3 Dividend Shares to Purchase Now That Have Raised Their Payouts for at Least 20 Consecutive Years

When scanning the marketplace for dividend shares, you are certain to note firms with excessive yields. However it’s arguably extra spectacular when firms pay and lift their dividends yearly it doesn’t matter what the economic system is doing. Constant dividend raises typically coincide with monetary well being and regular earnings development.

Emerson Electrical (NYSE: EMR), NextEra Power (NYSE: NEE), and Clorox (NYSE: CLX) do not have mind-numbingly excessive yields. However all three firms are effectively on their approach to extending their streak of dividend raises for many years to come back.

This is why all three dividend stocks are price shopping for now.

Repositioning the corporate in development markets will guarantee extra dividend development sooner or later

Lee Samaha (Emerson Electrical): After adjusting for inventory splits, Emerson Electrical has elevated its dividend yearly since 1956, and its development potential ensures a lot extra to come back.

The commercial firm has been reworking over the previous few years as administration steers it towards a future centered on automation and associated markets reminiscent of check and measurement, industrial software program, and sensible grid options.

The concept is to reposition the corporate in development markets that can profit from long-term megatrends reminiscent of labor automation, the electrification of every little thing, reshoring manufacturing (which suggests elevated demand for automation and sensible factories), and the digital revolution in manufacturing and processing.

Having offered the remaining vestiges of its local weather applied sciences enterprise, acquired automated check and measurement firm NI, and closed a transaction leading to a 55% stake in industrial software program firm Aspen Know-how (NASDAQ: AZPN), administration has positioned the corporate for future development.

That development will probably kick in after a few of its finish markets get well from a slowdown in 2024. For instance, funding in its manufacturing facility automation and check and measurement enterprise is presently weak as a result of a downturn within the economic system and a pullback in funding from industrial clients in manufacturing functionality (manufacturing facility automation) and analysis and improvement (check and measurement).

A lower-interest-rate surroundings will assist in 2025, and the underlying long-term secular traits mentioned above will proceed, enabling Emerson Electrical to generate the 4% to 7% natural income development administration expects to realize by way of the ups and downs of the financial cycle.

With three many years of dividend development beneath its belt, NextEra Power plans on powering its payout even greater

Scott Levine (NextEra Power): A lesson you might keep in mind studying in the beginning of your investing journey is that earlier performances do not assure future outcomes. However taking a look at earlier performances can nonetheless be helpful.

Take utility inventory NextEra Power, as an example. The corporate has elevated its dividend for 30 consecutive years, and whereas it is not assured to proceed doing so for the subsequent 30 years, that is definitely an auspicious signal. And that is only for starters. For these trying to complement their passive revenue streams, NextEra Power inventory — together with its 2.5% forward-yielding dividend — seems to be like a beautiful choice proper now.

Conservative traders will not discover solely the previous 20 years of dividend will increase compelling; the regular earnings and money movement development have supported the dividend. From 2003 to 2023, NextEra Power has boosted its dividend at a ten% compound annual development fee (CAGR). Equally, its adjusted earnings per share (EPS) and working money movement elevated at CAGRs of 9% and eight%, respectively, throughout the identical interval. Lest traders speculate that this implies the dividend will increase are jeopardizing the corporate’s financials, contemplate that the corporate has averaged a 60.2% payout ratio over the previous 10 years.

All of those accomplishments ought to give traders confidence that the corporate will obtain its 2024 adjusted EPS forecast of $3.23 to $3.43, rising at a 6% to eight% CAGR by way of 2027. Working money movement is projected to develop on the identical fee or greater. Administration expects to lift its dividend at a ten% CAGR per share from $2.06 in 2024 by way of 2026.

Shares of NextEra Power have traded at a five-year common working money movement a number of of 15.6. They’re now altering arms at a reduction: about 12.3 occasions working money movement. This inventory appears ripe for the choosing.

