This Is the Finest Approach To Generate Passive Revenue

In contrast to the revenue you earn from a job, passive income is the revenue you generate exterior of labor. It’s at all times a sensible thought to have a number of revenue streams, together with each passive and earned revenue.

Verify Out: 7 Best Passive Income Investments To Build Your Wealth in 2024

For You: 7 Reasons a Financial Advisor Can Grow Your Wealth in 2024

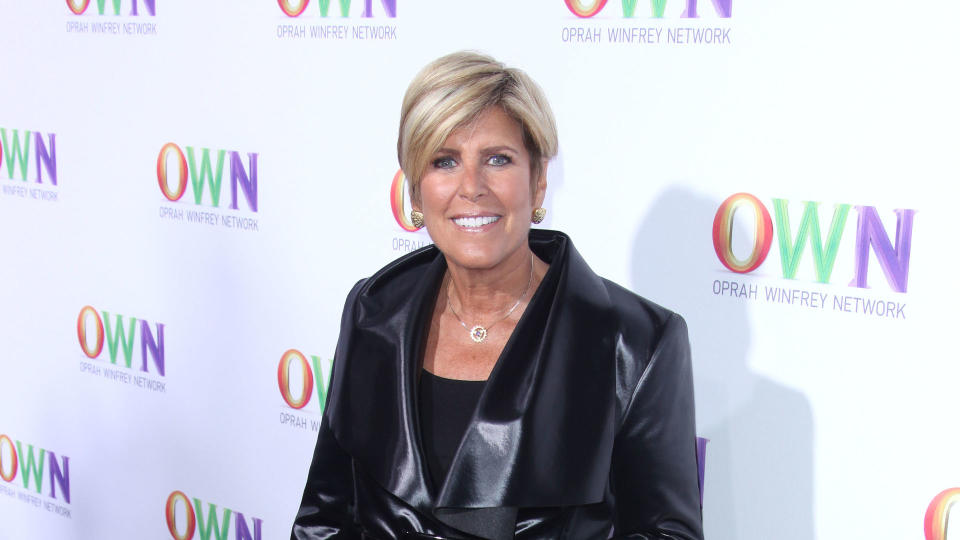

Whereas there are a variety of methods to earn passive revenue, Suze Orman, cash skilled and co-founder of emergency financial savings startup SecureSave, recommends one technique above the remaining.

Incomes passive revenue would not have to be troublesome. You can start this week.

Put money into Dividend-Paying Shares or Change-Traded Funds

Some investments pay a dividend — a daily distribution of earnings to shareholders. As a result of you possibly can depend upon this revenue at common intervals, these investments could be a dependable supply of passive revenue.

“Begin investing in dividend-paying shares or ETFs,” Orman advised GOBankingRates. “There are numerous shares on the market now which can be paying 5% or 6% or extra.”

Orman recommends persevering with to put money into these property at common intervals to maintain your passive revenue rising.

“If you happen to simply preserve greenback price averaging into them, you can construct your self an incredible portfolio — particularly with slices [aka fractional shares] — by the point you become old,” she mentioned. “You’ll be able to have a portfolio that’s producing super dividends for you for passive revenue with out you caring if the markets go up or down, as a result of your revenue can be going up — particularly for those who invested within the aristocrats.”

Shares which can be thought-about to be dividend aristocrats because of their lengthy historical past of returns embody Walgreens Boots Alliance (WBA), 3M (MMM), IBM (IBM) and Chevron (CVX).

Learn Subsequent: Passive Income Expert: Here’s How I Make $27,000 Every Week

Why Orman Does Not Advocate Actual Property as a Type of Passive Revenue

Actual property has traditionally been thought-about a gold customary so far as passive revenue investments are involved, however Orman believes this will now not be the case.

“I’d watch out with contemplating actual property to be a passive funding,” she mentioned. “If you happen to have a look at what’s taking place to residence insurance coverage and the premiums, it’s [no longer a matter of] are you able to simply afford to purchase a house. Now it’s are you able to afford to purchase it and preserve it? There are numerous people who find themselves in a position to afford a house however can’t afford to maintain the house, as a result of their residence insurance coverage premiums went from $2,000 a 12 months to $10,000 a 12 months.”

It will proceed to turn into a fair greater subject as pure disasters turn into extra widespread.

“Be very cautious with actual property all people, particularly with pure disasters in all areas — not simply hurricanes and earthquakes, however tornados, floods and all the things else,” Orman mentioned. “So I’m undecided about actual property being a passive funding anymore as simply because it was.”

Extra From GOBankingRates

This text initially appeared on GOBankingRates.com: Suze Orman: This Is the Best Way To Generate Passive Income