1 Prime Tech Inventory to Purchase Hand Over Fist Earlier than TSMC’s Spending Splurge Begins

[ad_1]

Taiwan Semiconductor Manufacturing (NYSE: TSM), popularly generally known as TSMC, is the world’s largest semiconductor foundry that manufactures chips for fabless semiconductor corporations. Its prospects embrace widespread names corresponding to Nvidia, Apple, Superior Micro Units, Broadcom, Qualcomm, and others.

TSMC controls 62% of the worldwide foundry market, having fun with a major lead over second-place Samsung, which has a market share of simply 13%. So, TSMC is in a stable place to benefit from the secular long-term progress alternative within the semiconductor market, which is getting a pleasant increase due to a brand new catalyst within the type of artificial intelligence (AI) that is positively impacting a number of finish markets.

The semiconductor market’s progress potential is encouraging TSMC to spice up capital spending

The worldwide semiconductor market’s income is predicted to cross $1.3 trillion in 2032, up from $547 billion final 12 months. This explains why TSMC is ready to spend so much on enhancing its manufacturing footprint. The corporate’s board not too long ago accredited a $30 billion funding plan to put in and improve superior chip manufacturing amenities, assemble new fabs, and in addition shore up its superior packaging and specialty chip manufacturing skills.

It’s value noting that TSMC spent an identical amount of cash in 2023 on capital expenditure. Nonetheless, it will not be stunning to see TSMC steadily rising its capex ranges. The corporate intends to spend between $30 billion and $32 billion on capital expenditure in 2024 as in comparison with its earlier estimate of $28 billion to $30 billion. Analysts predict its capital bills to land on the larger finish of that vary.

Extra importantly, analysts count on the upper finish of TSMC’s capex to hit $37 billion in 2025. Then again, The Wall Avenue Journal not too long ago reported that TSMC and Samsung are contemplating a $100 billion funding to construct large chipmaking amenities within the Center East as part of their world enlargement technique. So, there’s a good likelihood that the spending on semiconductor manufacturing gear might result in larger capex by the likes of TSMC and Samsung.

The potential soar in TSMC’s capex means that the corporate will spend extra to purchase chipmaking gear, particularly high-end gear in order that it could possibly meet the demand for chips made on superior manufacturing processes corresponding to 3-nanometer (nm) and 2nm nodes.

As an example, the manufacturing capability of TSMC’s 3nm course of node is at present full due to demand from the likes of Intel and Apple. In the meantime, Apple is reportedly trying to safe all of TSMC’s 2nm manufacturing capability for its 2025 iPhones. All of this bodes effectively for a key TSMC provider that’s important to its manufacturing of those superior chips — ASML Holding (NASDAQ: ASML).

ASML Holding’s progress is ready to speed up

Dutch semiconductor gear large ASML has a monopoly out there for excessive ultraviolet (EUV) lithography machines which can be used for making superior chips primarily based on small course of nodes corresponding to 5nm and 3nm. Not surprisingly, chipmakers corresponding to Samsung, TSMC, and Intel have been lining as much as purchase ASML’s superior machines in order that they’ll manufacture sooner and extra power-efficient chips.

This resulted in ASML reporting a large order backlog of 39 billion euros, which is larger than the corporate’s 2024 income forecast of 27.5 billion euros. Oddly, ASML expects its income to stay flat in 2024 when in comparison with 2023, however the latest developments regarding the semiconductor business’s capex counsel that higher occasions lie forward for the corporate.

