1 Magnificent Excessive-Yield Inventory Down 14% to Purchase and Maintain Endlessly

[ad_1]

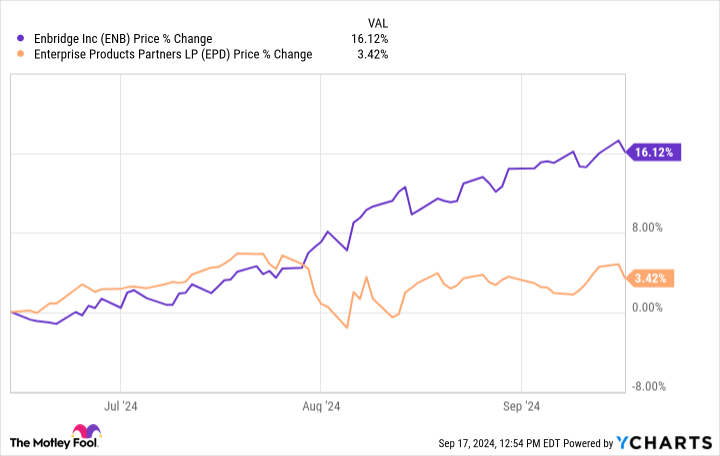

Share costs of Enbridge (NYSE: ENB) have risen 16% over the previous three months as traders reassess the North American midstream big’s future. However that rebound nonetheless is not sufficient to shut the hole with fellow high-yield midstream big Enterprise Merchandise Companions (NYSE: EPD), which has recovered all its losses from a peak in mid-2022.

There’s prone to be further restoration potential with Enbridge.

Get well: Enbridge versus Enterprise

Enterprise Merchandise Companions is up nearly 3.4% over the previous three months, lagging properly behind the 16% achieve Enbridge’s inventory has seen. Should you simply checked out this short-term efficiency, you’d in all probability counsel that Enterprise has extra attraction.

However once you pull the lens again a bit additional to embody three years, the story adjustments dramatically.

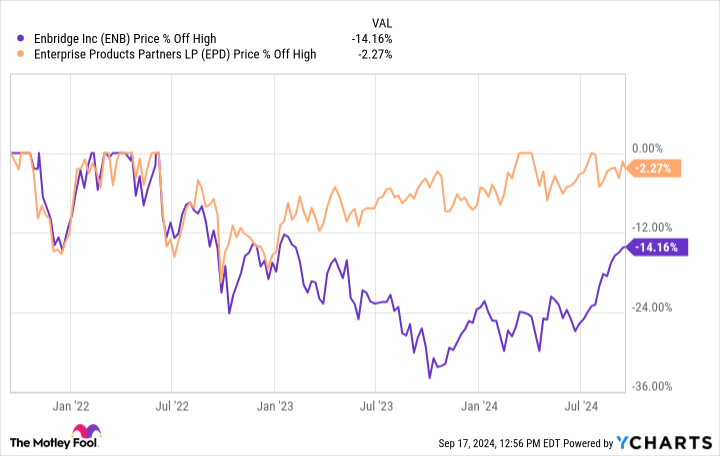

Over the previous three years, you see that Enterprise and Enbridge each hit peaks in mid-2022. They each fell after the height, however Enbridge’s decline was far more dramatic. It additionally lasted longer. Thus, the Canadian midstream big’s restoration did not begin till later, and the shares had extra losses to get well. So, on this means, it is smart that the final three months have been higher for Enbridge’s shares than for Enterprise’s models.

However there’s another necessary piece from the above graph. Enterprise in 2024 has recovered all of what it misplaced and trades close to prior highs, whereas Enbridge nonetheless has extra room to run earlier than it will get to that time. The distinction between the restoration of those two midstream gamers is about 12 proportion factors.

If you’re in search of a mixture of yield and progress, that in all probability offers Enbridge the sting proper now. That mentioned, on the revenue entrance, Enbridge’s dividend yield is roughly 6.6% versus a 7% distribution yield for Enterprise. So, if all you need is revenue, you may favor Enterprise.

