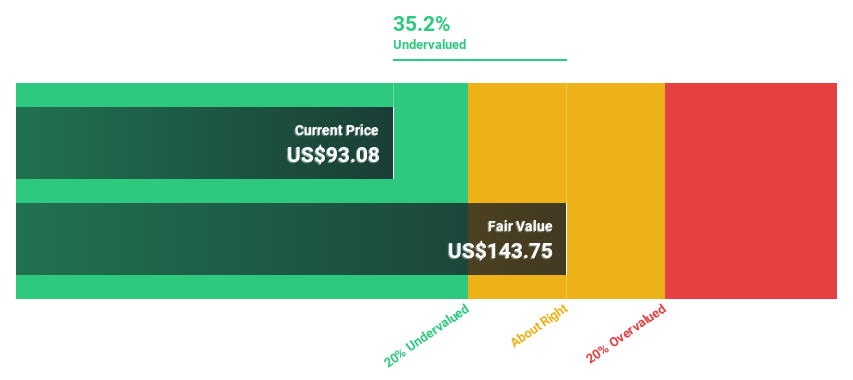

Estimated Low cost To Honest Worth: 33.8%

Micron Expertise is buying and selling at 33.8% beneath its estimated truthful worth of US$137.80, making it extremely undervalued primarily based on discounted money flows. Latest product improvements, together with the PCIe Gen6 SSD and G9 TLC NAND, underscore its management in AI and information heart storage options. Regardless of a difficult previous 12 months, Micron’s income grew to US$17.36 billion for the primary 9 months of 2024 from US$11.53 billion a 12 months in the past, with earnings forecasted to develop considerably over the following three years.

Overview: 3M Firm presents diversified know-how providers each in the USA and globally, with a market cap of $73.16 billion.

Operations: The corporate’s income segments embody Client ($4.94 billion), Security and Industrial ($10.90 billion), and Transportation and Electronics ($8.51 billion).

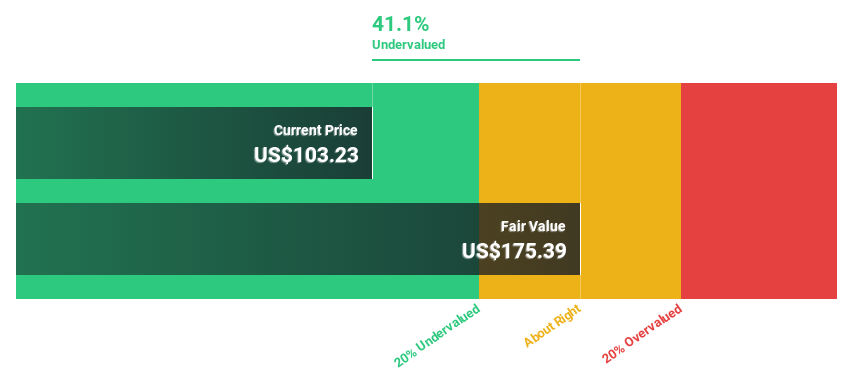

Estimated Low cost To Honest Worth: 37.8%

3M is buying and selling at US$133.18, considerably beneath its estimated truthful worth of US$214.18, indicating it’s undervalued primarily based on discounted money flows. Regardless of a forecasted income decline of 5.6% per 12 months over the following three years, earnings are projected to develop by 21.48% yearly, outpacing the broader market’s progress charge of 15.3%. Nonetheless, the corporate faces challenges corresponding to excessive debt ranges and huge one-off objects impacting monetary outcomes.

Subsequent Steps

-

Uncover the total array of 186 Undervalued US Stocks Based On Cash Flows proper right here.

-

Maintain shares in these corporations? Setup your portfolio in Simply Wall St to seamlessly observe your investments and obtain personalised updates in your portfolio’s efficiency.

-

Streamline your funding technique with Merely Wall St’s app without cost and profit from intensive analysis on shares throughout all corners of the world.

Looking for a Contemporary Perspective?

This text by Merely Wall St is basic in nature. We offer commentary primarily based on historic information and analyst forecasts solely utilizing an unbiased methodology and our articles usually are not meant to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your targets, or your monetary scenario. We goal to deliver you long-term targeted evaluation pushed by basic information. Notice that our evaluation could not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.

Corporations mentioned on this article embody NasdaqGS:CRWD NasdaqGS:MU and NYSE:MMM.

Have suggestions on this text? Involved in regards to the content material? Get in touch with us immediately. Alternatively, e mail editorial-team@simplywallst.com

[ad_2]

Source