CrowdStrike Triggered 1 of the Largest IT Outages Ever. You will By no means Imagine What Its CEO Stated Is Occurring With the Enterprise Now.

On July 19, a defect in a software program replace from cybersecurity specialist CrowdStrike (NASDAQ: CRWD) prompted one of many largest IT outages in historical past. All over the world, flights have been canceled, monetary establishments have been unable to course of transactions, and buyers began panicking.

On the time of the outage, shares of CrowdStrike have been buying and selling close to all-time highs. However lower than one month later, the inventory had already tumbled by greater than 40%.

I do not imagine buyers have been behaving irrationally. In its filings with the Securities and Exchange Commission (SEC), CrowdStrike’s personal administration says, “If our options … are perceived to have defects, errors, or vulnerabilities, our model and repute can be harmed, which might adversely have an effect on our enterprise and outcomes of operations.”

In brief, its software program had the defect and prompted the outage. Due to this fact, I imagine it is very secure to say that CrowdStrike had an elevated danger of struggling injury to its repute. Realizing this, buyers have been behaving rationally by promoting their positions in CrowdStrike inventory.

Nevertheless it might develop into the improper choice nonetheless. If what CrowdStrike’s co-founder and CEO George Kurtz simply mentioned is true, then this cybersecurity company has already bounced again nearly as if nothing occurred.

Is CrowdStrike’s repute actually nonetheless intact?

On Sept. 17, Kurtz gave a presentation at its Fal.Con convention. And through his presentation, he casually famous, “Our pipeline era has returned to pre-incident ranges.” However there’s nothing informal about that assertion by any means.

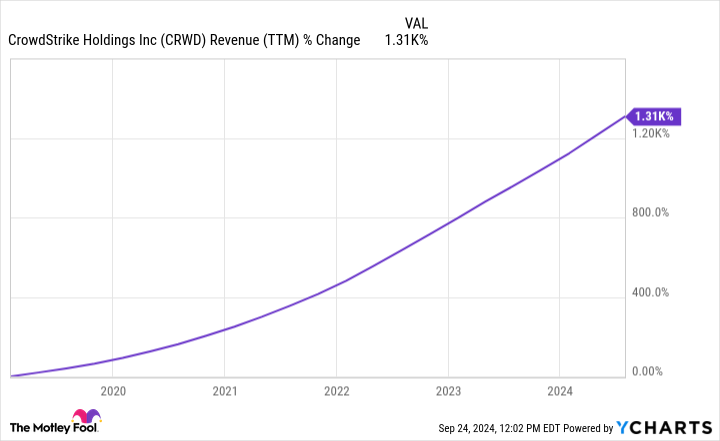

For context, CrowdStrike has been an absolute powerhouse of a development firm. It grows by attracting new prospects to its cybersecurity platform in addition to by upselling its prospects on certainly one of its many cybersecurity merchandise. With each of those development engines buzzing, its top-line development has been spectacular.

The draw back to development of this caliber is that buyers pushed CrowdStrike inventory to an costly valuation — it traded at practically 30 instances its trailing gross sales earlier this 12 months.

Due to this fact, the IT outage introduced two issues for CrowdStrike’s shareholders. First, it might have doubtlessly broken its development charge as prospects switched to a special supplier or hesitated to signal new offers. Second, if development slowed, then CrowdStrike’s premium valuation would fall, which might additionally drag the inventory down.

Nevertheless, CrowdStrike’s enterprise seems to have prevented long-term injury to its repute, in keeping with the pithy assertion from Kurtz. Buyers can consequently breathe a cautiously optimistic sigh of aid.

Enterprise as typical for CrowdStrike?

By someday round 2030, CrowdStrike desires to be producing over $10 billion in annual recurring income. For perspective, the corporate had $3.8 billion in annual recurring income as of its fiscal second quarter of 2025.

CrowdStrike’s Q2 ended July 31. So it wasn’t clear on the time whether or not the incident on July 19 had prompted any actual disruption. However in keeping with Kurtz, the pipeline of potential new offers is full and the corporate’s imaginative and prescient stays resolutely fixated on its $10 billion objective.

The corporate is not anticipated to report monetary outcomes once more till late November. So buyers have to patiently await extra indicators concerning the well being of the enterprise. However in keeping with Kurtz, CrowdStrike has already bounced again from the IT outage. And if that is actually the case, then that is extraordinarily excellent news for long-term buyers.

Relating to what can go improper with a software program enterprise reminiscent of this, CrowdStrike simply made it by means of a extremely dangerous situation. I will cease wanting calling it a worst-case situation, as a breach can be worse. However inflicting a serious outage in a aggressive subject can damage an organization.

But, CrowdStrike might be overcoming the setback in brief order. If it will possibly bounce again from this, CrowdStrike can doubtless bounce again from numerous issues sooner or later. And that is why Kurtz’s feedback concerning the corporate’s pipeline are crucial for buyers.

Do you have to make investments $1,000 in CrowdStrike proper now?

Before you purchase inventory in CrowdStrike, contemplate this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they imagine are the 10 best stocks for buyers to purchase now… and CrowdStrike wasn’t certainly one of them. The ten shares that made the minimize might produce monster returns within the coming years.

Take into account when Nvidia made this record on April 15, 2005… in the event you invested $1,000 on the time of our suggestion, you’d have $760,130!*

Inventory Advisor gives buyers with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 23, 2024

Jon Quast has no place in any of the shares talked about. The Motley Idiot has positions in and recommends CrowdStrike. The Motley Idiot has a disclosure policy.

CrowdStrike Caused 1 of the Biggest IT Outages Ever. You’ll Never Believe What Its CEO Said Is Happening With the Business Now. was initially printed by The Motley Idiot