What is the backstory with Enbridge?

The story right here is pretty fascinating. Enterprise is principally laser-focused on the midstream sector. Enbridge’s long-term aim is to shift its portfolio together with the world’s vitality wants. Whereas most of its enterprise is tied to midstream property, like pipelines, it additionally owns pure gasoline utilities and renewable vitality services, like offshore wind developments. The corporate’s regulated utility operations are a key focus immediately because it completes and integrates the acquisition of three giant regulated U.S. pure gasoline utilities from Dominion Power (NYSE: D).

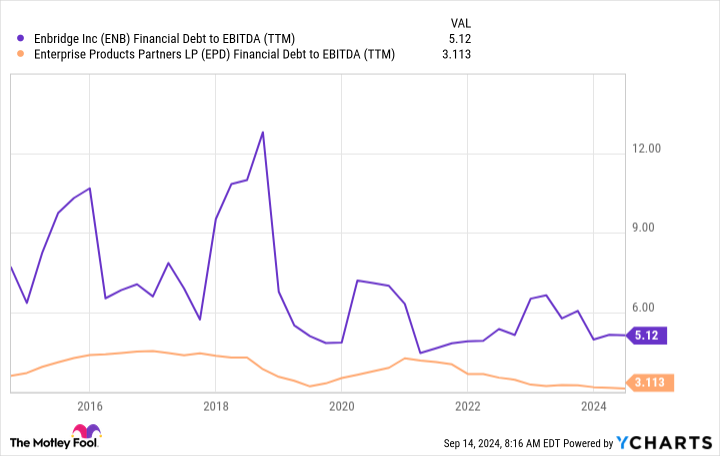

There are two necessary takeaways. Due to its utility operations, Enbridge tends to make heavier use of leverage than different midstream gamers, like Enterprise. The truth is, Enterprise has lengthy operated with a really modest degree of leverage on its steadiness sheet. When rates of interest have been on the rise, traders have been merely extra fearful about Enbridge than Enterprise, and thus, the inventory of Enbridge carried out worse.

However Enbridge additionally agreed to purchase these pure gasoline utilities from Dominion. There have been issues about how it will fund the acquisition worth, resulting in extra downward strain on the shares. It is a key purpose Enbridge’s inventory fell up to now and laborious.

Now, nevertheless, Enbridge has confirmed it was capable of handle the price of buying the utilities (with out blowing up its steadiness sheet), and rates of interest look prone to begin falling. So, there is a double tailwind behind Enbridge’s inventory, with extra room to run earlier than it will get again to the place it was earlier than the present sell-off.

Enbridge has a stable future forward

With practically three many years of annual dividend will increase beneath its belt, Enbridge has confirmed it’s a dependable dividend inventory. Though the yield is decrease proper now than that of Enterprise, do not let that cloud your view of Enbridge. It’s nonetheless a sexy dividend inventory, and in contrast to Enterprise, there’s nonetheless materials restoration potential for the shares.

Should you purchase it, although, do not simply take into consideration that short-term alternative. It is a high-yield dividend inventory you may comfortably maintain in your portfolio endlessly. Keep in mind, not like Enterprise, Enbridge is actively adjusting its portfolio to serve the world’s vitality wants as they alter.

Do you have to make investments $1,000 in Enbridge proper now?

Before you purchase inventory in Enbridge, think about this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they imagine are the 10 best stocks for traders to purchase now… and Enbridge wasn’t one in all them. The ten shares that made the reduce might produce monster returns within the coming years.

Think about when Nvidia made this checklist on April 15, 2005… if you happen to invested $1,000 on the time of our suggestion, you’d have $715,640!*

Inventory Advisor offers traders with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 16, 2024

Reuben Gregg Brewer has positions in Dominion Power and Enbridge. The Motley Idiot has positions in and recommends Enbridge. The Motley Idiot recommends Dominion Power and Enterprise Merchandise Companions. The Motley Idiot has a disclosure policy.

1 Magnificent High-Yield Stock Down 14% to Buy and Hold Forever was initially printed by The Motley Idiot

[ad_2]

Source