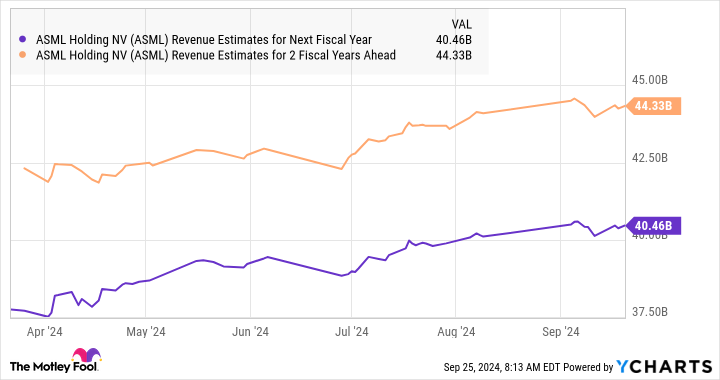

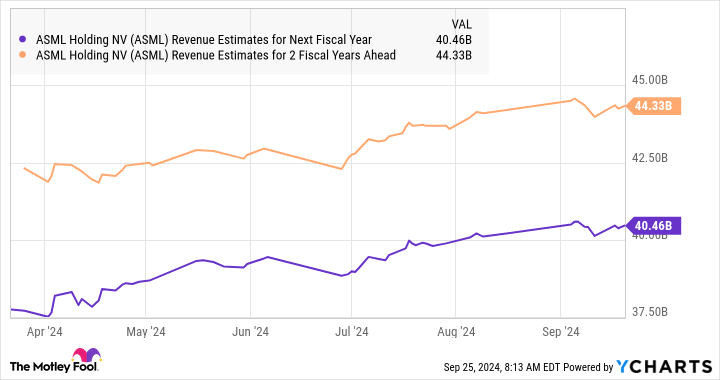

As per consensus estimates, ASML’s income in 2024 might rise by 5% to $30.9 billion. Nonetheless, the forecasts for the subsequent couple of years have been rising and level towards a pleasant acceleration in its progress.

That will not be stunning contemplating the massive sums of cash that TSMC and different chipmakers are planning to spend to shore up their manufacturing capacities. It’s value noting that ASML acquired 29% of its income from prospects primarily based in Taiwan final 12 months, indicating that TSMC is most likely a giant buyer for the Dutch firm.

Traders also needs to notice that South Korean prospects accounted for 25% of ASML’s web gross sales in 2023. So, Samsung’s rumored spending splurge within the Center East, as talked about earlier, may very well be a catalyst for ASML. Moreover, South Korean reminiscence producer SK Hynix can also be reportedly in line to buy ASML’s superior chipmaking gear.

All this explains why the marketplace for EUV lithography machines is predicted to the touch $50 billion by 2039 as in comparison with $8 billion in 2022. ASML, subsequently, might see terrific incremental income progress over the subsequent 5 years as chipmakers pour extra money into its choices to make superior chips.

That is why now can be an excellent time for buyers to purchase ASML inventory as it’s buying and selling at 28 occasions ahead earnings, a reduction to its five-year common ahead earnings a number of of 35 and in addition to the U.S. know-how sector’s earnings ratio of 45. The inventory could have underperformed the broader market this 12 months with features of simply 7%, however it might get away of this mediocrity due to a bump in capital spending by chipmakers corresponding to TSMC and others.

Do you have to make investments $1,000 in ASML proper now?

Before you purchase inventory in ASML, contemplate this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they imagine are the 10 best stocks for buyers to purchase now… and ASML wasn’t one among them. The ten shares that made the minimize might produce monster returns within the coming years.

Take into account when Nvidia made this record on April 15, 2005… for those who invested $1,000 on the time of our suggestion, you’d have $760,130!*

Inventory Advisor offers buyers with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 23, 2024

Harsh Chauhan has no place in any of the shares talked about. The Motley Idiot has positions in and recommends ASML, Superior Micro Units, Apple, Nvidia, Qualcomm, and Taiwan Semiconductor Manufacturing. The Motley Idiot recommends Broadcom and Intel and recommends the next choices: brief November 2024 $24 calls on Intel. The Motley Idiot has a disclosure policy.

1 Top Tech Stock to Buy Hand Over Fist Before TSMC’s Spending Splurge Begins was initially printed by The Motley Idiot

[ad_2]

Source