This Telecom Inventory Simply Declared a Huge Dividend Increase. Ought to You Purchase?

Usually, a dividend elevate from a large-cap inventory is not very huge. Such firms usually have an amazing many shares excellent, so even a modest hike within the shareholder payout may imply extra bills of thousands and thousands, probably even billions, of {dollars}. So for essentially the most half, each time considered one of these titans declares a dividend elevate, it is extra of a bump than a bounce.

That positive wasn’t the case with telecom T-Cell US (NASDAQ: TMUS) earlier this month, when it enacted a 35% dividend elevate. That is fairly the beneficiant hike; let’s take a better have a look at it and determine if it helps make the inventory a purchase.

Bettering outcomes and a FCF windfall

In mid-September, T-Cell’s board of administrators declared that its upcoming quarterly dividend is to be $0.88 per share. That was certainly pleasing to shareholders who had beforehand earned a payout of “merely” $0.65. For traders who wish to reap the benefits of such conditions, there’s nonetheless loads of time to hop on this dividend elevate, as it will be paid on Dec. 12 to traders of document as of Nov. 27.

T-Cell is probably going feeling flush as a result of its money waterfall is flowing robustly. Scrolling via its second-quarter earnings launch from the top of July, one line merchandise stands out sharply — non-GAAP (adjusted) free cash flow (FCF). At $4.4 billion, this was a whopping 54% greater 12 months over 12 months and notched an all-time excessive for the corporate. Different monetary metrics rose properly, however not as steeply, with its core companies income advancing 4% to $16.4 billion, and headline internet revenue growing a chunky 32% to $2.9 billion.

FCF progress is the motor that drives dividend raises, therefore the corporate’s confidence in boosting the payout greater than one-third greater. T-Cell has truly had fairly a little bit of fuel within the tank for raises even earlier than the second-quarter FCF pop, because the quarterly spend on its few rounds of dividends — it solely initiated its payout on the finish of 2023 — was $769 million at most.

Fortunately for the corporate’s shareholders, administration raised its FCF steering for full-year 2024. This could assist administration meet its purpose of roughly 10% annual dividend progress.

Taking part in catch-up

T-Cell administration may really feel it is in catch-up mode. In any case, the 2 rivals it is at all times in comparison with — Verizon Communications and AT&T — have been regular and dependable dividend payers for years. Not solely that, however the pair way back wandered into high-yield dividend territory and stayed there (regardless of vital adjustments in company construction, as in AT&T’s case). Verizon retains its traders candy with a payout that yields over 6%, whereas AT&T is not far behind at 5.1%.

Though ever-scrappy T-Cell’s 35% elevate is spectacular on a variety of ranges, even on the enhanced new stage its distribution would solely yield 1.7%.

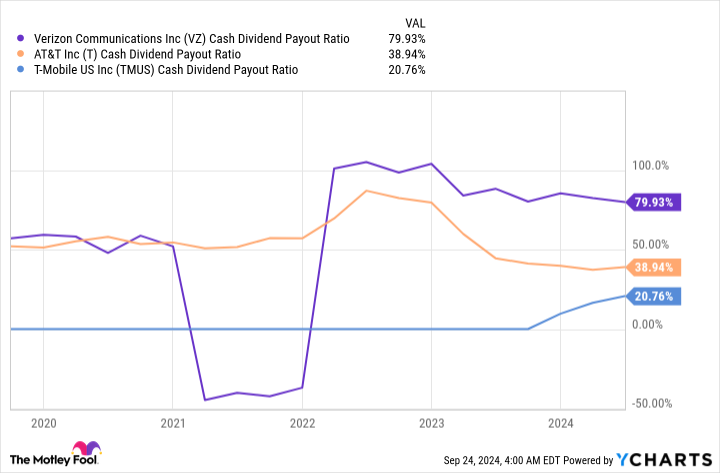

However we are able to anticipate this distinction in yields to slim earlier than lengthy, assuming T-Cell retains roaring alongside. Taking a look at its money dividend payout ratio — that is the share of FCF it devotes to these dividend payouts — reveals a notably decrease determine than that of AT&T or (particularly) Verizon:

VZ Cash Dividend Payout Ratio information by YCharts

In the meantime, in next-generation cellular know-how T-Cell is healthier positioned than its two friends. It has managed to construct out its 5G infrastructure to the purpose the place it is a chief; in keeping with a July evaluation from telecom researcher OpenSignal, the corporate is “untouchable” for 5G availability, with T-Cell 5G service subscribers related to the tech virtually 68% of the time when on-line. That share is almost six occasions that of AT&T, and roughly 9 occasions the speed of Verizon.

The truth is, of the 15 classes tracked by OpenSignal, T-Cell took the gold in 9 of them, together with 5G protection expertise and consistency of high quality.

AT&T and Verizon are clearly decided to shut these gaps, however 5G is not low cost or simple to construct out. AT&T plans to spend $11.5 billion to $12.5 billion all through the second half of this 12 months on capital expenditures, and you’ll guess massive chunks of which might be being poured into 5G. In the identical interval final 12 months, AT&T’s outlays totaled $11.2 billion. Verizon can be spending extra, to the tune of $8.9 billion to $9.4 billion towards second-half 2023’s $8.7 billion. Is it any marvel that the 2 are closely indebted?

Make no mistake, T-Cell has to spend to earn, too, however its burden is not practically as burdensome. The corporate estimates its second-half capex will are available at $4.2 billion, up from $4 billion within the year-ago interval.

So in brief, T-Cell operates in a enterprise thought-about indispensable to many shoppers, it is bettering its fundamentals successfully whereas not being as weighed down by spending targets as others, and it has a dividend with room to develop at inspiring charges. All that makes its inventory quite compelling, for my part.

Do you have to make investments $1,000 in T-Cell US proper now?

Before you purchase inventory in T-Cell US, take into account this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they imagine are the 10 best stocks for traders to purchase now… and T-Cell US wasn’t considered one of them. The ten shares that made the reduce may produce monster returns within the coming years.

Contemplate when Nvidia made this listing on April 15, 2005… when you invested $1,000 on the time of our advice, you’d have $756,882!*

Inventory Advisor gives traders with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 23, 2024

Eric Volkman has no place in any of the shares talked about. The Motley Idiot recommends T-Cell US and Verizon Communications. The Motley Idiot has a disclosure policy.

This Telecom Stock Just Declared a Massive Dividend Raise. Should You Buy? was initially revealed by The Motley Idiot