Clorox has room to run after hitting an all-time excessive

Daniel Foelber (Clorox): Clorox hit an intraday 52-week excessive on this week, however there’s nonetheless cause to consider the buyer items inventory is price shopping for now.

Clorox started paying dividends in 1986. It has raised its dividend yearly since then. Regardless of the run-up within the inventory value, Clorox nonetheless yields 2.9%, which is greater than the two.6% common yield within the client staples sector.

Clorox has rocketed greater since present process a steep sell-off this summer, with the inventory now up 24% in simply three months. That is an enormous transfer for a stodgy firm like Clorox.

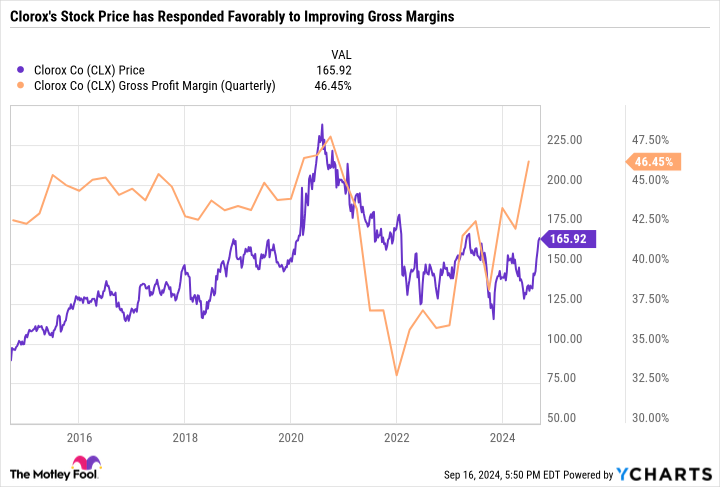

The rebound is probably going as a result of bettering gross margins. Clorox’s margins initially surged in the course of the peak of the COVID-19 pandemic, solely to nosedive after Clorox guess too huge on client demand traits towards cleansing merchandise and hygiene. The next chart reveals that Clorox’s inventory value has returned to round its pre-pandemic excessive, and so have gross margins.

It took a couple of years and a number of operational blunders, however Clorox has lastly discovered its footing. Administration expects gross margins to tick up one other 100 foundation factors in fiscal 2025. It additionally expects $6.55 to $6.80 in adjusted EPS. On the midpoint, that might be an 8% enhance from fiscal 2024 and would give Clorox a ahead price-to-earnings ratio of 24.9 on an adjusted foundation. That is not grime low cost, but it surely’s affordable if Clorox can proceed high-single-digit earnings development.

Clorox is understood for its flagship cleansing merchandise, however the firm owns quite a lot of manufacturers throughout classes together with cleansing, residence care, wellness, and life-style. Chances are you’ll be shocked to be taught that Clorox owns Brita, Burt’s Bees, Glad, Hidden Valley, Kingsford, Pine-Sol, and dozens of different manufacturers.

When Clorox is on the high of its sport, it’s a diversified conglomerate with high-margin merchandise that lead or are near main their classes. Clorox hasn’t been at that degree for a while, but it surely’s getting there once more, making now a superb time to scoop up shares of this high-quality dividend inventory.

Must you make investments $1,000 in Emerson Electrical proper now?

Before you purchase inventory in Emerson Electrical, contemplate this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they consider are the 10 best stocks for traders to purchase now… and Emerson Electrical wasn’t one among them. The ten shares that made the reduce might produce monster returns within the coming years.

Contemplate when Nvidia made this listing on April 15, 2005… if you happen to invested $1,000 on the time of our suggestion, you’d have $708,348!*

Inventory Advisor offers traders with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 16, 2024

Daniel Foelber has no place in any of the shares talked about. Lee Samaha has no place in any of the shares talked about. Scott Levine has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Emerson Electrical and NextEra Power. The Motley Idiot has a disclosure policy.

3 Dividend Stocks to Buy Now That Have Raised Their Payouts for at Least 20 Consecutive Years was initially revealed by The Motley Idiot